[ad_1]

Gojek drivers wait for orders outside a restaurant in Jakarta, Indonesia, in 2020.

Photographer: Dimas Ardian / Bloomberg

Photographer: Dimas Ardian / Bloomberg

Indonesia’s transportation services and payments giant Gojek is in advanced talks about merging with local e-commerce pioneer PT Tokopedia, anticipating a planned initial public offering of the combined entity, according to people with knowledge of the matter.

The country’s two most valuable startups have signed a detailed term sheet to conduct due diligence on each other’s businesses, said the people, who asked not to be identified because the discussions are private. Both parties see possible synergies and are willing to close the deal as soon as possible in the coming months, they said.

The merged entity would create an Internet powerhouse in Indonesia with a combined valuation of more than $ 18 billion. Their businesses range from private travel and payments to online shopping and delivery, a local combination of Uber Technologies Inc., PayPal Holdings Inc., Amazon.com Inc., and DoorDash Inc. plans to go public in the United States and Indonesia.

Gojek and Tokopedia have considered a possible merger since 2018, but the discussions accelerated after deal negotiations between Gojek and his archrival. Grab Holdings Inc. came to a standstill, the people said. Grab CEO Anthony Tan continues to resist pressure from Masayoshi Son of SoftBank Group Corp. to cede some control in a combined entity with Gojek, the people said.

Photographer: Akio Kon / Bloomberg

The two most valuable startups in Southeast Asia, with a combined value of about $ 25 billion, had on-and-off talks to combine after years of fierce competition in transportation, food delivery and financial technology. As recently as December, the companies were said to have made substantial progress in crafting a deal to combine, people with knowledge of the talks told Bloomberg News at the time. But they clashed over how to run Indonesia, the region’s key market.

Read more: Grab, Gojek said to close terms for merger deal

Son, who had been a staunch supporter of Tan in the past, is losing patience with the Grab co-founder’s reluctance to give up some control and now supports a SoftBank-backed merger between Gojek and Tokopedia, the people said. The two pioneers of homegrown technology have common inverters, including Google, Temasek Holdings Pte and Sequoia Capital India.

Representatives for Gojek and Tokopedia declined to comment.

The companies are valued at around $ 10.5 billion and around $ 7.5 billion, respectively, according to people familiar with their accounts, and merger ratios are currently being discussed. The founders of the two companies have been friends since their inception more than 10 years ago and anticipate a friendly alliance. The Grab and Gojek discussions were more contentious and had not progressed enough for them to sign a term sheet, the people said.

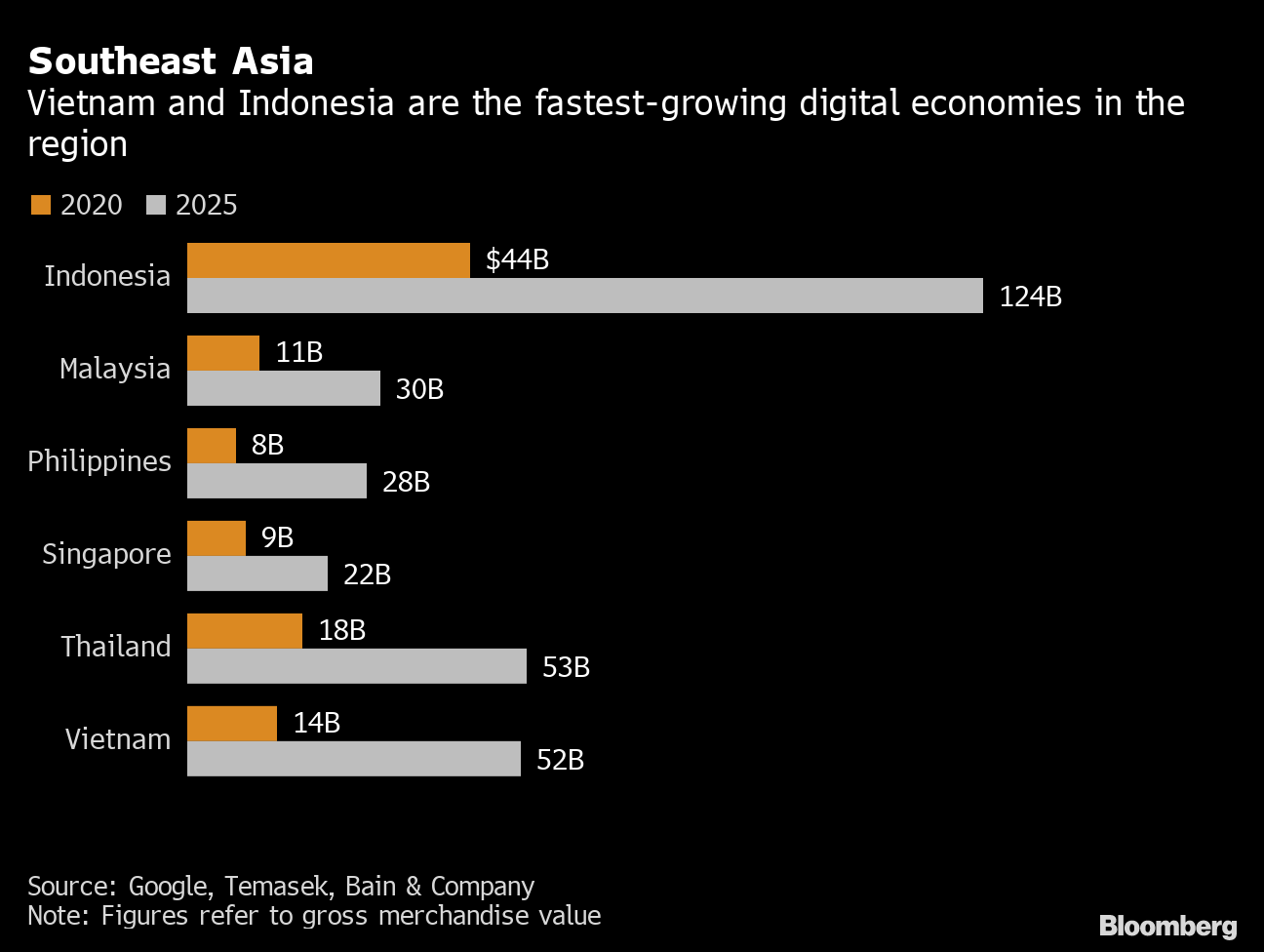

A combination of Gojek and Tokopedia would dominate Indonesia, one of the fastest growing Internet economies in the world. Its planned listing in the US would provide global investors with an alternative to Sea Ltd., the only major Internet company in Southeast Asia listed in the United States. Sea’s shares rose nearly 400% last year, driven by the growing popularity of its online shopping and mobile gaming platform.

Southeast Asia

Vietnam and Indonesia are the fastest growing digital economies in the region

Source: Google, Temasek, Bain & Company

A deal between Gojek and Tokopedia is likely to face less regulatory opposition than the deal that was previously being considered. The combination of Grab and Gojek would reduce competition in transportation, delivery and digital payments in Southeast Asia, a prospect about which government officials have already expressed reservations.

Companies are contemplating various options for a public offering. They could choose a traditional initial public offering in Indonesia and the United States or work with a blank check company to list in the United States, one of the people said. A handful of blank check companies have had conversations with the two companies in recent months, the person said.

Tokopedia said last month that it hired Morgan Stanley and Citigroup Inc. as advisers to help accelerate its plan to go public, following Bloomberg News report that Bridgetown Holdings Ltd., the blank check company backed by billionaires Richard Li and Peter Thiel, is considering a possible merger with the e-commerce giant. The special purpose acquisition company is exploring the structure and feasibility of a deal with Tokopedia.

“We have not yet decided which market and method, and we are still considering options,” the Jakarta-based company said in a statement on December 16. “SPAC is a potential option that we could consider, but we have not committed to anything at the moment.”