[ad_1]

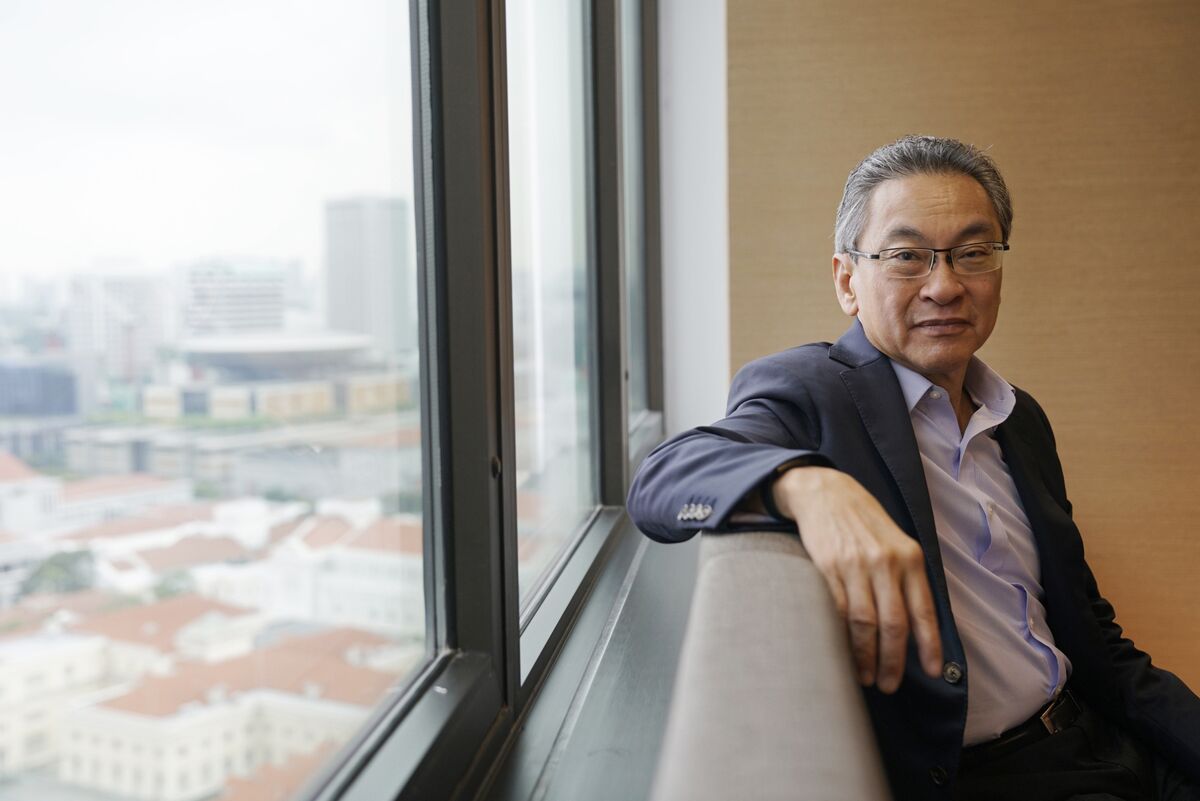

Photographer: Wei Leng Tay / Bloomberg

Photographer: Wei Leng Tay / Bloomberg

Koh Boon Hwee, one of Singapore’s most prominent executives, is teaming up with four fellow investors to try to raise $ 100 million for a new venture company targeting Southeast Asia.

Koh, former president of DBS Group Holdings Ltd. and Singapore Telecommunications Ltd. and its partners believe the time is right to start a new venture capital company, despite the challenges of the coronavirus pandemic. They will target early stage investments in fintech, consumer internet, business software, logistics, health care and education.

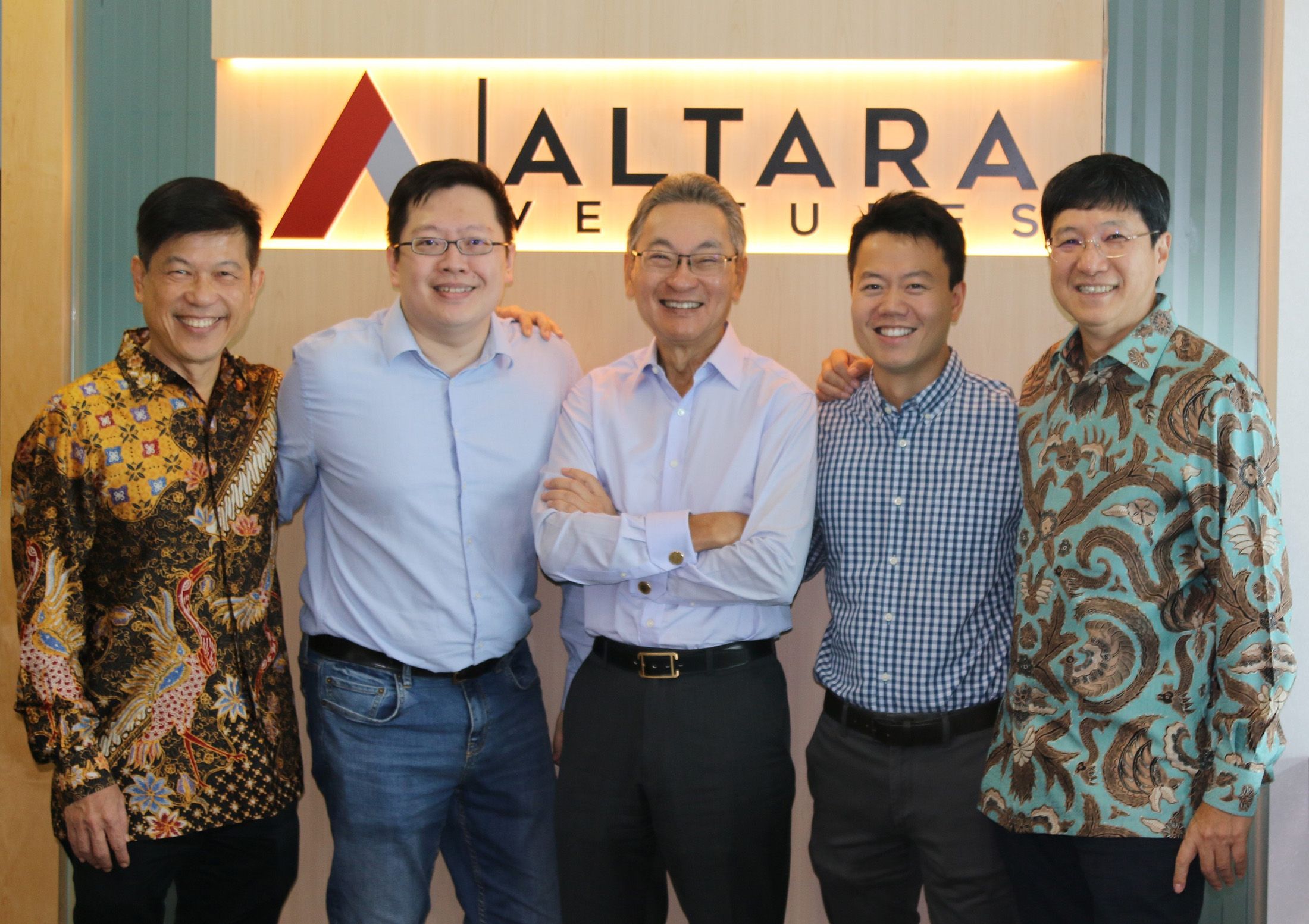

Koh Boon Hwee, center, with Altara Ventures general partners.

Altara Ventures will launch as China’s tech giants expand into Southeast Asia in the face of increasing hostility from the US and other major markets. Tencent Holdings Ltd. has chose Singapore for its beachhead beyond China, joining its rivals Alibaba Group Holding Ltd. and ByteDance Ltd. in the race to build a global presence closer to home.

Read more: How A Senior Singaporean Executive Decided He Had To Say Goodbye

“The level of international investment in Southeast Asia will increase further with the ongoing global trade dynamics between geopolitical powers,” said Dave Ng, one of the five general partners of the new firm. “That will continue to drive the ecosystem here.”

Ng and Gavin Teo previously worked at B Capital, The venture capital house of Facebook Inc. co-founder Eduardo Saverin. The other three partners are Koh, Tan Chow Boon and Seow Kiat Wang, who founded Omni Industries Ltd., a manufacturer of electronic components. acquired by Celestica Inc. in 2001. The trio has supported more than 100 companies, including Razer Inc., and ran a private equity firm Credence Partners Pte.

“We are former entrepreneurs, business builders and seasoned investors and we know what it takes to scale and get out,” said Koh, who spent more than a decade on the board of the Singapore state investment firm. Temasek Holdings Pte.

Read more: Investments in Southeast Asian Tech Startups Drop 13% in H1