Bitcoin is apparently trapped in no man’s land.

As this exit has covered extensively, the cryptocurrency has been caught between crucial support and crucial resistance; every time BTC tries to exceed $ 8,500 or $ 10,000, it is rejected.

However, there is a growing sentiment that going down will be the direction that Bitcoin is finally breaking with further analysis.

There are multiple similarities between Bitcoin in March and now

According to a trader, there is an increasing chance that Bitcoin will correct instead of manifesting in the coming months.

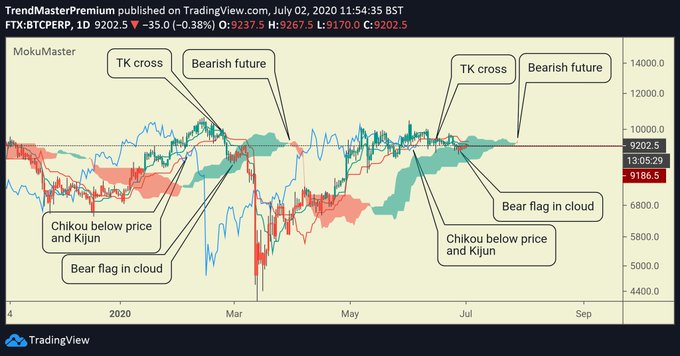

He shared the chart below on July 2, showing that according to the one-day Ichimoku cloud, Bitcoin has a “bearish future” ahead. While he didn’t explicitly say so, the chart indicates that, according to the Ichimoku Cloud, Bitcoin looks quite similar to how it looked before the March collapse of $ 9,000-10,000 to $ 3,700.

The bearish state of the Ichimoku cloud is not the only similarity that analysts have observed between the March highs and now.

A cryptocurrency tech shared the image below two weeks ago. It shows the price action of Bitcoin in the last 18 months along with the width of Bollinger Bands. Bollinger Bands is a technical analysis tool that is often used to show volatility in the markets.

The last time the bandwidth was so low, according to the graph, was before the March crash.

Bitcoin price chart over the last year and a half with volatility indicator (Bollinger Bandwidth). TradingView.com Chart; shared by the Byzantine general (@Byzgeneral on Twitter).

Also, just like in February and March, institutional traders are building a net short position in Bitcoin via CME futures.

The same merchant recently shared data from the CME Merchant Engagement report. The report is released weekly and shows the cumulative sentiment of a futures market.

The data shows that institutional traders now have more than 2,000 short CME futures contracts in Bitcoin. Such negative sentiment from this group of investors was last seen before the March capitulation at $ 3,700.

A different macro setting

However, what these technical aspects and trends ignore is the dramatically different macro context now and then. Basically analysts say Bitcoin is more optimistic than ever.

BlockTower Capital released a May report stating that the “macro case for Bitcoin has never been more obvious.” At the core of his sentiment is the existence of geopolitical tensions, the pandemic that makes the world go digital, and the collapse of small emerging markets.

As Bitcoinist previously reported, Nexo’s Antoni Trenchev said that due to the convergence of fiat money printing and Bitcoin halves, BTC will hit $ 50,000.

“So yeah, I stick to my 50K prediction until the end of the year. I appreciate it being a bold statement, but the fundamentals are there and the momentum is also changing there, “Trenchev told the Bloomberg journalist.

Featured Image from Shutterstock Price tags: xbtusd, btcusd, btcusdt Charts from TradingView.com Bitcoin Indicator That Predicted March's 60% Drop Is Bearish Again