[ad_1]

Photographer: Kiyoshi Ota / Bloomberg

Photographer: Kiyoshi Ota / Bloomberg

US futures fell in Asian trading on Friday after a clash between Treasury Secretary Steven Mnuchin and the Federal Reserve over their emergency loan facilities. Asian stocks looked poised for a quiet opening.

The S&P 500 contracts were withdrawn after the Trump administration and the Fed publicly disagreed on whether to extend the pandemic programs. Tech stocks had driven US benchmarks higher as investors weighed the impact of tighter restrictions against viruses against the prospect of a vaccine launch in the coming months. Stocks of companies that were on the verge of performing well during the lockdowns performed better. Futures changed little in Japan, Australia and Hong Kong.

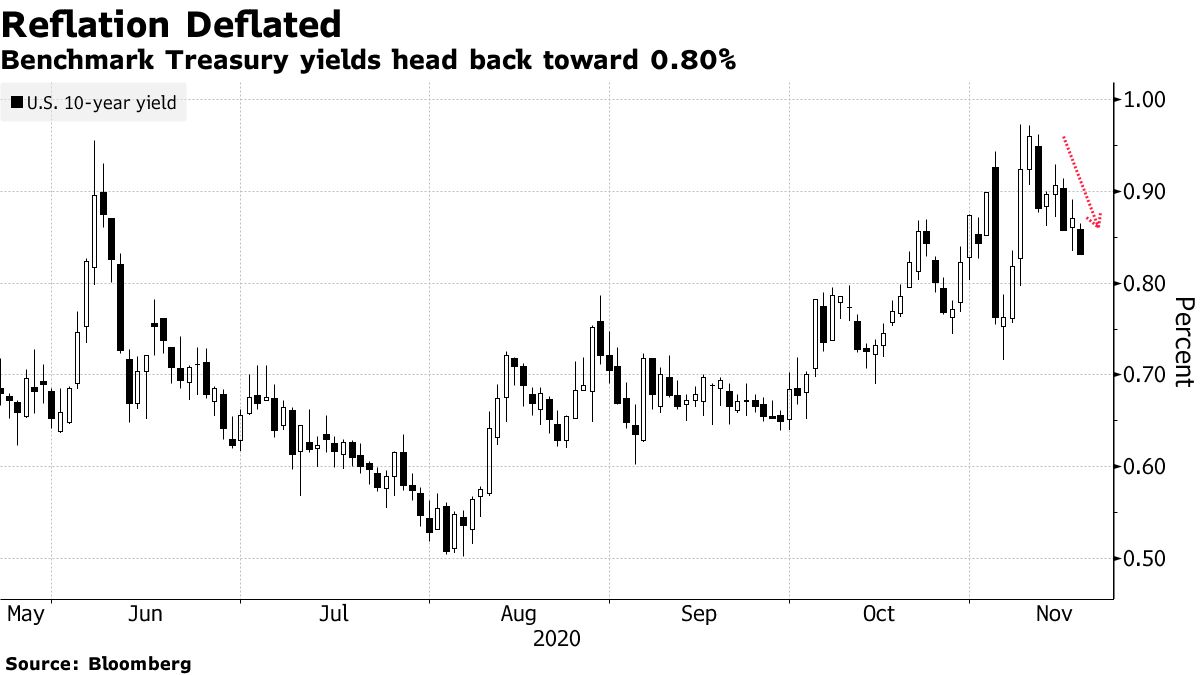

Treasury yields fell and the dollar fell after weekly U.S. jobless claims rose more than expected. Gold extended a slide amid a slump in bullion-backed exchange-traded funds. Tesla Inc. hit a record as investors bet the global auto market will be dominated by electric cars for decades to come.

Mnuchin on Thursday sought the return of unspent funds from the Fed’s emergency loan facilities, but the central bank declined, saying the programs played a vital role. Mnuchin sought a 90-day extension for four programs, but requested that others expire as scheduled on Dec. 31 and that the Fed return $ 455 billion to the Treasury so that Congress can spend the money elsewhere.

Some of the investor optimism about vaccine progress that pushed global stocks to an all-time high on Monday has waned, amid a surge in virus cases and strain on public health facilities in many parts of the world. . California has imposed a curfew on the vast majority of the state, one of the world’s toughest closures is underway in South Australia and Tokyo raised its virus alert to the highest level.

The International Monetary Fund and the Group of 20 nations have warned that new restrictions on households and businesses due to the resurgence of Covid-19 are a risk to the global economic recovery. IMF famous advances on a vaccine, but he also said that high asset prices point to a disconnect from the real economy and a potential threat to financial stability.

“There is short-term versus long-term push and that’s what investors are looking at right now,” said Chris Gaffney, president of world markets at TIAA Bank. “There are some very serious risks in the short term, especially with closings.”

Elsewhere, the Turkish lira strengthened after the new The central bank governor raised the benchmark interest rate.

OBSERVE: RBC’s Elsa Lignos considers the global impact of the weak US dollar.

These are the main movements in the markets:

Stocks

- S&P 500 futures were down 0.8% at 8:08 am in Tokyo. The S&P 500 Index rose 0.4%.

- Nikkei 225 futures rose 0.1%

- Australian S & P / ASX 200 Index Futures Up 0.4%

- Hang Seng Index futures previously rose 0.2%

Coins

- The Bloomberg Dollar Spot Index fell 0.2% on Thursday.

- The euro was stable at $ 1.1870.

- The pound fell 0.1% to $ 1.3252.

- The yen was down 0.1% to 103.80 per dollar.

Captivity

- The 10-year Treasury yield fell four basis points to 0.83% on Thursday.

Raw Materials

- West Texas Intermediate crude fell 0.4% to $ 41.58 a barrel

- Gold fell 0.2% to $ 1,863 an ounce.

– With help from Jan-Patrick Barnert and Todd White