[ad_1]

Wednesday marked one of the strongest manifestations of Bitcoin in weeks. Within 12 hours, the price of the leading cryptocurrency rose from $ 7,700 to as high as $ 9,200, a whopping gain of $ 1,500.

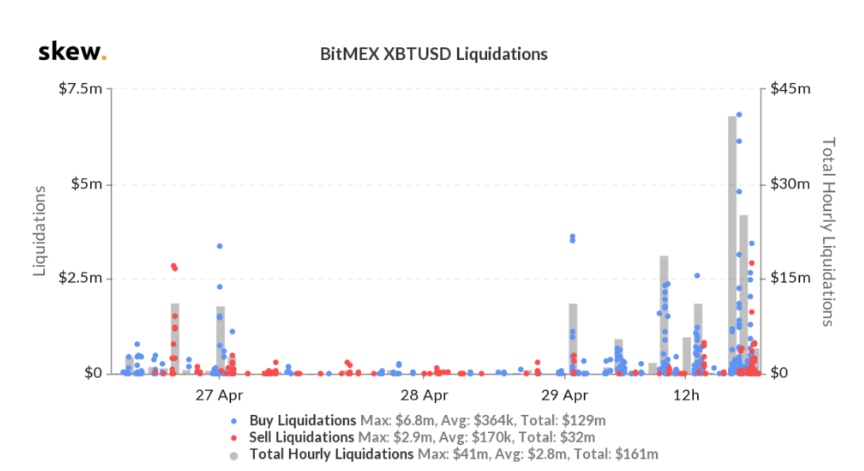

It was a move that shocked Bitcoin investors across the board: Skew.com data shows BitMEX is short and long-value $ 80 million liquidated when this movement started.

Bitcoin’s development during this surge is so pronounced that the Relative Strength Index (RSI) briefly approached 100. High RSI levels indicate a resonant peak, but this is a technical event marking the beginning of the 300% rally marked in 2019, suggesting that Bitcoin still has additional bullish potential.

Bitcoin sees the same RSI value as at the start of the 2019 rally

The trend is so strong that in the midst of the peak of the rally, when Bitcoin was trying to cross $ 9,000 on some exchanges, a trader saw an unexpected technical event:

In a message he posted on his Telegram channel, he noted that the RSI of Bitcoin’s one-hour chart reached 96.5.

Traditional forms of technical analysis say that whenever the RSI exceeds 70, it is overbought within the time frame analyzed. The fact that Bitcoin’s one-hour RSI briefly hit 96.5, the trader says, means it was extremely overbought, almost to the point of absolute peak.

– screen –

According to the trader, this value was so high for BTC in April 2019, the day the cryptocurrency shot up 25% in a few hours. What followed this move was an extended recovery of $ 4,000 to $ 14,000 in three months.

So history can repeat itself and Bitcoin could merge into one in the coming days, weeks, and months mature bull market.

Far from the only positive sign

Extremely high RSI pressure is not the only sign that BTC will soon enter a full-fledged bull market. In previous reports, a cryptographer noted that Bitcoin has recently accomplished a very important technical feat: It managed to skip $ 6,400 with little resistance and then claim the level as support.

This is important because $ 6,400 is the checkpoint: a price level on the chart of an asset over a period of time, with the highest trading volume and the most liquidity.

Internal indicators of the chain, such as the number of active users of the Bitcoin network and the number of new users of BTC, are also increasing. Bitcoin’s halving takes place in less than two weeks, and as the traditional financial world crumbles, it becomes Bitcoin’s assets are even scarcer.

If the recovery continues to expand, along with the next halving, a sort of FOMO (fear of missing something) could emerge among investors and push the course even higher. Even PlanB has revised its S2F forecast upward with a price target between 2020 and 2024. $ 288,000 for Bitcoin.

Still don’t have bitcoin? Buy bitcoins from the winner of the eToro test now

– screen –