[ad_1]

Thursday, October 1, 2020 – 5:50 am

Singapore

TEMASEK Financial (I) Limited (TFin-I) has priced a transaction of three tranches of long-term covered bonds of US $ 2.75 billion in excess of subscription, obtaining orders from a diverse base of investors.

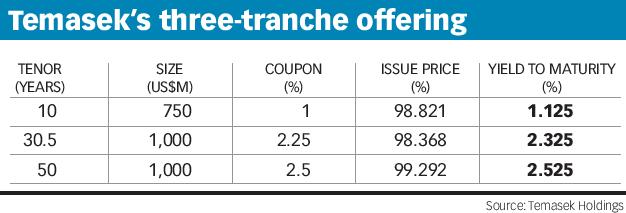

The Temasek Holdings subsidiary fixed a 50-year bond of $ 1 billion at 2.5%, a 30.5-year bond of $ 1 billion at 2.25% and a 10-year bond of $ 750 million. at 1%.

Support for the tranches came from high-quality institutional investors, accredited and / or other targeted investors globally, Temasek said in an exchange presentation on Wednesday.

Deal statistics seen by The Business Times (BT) showed that the final order book reached around $ 5 billion from 284 accounts.

The 50-year paper, Temasek’s longest-term debt to date, was trading at a 110 basis point (bp) spread over benchmark 30-year US Treasuries. Due October 6, 2070, this bond was issued below par, at 99.292 percent, giving a yield to maturity of 2.525 percent per annum.

More than half (55 percent) of the demand was from fund managers; pension funds and insurance companies accounted for 37 percent. The rest included central banks, sovereign wealth funds, and private banks.

Most of the investor interest (58 percent) in this bond came from Asia, followed by the United States with a third of the orders; Europe, the Middle East and Africa (EMEA) accounted for 9 percent.

The 30.5-year bond traded at a 90 bp spread over benchmark 30-year US Treasuries. Maturing on April 6, 2051, it was issued at 98.368 percent to give a yield to maturity of 2.325 percent per annum.

This instrument was most popular with fund managers (48 percent of orders). Pension funds and insurance companies recovered 41 percent. Other buyers included central banks, sovereign wealth funds and hedge funds.

US investors were the most interested in the 30.5-year note, getting 45 percent of orders, followed by Asia with 39 percent and EMEA with 16 percent.

The 10-year paper was priced at 47.5bp over 10-year US Treasuries and was issued at 98.821 percent to give a yield to maturity of 1.125 percent per year. Expires October 6, 2030.

A third of the orders for this promissory note came from central banks, sovereign wealth funds and official institutions; 28 percent were from banks. Fund managers collected a fifth, and pension funds and insurance companies, 15%.

By geography, Asian investors piled into the 10-year issue, with nearly half of the region’s orders.

The three tranches are the issuance of bonds 19, 20 and 21 under the global program of medium-term notes guaranteed for US $ 25 billion of TFin-I.

Temasek received an overall corporate credit rating of Aaa from Moody’s Investors Service and AAA from S&P Global Ratings. The three new bonds are also rated Aaa by Moody’s and AAA by S&P.

Temasek and its investment holding companies will use the net proceeds of the issues to finance the normal course of their business.

The offering, launched Tuesday, is scheduled to close on October 6. The new bonds are expected to be listed on the Singapore Stock Exchange on October 7.

The joint senior managers and book brokers were Barclays, Citigroup, DBS, HSBC and Morgan Stanley.

[ad_2]