[ad_1]

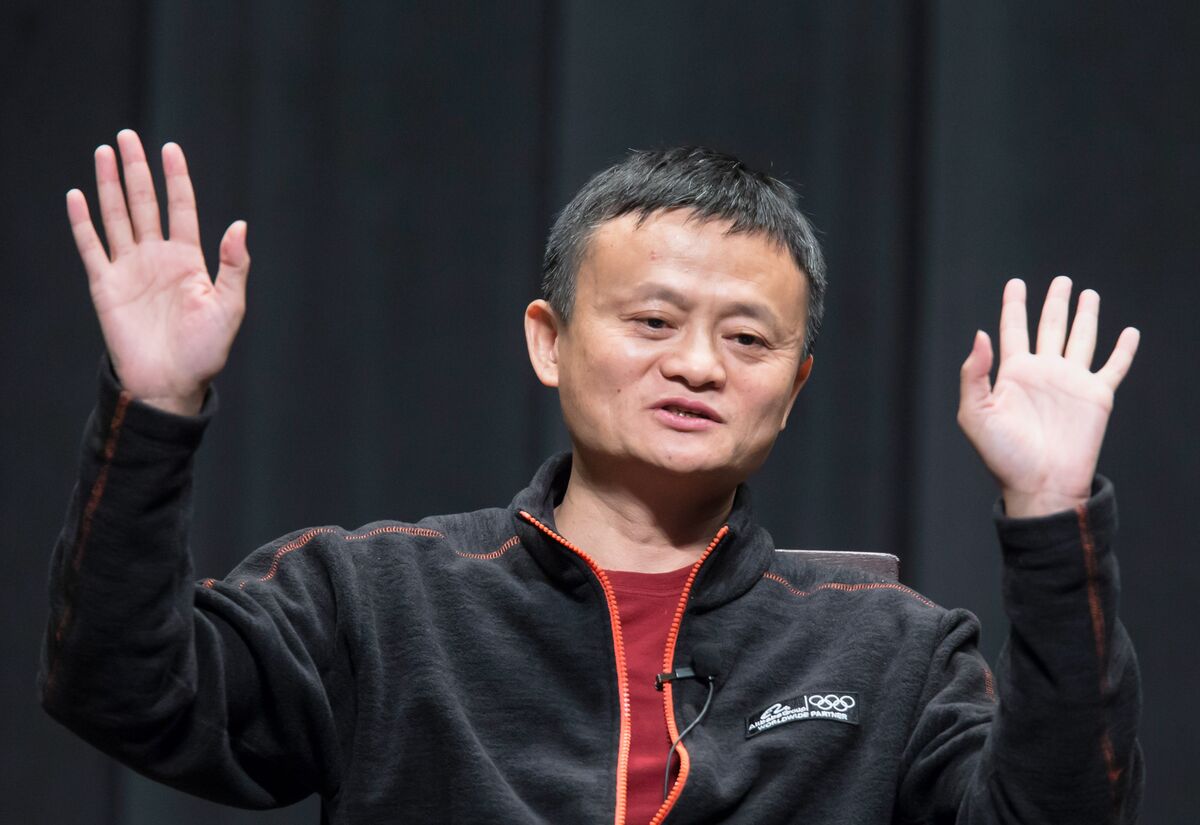

Photographer: Tomohiro Ohsumi / Bloomberg

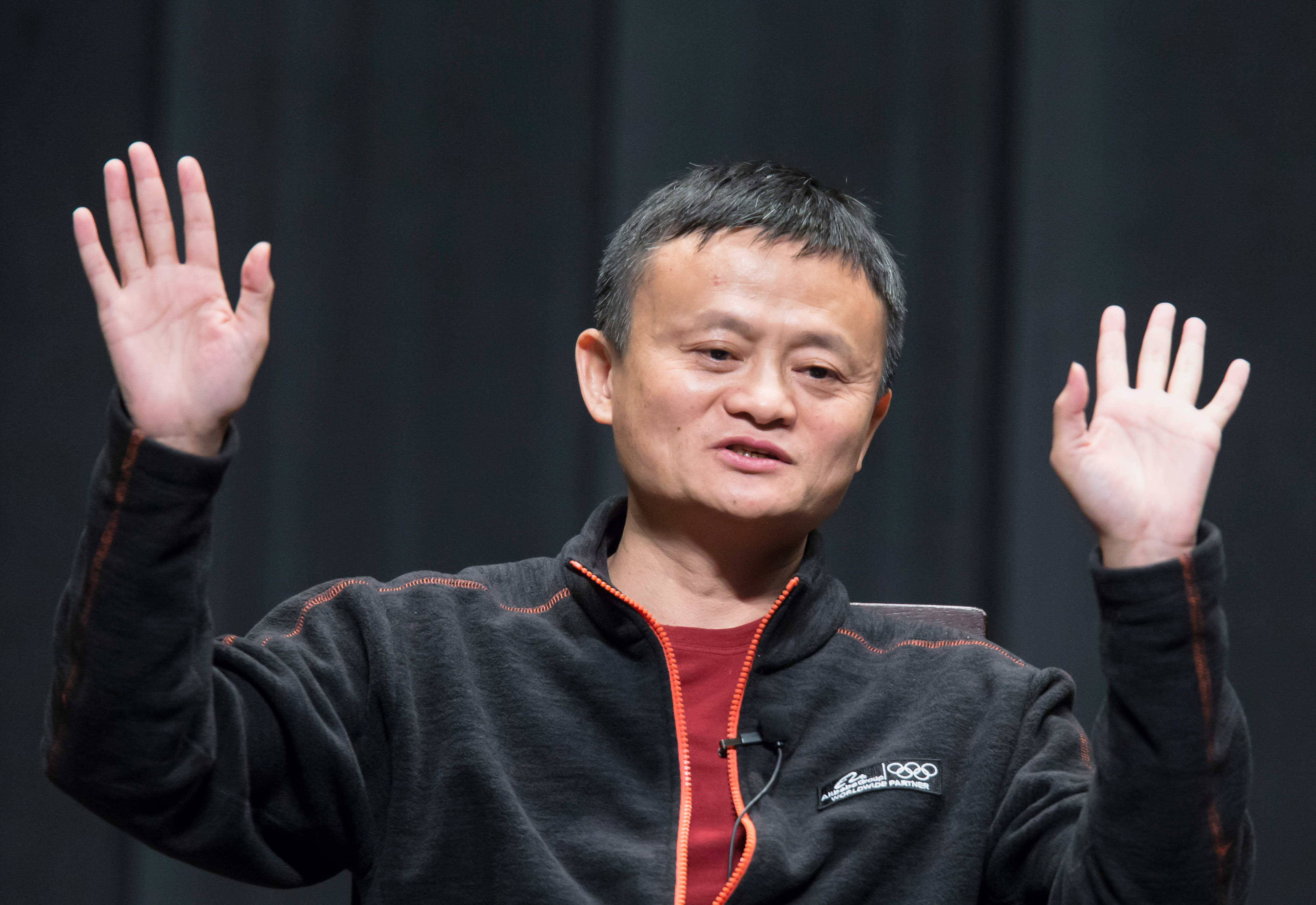

Photographer: Tomohiro Ohsumi / Bloomberg

Alibaba Group founder Jack Ma criticized global financial regulations for stifling innovation and urged China to seek a system that accommodates development.

“After the Asian financial crisis, the risk control highlighted in the Basel Accords has been” the priority for regulators, Ma said at the Bund Summit in Shanghai on Saturday. Now the world “is only focused on risk management, not development, and opportunities for young people and developing countries are rarely considered.”

the The Basel Accords, which Ma compared to a club for the elderly, are used to solve problems in financial systems that have been operating for decades, he said. China, however, is still a “youngster” and needs more innovation to build an ecosystem for the healthy development of local industry, according to Ma.

Digital currencies can play an important role in building the kind of financial system that will be needed in the next 30 years, Ma said.

“Digital currency could create value and we should think about how to establish a new type of financial system through digital currency,” Ma said.

Ant Group Co., Ma’s fintech giant, plans initial public offerings in both Shanghai and Hong Kong. Ma said the signature it priced its listing in Shanghai on Friday, without providing details. The deal is one of the most anticipated IPOs in years, on track to make history by beating Saudi Aramco’s record sale of $ 29 billion shares in 2019.

– With the help of Ken Wang, Jun Luo and Zheng Li