[ad_1]

National Bank reveals economic contraction in October after temporarily exhausted support Watch for additional measures to extract solid baht

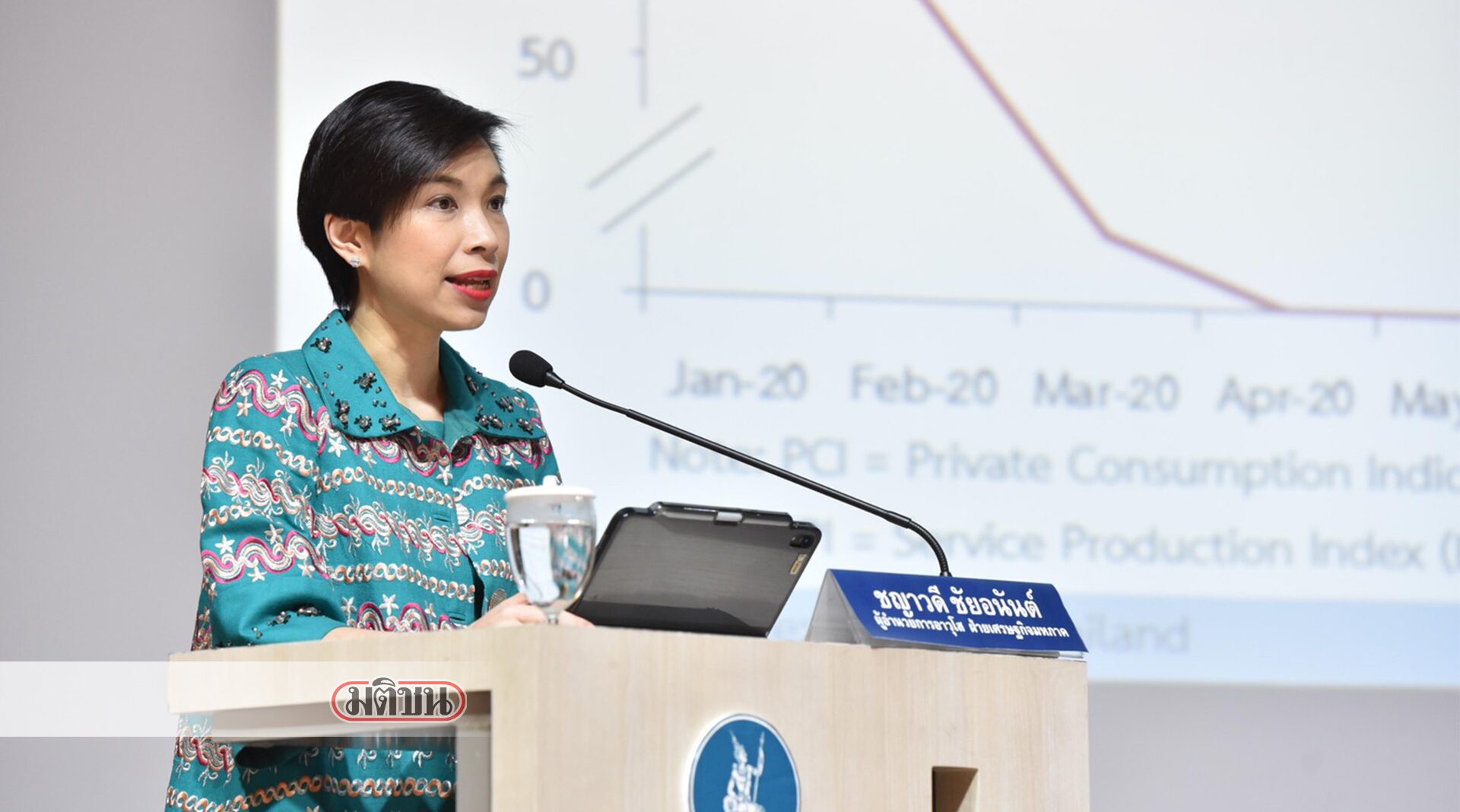

Ms. Chayawadee Chai-anan, Senior Director Macroeconomic Department Bank of Thailand (BOT) It revealed that the Thai economy in October 2020 has a contraction at a higher rate. If compared to the September contraction, due to the temporary support that was exhausted. And partly due to a high base in the same period in 2019, private consumption indicators contracted from a slight expansion last month. After the temporary factor, the long vacations have expired, yet the overall economy is still continuously recovering. But a gradual recovery But smoothed compared to the previous month.

“The address of the quarter 4/2020, the sending force still exists. But it may not be as strong as in the third quarter, as the economy in the third quarter recovered a lot from the second quarter, which was the lockdown period. Coupled with the government’s economic stimulus measures to support With the view that it will still rebound But it may not improve much. As for the measures I want to see come up to further stimulate the economy. There are both short-term and long-term measures to prepare everything to be in line with future economic conditions. Regarding the appreciation of the baht rate If you look at the data for November 1 to 30, the baht appreciates more than 2.9%. The BOT has closely monitored the movement of the currency 24 hours a day. On December 9th, there will be Statement of Guidance for Caring for the Extra Baht Regarding the Big Exchange Rate Ecosystem Package, ”said Ms Chayawadee.

Ms Chayawadee said For the value of exports of goods excluding gold It also increased from the previous month But it contracted more compared to the same period last year. The value of merchandise imports fell by 12.1% compared to the same period last year. If you do not include gold imports The value of imports contracted by 9.9%, the contraction of the previous month in almost all product categories. Both fuel imports Consumer and capital goods were in line with the contraction in domestic spending. This is similar to the major contraction in private investment indicators. Partly because of last year’s high base effect. Although public spending has decreased Because the disbursement of ordinary expenses is delayed Regarding the payment of personal salaries But the device can still work well The tourism sector also contracted sharply. As a result of international travel restrictions Even in October It is open for foreigners to enter with a special visa (STV), but it is difficult to assess. Because there are still few

Economic stability Headline inflation is less negative. From an increase in energy prices Core inflation decreased. Part of the use of entrepreneurial promotional measures Regarding the labor market in general, it continued to improve. In both employment and income But still fragile This is partly reflected in both the unemployment rate. And the share of job seekers in the social security system remains high. For the current account surplus, it fell slightly. This followed the growing deficit in services, income and transfers. While the trade surplus was close to before

Stick to all situations from

@Matichon line here

[ad_2]