The S&P 500 index is crawling to the brink of a rare barrage, and persistent uncertainties created by the COVID-19 pandemic in its rise.

Although the most important benchmark of the stock in the world is likely to have climbed to a record, the rally has been postponed by the last few days and the proximity of a completely closed peak has made some investors uneasy to say the least.

“Never before have I seen a market valued so highly in the face of overwhelming uncertainty,” wrote James Montier, behavioral economist and member of GMO’s asset allocation team, in a recent research paper entitled ” Reasons (not) to be cheerful: certainty, absurdity, and false telling. ”

“

The U.S. stock market is increasingly resembling the heeled Wile E. Coyote, who runs from the edge of a cliff in pursuit of the pesky Roadrunner, but has not yet realized that the ground beneath his feet was a while ago out round

”

“It seems that the American stock market is drunk on Dr. Pangloss’ Kool-Aid – where everything is for the best in the best of all possible worlds,” he wrote, referring to the character of Voltaire in Candide, who asserted in Pollyanian philosophy that the present state of affairs always represents the best of all possible worlds.

Of course, like Satta from Voltaire in Candide of the 17th-century philosopher Gottfried Wilhelm Leibniz, who also proposed the dissertation of a kind of dauntless optimism, Montier thinks market participants are far too cavalier about the burst of the equity index higher in the face of an unusual economic disaster caused by the worst pandemic in modern times.

“It’s when Mr. Market takes a tail risk (albeit a good one) and pricing it with certainty,” Montier wrote.

On Friday the Dow Jones Industrial Average DJIA,

posted a weekly gain of 1.8%, completing about 5.5% of the February 12 record close, and the S&P 500 SPX,

rose 0.6%. The S&P 500 fell briefly above its Feb. 19 close of 3,386.15 on Wednesday and Thursday, but could not hang on.

The Nasdaq Composite Index COMP,

meanwhile, barely positive for the week ready, up 0.1%. The index has so far placed 32 records in 2020.

If the S&P 500 can compete with the Nasdaq Composite in record range at any point in the coming weeks, it will have flooded its bearish low to a record high in the shortest time on record, according to Dow Jones Market Data. The current record recovery was 310 trading days from February 9, 1966 to May 4, 1967. So far, 102 trading days have passed between the S&P 500s on March 23, 2020.

Montier’s concern about the pace of recovery in equities is one held back by a number of bearish and bullish investors. How can the market grow so powerfully after in March more than 30% tumbled to its low against a background of economic carnage.

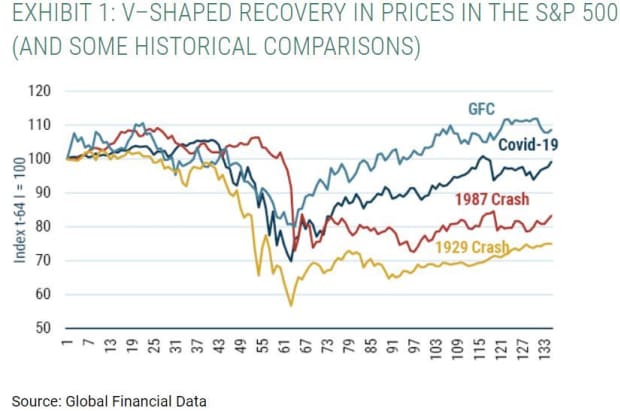

The GMO investor said that only the Great Financial Crisis of 2008-2009 represents a parallel to the so-called V-shaped, rapid and potent, higher bounce we have noticed in the market.

GMO and global financial data

“It is certain in theory that the stock market is intended as a progressive device, which can be seen by problems in the short term,” notes Montier. “History teaches us that the market is normally a master of double-counting, adding peak multiples to peak earnings, and trough multiples to trough earnings,” he adds.

Concerns over further fiscal stimulus from Congress, a scam by the US-US, as the two countries endlessly cancel plans to hold talks on Beijing’s adherence to the terms of a phase-one trade agreement, and raise their concerns that the viral outbreak could reach a penalty resurgence in the fall and / or winter are just a few pressing concerns for market participants.

Thomas Lee, founder of Fundstrat Global Advisors, however, remains unabashedly sanguine about the market outlook. He increased his goal for the end of the year for the S&P 500 by 75 points to 3,525. “From our point of view, this is just a waiting game. That is, we believe there are catalysts to support a move well above 3,393.52, ”he wrote in a research note on Friday.

That said, Lee’s forecast for the start of a bullish burst higher for the market, fueled by so-called epicenter shares, finance, energy and other sectors left behind in the recent rally, failed to materialize on August 14. materialize as he had predicted. It might be worth giving the strategist a few more sessions to see how that call goes up in new week.

It is difficult to win the prospects for the economy and the market by observing one of the Wall Street luminaries.

To read: Unemployed claims fall below 1 million for the first time since the onset of coronavirus pandemic

Also checkout: Did the expired benefit of $ 600 federally unemployed people not keep working back?

On Friday, a recurring search for funds conducted by billionaire George Soros indicated he was loaded on financial companies, including Bank of Americ BAC,

a, Morgan Stanley MS,

Wells Fargo & Co WFC,

, Citigroup C,

and PNC Financial Services PNC,

which would suffer the most if the economy did not manifest the V-shaped recovery that supplies seem to predict. During the same period, Berkshire Hathaway BRK.B, by Warren Buffett,

BRK.A,

was to redeem or enlighten his position in many of the same names and to raise shares of gold miner Barrick Gold Corp GOLD,

according to public filings that provide a snapshot of investors at a particular point.

So, who’s right about the view?

Montier offers some advice, though: “Rather than act as if the uncertainty does not exist (the current divide), the value investor embraces it and asks for a safety margin to reflect the unknown.”

What’s ahead?

Look at next week, the economic calendar also looks bright, as corporate earnings reporting drops to a trickle.

The usual report on U.S. weekly claims on unemployment benefits on Thursday takes center stage and before that on Wednesday, the Federal Reserve will release the minutes following its July 28-19 meeting, which provide some further insight into policymakers’ views on the economy.

Many Fed members have argued that fiscal stimulus is a key pillar of the next phase of the economic recovery, after the Fed ran out trillions to support financial markets.

There will also be regional factory surveys of the regions in New York and Philadelphia next week, which will help investors determine whether the recovery in the heavy industry in August is faster, as likely.

.