In my last article, I covered “What is a dividend trap”. In order for you to avoid a future wave of dividend cuts, I’d like to offer you my three favorite techniques to avoid them. They have been shown to be highly effective in the past. In addition to a few exceptions (mainly due to the nature of the exceptional economic blockade we suffered), we were able to avoid most dividend cuts in DSR.

The following is a brief and applicable list of actions to take with your portfolio this summer. There’s nothing like hanging out in a pool and optimizing your wallet. The volume will be lower, the volatility will stop and it is time for you to take a deep breath and make sure you don’t suffer any further cuts this fall.

# 1 Trust the Market: Watch Out for High Yield Dividend Stocks

My first indication that something is wrong is usually the action of the market itself. While I don’t trust it, there is still some truth to the action in the market. When a sector or the majority of the market follows the same movement, it is difficult to understand exactly what the market tells us. However, when you see companies being hit harder than others, this is usually a sign that something is wrong.

At this point, many companies have seen their share prices partially or fully recover. Companies that are still 30-40% and have not yet cut their dividends will offer you astronomical returns. Don’t fall into the performance trap, because this is what it is most likely to be.

If you’ve been reading my work for a while, you know I’m not interested in high-performance stocks. Stocks with high dividend yields (over 5%) often offer a higher degree of risk, poor growth prospects, or most likely both. Since I am not looking for an immediate source of income, I do not have to worry about high-yield stocks. However, every time I have a stock where the performance exceeds 5%, like Enbridge (ENB), I will pay more attention.

Not all high-yield stocks are bad investments. You will find some interesting choices among this category. Here are some examples.

The ratings you see in the table below are based on the rating system we created at Dividend Stocks Rock. The PRO rating gives a 1-5 star rating, with 5 being an exceptional purchase (it’s all there; a solid business model, multiple growth vectors, and an undervalued price). The dividend security score indicates what kind of dividend policy to expect, 5 with past, present and future dividend growth prospects being wonderful.

You don’t have to follow the same ratings, but I’ll never stress enough about the importance of having a rating system for your portfolio.

| Company name | Heart | Sector | performance | Pro rating | Div Security |

| AT&T | T | Communication services | 6.80% | 4 4 | 3 |

| Wells Fargo | WFC | Financial services | 7.42% | 4 4 | 3 |

| National health investors | NHI | Real estate | 6.70% | 4 4 | 3 |

| Lazard | Laz | Financial services | 6.20% | 3 | 3 |

| Brookfield Property |

BPY, BPY.UN.TO |

Real estate | 11.92% | 4 4 | 3 |

| Power corporation |

OTCPK: PWCDF, POW.TO |

Financial services | 8.70% | 3 | 3 |

| Enbridge | ENB, ENB.TO | Energy | 7.15% | 3 | 3 |

| Intertape Polymer Group Inc |

OTCPK: ITPOF, ITP.TO |

Cyclic consumer | 6.75% | 4 4 | two |

| Scotiabank |

BNS, BNS.TO |

Financial services | 6.17% | 4 4 | 4 4 |

This is not an exhaustive list, but just some examples of large companies that offer higher-than-normal performance. I’m the first to be surprised to find a few Canadian banks on that list (the Canadian Imperial Bank of Commerce (CM) shows a return of over 6%).

The point here is not to completely avoid stocks with a return of more than 5%, but rather not to focus your money on that type of riskier holding. Remember, there are no free lunches in finance. There are reasons why these companies are “so generous.” You have to keep a close eye on those companies and make sure to review every quarterly report with great attention.

# 2 Avoid stocks with no dividend growth

Since the inflation rate has not been excessive in the last 10 years, most investors looking for income do not take inflation into account in their investment decisions. Many say, “Mike, I’m retired and I need this 8% income, I don’t care about inflation.” I can understand that position if you have $ 1 million invested at 8% and only need $ 60k / year to live. This means that inflation can consume up to $ 20,000 per year in dividend income before it affects your lifestyle. That may make sense to some people.

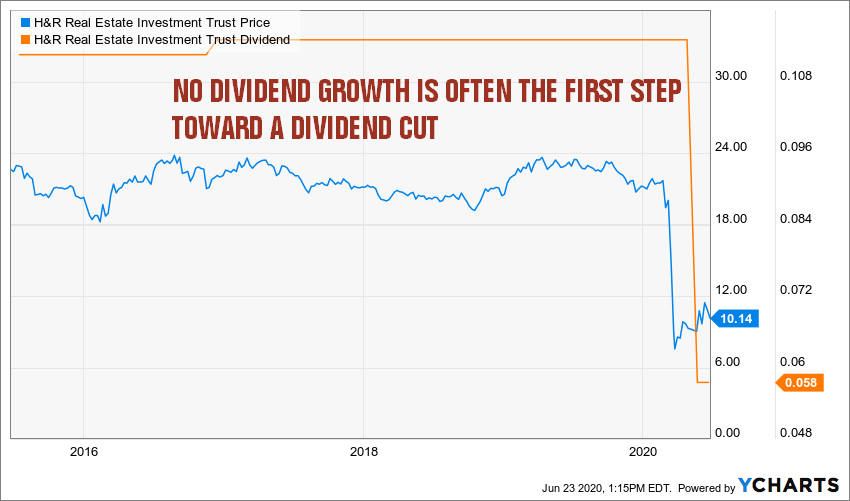

The problem is that many companies that keep their dividends static will eventually cut it. If management cannot increase its payments when the economy is growing, what will happen during a crisis? You are right: they will be among the first to reduce their dividend. I tried to find companies where they would show increasing income and earnings, but no dividend increases in the last 5 years. They are rare. In fact, most stocks that don’t pay “non-growing” dividends will ultimately look like this:

(Source: YCharts)

Before telling me that H&R REIT (HRUFF) cut its dividend due to COVID-19, please note that the company also had to cut it in 2009. In fact, this is a copy / paste scenario from the latest crisis. . In the early 2000s, the REIT grew for about 10 years and then reduced its dividend by 50% to preserve the business. 10 years later, we see the same scenario evolving.

If you go back to your portfolio now and look for companies that haven’t steadily increased their payments between 2015 and early 2020, chances are they’ve either cut their dividends or are already priced for a cut. It’s time to act now and see which shares would do a better job with what is left of your capital. Don’t expect a full recovery as it will be a painful path that will only lead to more losses.

# 3 Weak dividend triangle

You know that by now the dividend triangle is a very strong indicator when it comes to evaluating the probability of a dividend cut.

The dividend triangle is made up of three metrics:

Income – A business is not a business without income. What is the difference between a company that enjoys an increasing revenue stream from a company that shows stagnant results? Most of the time, the difference is in the competitive advantages that the company enjoys over its competition.

Profits – You cannot give money to your shareholders if you do not have a profit. Furthermore, this is a very simple statement. Still, if earnings don’t grow strongly, there is no point in anticipating that dividend payments will increase indefinitely.

Dividends – Last but not least, dividend payments are obvious backbone of any dividend growth strategy. I don’t focus on dollar amount or specific return, as my sole goal is dividend growth.

Companies that lose market share due to a lack of competitive advantage will see their history through their revenue trends. It is very rare to see that a company publishes increasing income year after year. For many reasons, a company could post weaker results. It could be the end of a cycle, a change in the business model or simply the slowdown in the economy. However, if this situation persists for several years and management cannot find growth vectors, the red flag should be raised.

The same logic applies to earnings. Since earnings calculations are based on GAAP, we are not talking about real money. This number is far from perfect. In fact, it’s best to combine it with free cash flow or cash flow from operations to see what’s really going on. However, if a company cannot generate growing EPS for a long period of time (5-10 years), chances are that it will not follow the growth of dividends.

Finally, as I discussed earlier in this article, the lack of dividend growth is a sign that there is a problem that needs to be investigated. When management is confident enough to increase their payments by 4-5% or more each year, I can sleep well at night and I really don’t care what is going on in the market. Sooner or later, the market will recover and dividend producers are among the companies that will prosper.

Original publication

Editor’s Note: The summary bullets for this article were chosen by the editors of Seeking Alpha.