[ad_1]

Friday, October 16, 2020 – 12:25 pm

Increased activity in Singapore’s retail sector suggests that rents will bottom out by the end of this year or early next, Knight Frank’s research team said in a report released Friday.

Overall retail rents are expected to fall 10-15% throughout this year due to recessionary pressures and safe distancing restrictions, according to the real estate consultancy.

That said, in the suburban region, rents from retailers are likely to decline by just 7.5 percent or less.

“As brick-and-mortar retail stores resumed operations, shopper traffic also returned to a greater extent in suburban shopping malls compared to downtown ones that rely more on the tourist dollar,” Knight Frank analysts wrote.

Therefore, the rental gap between suburban and Orchard malls is likely to continue to narrow as the influx of tourists to Singapore is still hampered by travel restrictions. Suburban retail rentals are expected to rebound earlier because they are supported by the resident population of the national catchment area.

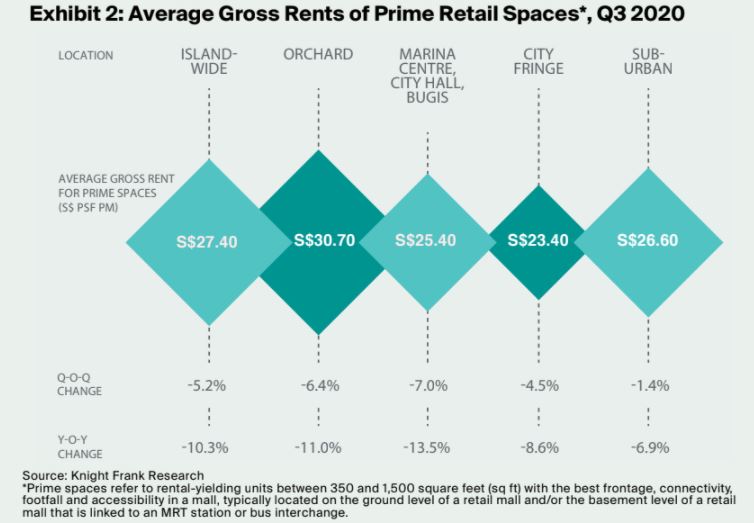

In the third quarter of this year, island-wide top-notch retail rentals declined 10.3 percent year-on-year to an average of S $ 27.40 per square foot (psf) per month, as measures were maintained. of safe distancing and border controls.

This drop was largely due to the 11 percent drop in gross rents for top-notch retail spaces along the Orchard Road shopping belt, as stores there continued to struggle with the absence of international tourists, he noted. Knight Frank.

Privileged spaces refer to profitable units of between 350 and 1,500 square feet with the best facade, connectivity, passage and accessibility in a shopping center. Such spaces are generally found on the ground level of a shopping center or the basement level of a shopping center that is linked to an MRT station or bus interchange.

In the Marina Center, City Hall and the Bugis region, gross rents for premium retail spaces fell 13.5% year-on-year to S $ 25.40 psf per month on average during the third quarter.

The strip of the city, meanwhile, registered a decrease of 8.6 percent from the previous year, to S $ 23.40 psf per month.

Supporting the retail market were suburban areas, where rents began to stabilize during the July-September period.

“As more employees work from home, shopping centers located within the residential population centers were visited by many for their daily needs and sundries,” the analysts wrote.

The suburban region recorded the smallest drop in gross premium retail rents during the quarter, falling 6.9 percent on the year to an average of S $ 26.60 psf per month.

Quarter over quarter, rents for prime commercial spaces in suburban areas also fell by just 1.4%, compared to the biggest drops of 6.4% at Orchard, 7% at Marina Center, City Hall and Bugis, and 4.5% on the outskirts of the city.

While traditional retailers like Topshop in VivoCity and Robinsons in Jem closed during the last quarter, there were newcomers on the scene as well. For example, Hang Heung, a 100-year-old Hong Kong bakery, opened its first Singapore store in Ion Orchard, Knight Frank noted.

Other notable retail openings in the three months include store expansions such as Foot Locker at Orchard Gateway @ Emerald and Decathlon at The Centrepoint.

In August, retail sales, excluding motor vehicles, fell 8.4 percent year-on-year, according to figures released by the Statistics Department last week.

On a seasonally adjusted monthly basis, total retail sales increased 1.4 percent in August. Excluding motor vehicles, sales were up 0.1 percent for the month.

[ad_2]