[ad_1]

When it launched in April, Tesla Inc.The Model 3 was the most popular New Energy Vehicle (NEV) in China.

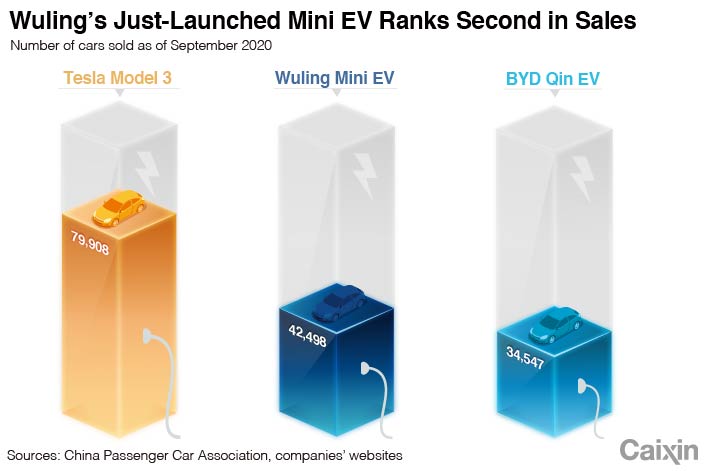

But last month, a closely watched monthly sales report from the China Passenger Car Association (CPCA) showed a change. At the top of NEV’s ranking with 15,000 sales in August was a battery-powered, two-door, four-seat mini-car, which retailed for just one-tenth the price of the cheaper Model 3.

The small, boxy car, known in its entirety as the Wuling Hongguang Mini EV, was launched in July by a Chinese partner of US giant General Motors Co.

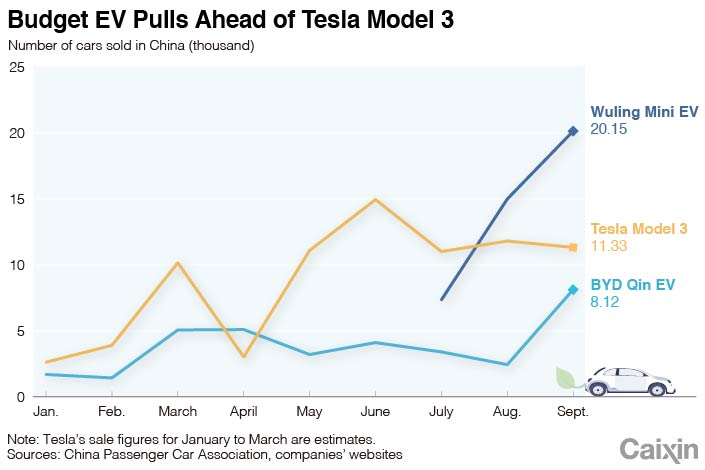

The performance was repeated this week when the CPCA released its sales figures for September, showing 20,150 Mini EVs were sold versus 11,329 Tesla Model 3s.

|

Despite selling twice as many vehicles, Wuling’s economy model doesn’t compete with top-tier brands like Tesla or its local copycats. Instead, it’s pointing to a crack in China’s vast low-end electric vehicle market. And it has benefited from a confluence of factors, including generous state subsidies and tighter controls on unlicensed forms of cheap short-haul transportation.

The Mini EV, which may have a crucial vehicle license, is proving to be particularly popular in less prosperous regions of China, according to GM’s joint venture officially known as SAIC-GM-Wuling Automobile Co. Ltd. (SGMW) and locally as Wuling.

Compared to other NEV brands like Tesla and its homegrown rival BYD Co. Ltd., the Mini EV goes a much shorter but still respectable distance on a single charge, traveling 120 kilometers (74.6 miles) or 170 kilometers. according to the model. The BYD Qin EV can run 421 kilometers and the Model 3 at least 468 kilometers, according to its manufacturers.

Zhang Yiqin, a public relations person at SGMW, said that the Mini EV is often used by people to pick up family members and travel, unlike high-end NEVs that are often sold to rental companies. “Most of (our) buyers are individuals,” he said.

The company has built more than 10,000 charging stations for the models, most located in less developed regions such as the Guangxi Zhuang and Henan Autonomous Region, as well as the relatively more prosperous Shandong.

|

Vast low-end market

Founded in 2002 as an alliance between state auto giant SAIC Motor Corp. Ltd., General Motors, and popular microvan maker Wuling Motor Co. Ltd., SGMW has long focused on the low-end automotive market of China from its headquarters in Liuzhou, Guangxi. .

But it was only this year that the company extended the strategy to the electric vehicle business, debuting the Mini EV range starting at 28,800 yuan ($ 4,209), with a high-end model going for 38,800 yuan, still just one-tenth the price. of the cheapest Tesla Model 3.

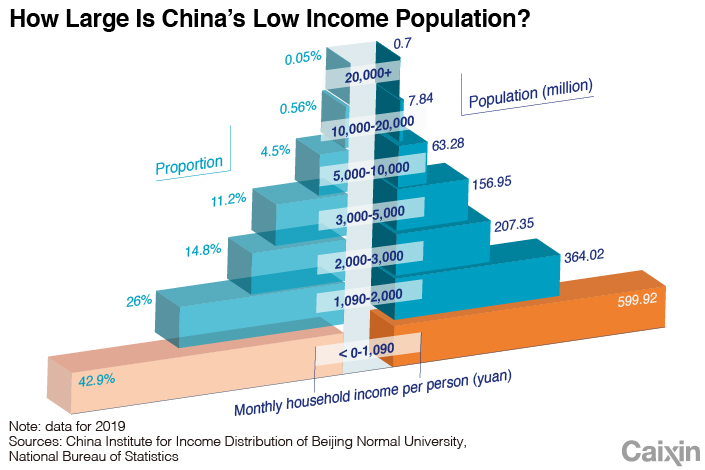

That price makes it accessible to at least some of China’s vast low-income population in rural and inland areas. About 600 million people in the country earn a monthly income of about 1,000 yuan, Prime Minister Li Keqiang revealed at a press conference in May, and a survey conducted by researchers from Beijing Normal University supports their comments.

The survey, from the China Income Distribution Institute, found that 42.9% of the 70,000 random families surveyed had a monthly household income per person of no more than 1,090 yuan in 2019. If that statistic is true across the world country, would represent more than 599.9 million. people.

More than half of the surveyed families earned between 1,090 and 5,000 yuan a month.

|

According to Zhang, Mini EVs make their biggest sales in Shandong, Hebei, and Henan provinces, as well as the Guangxi Zhuang Autonomous Region, which ranks 9th, 17th, 23rd and 25th among China’s regions in terms of revenue after taxes. per person last year, according to data from the National Statistics Office. While Shandong is more prosperous, people in the other three regions had an average annual disposable income of between 20,000 and 25,000 yuan.

The Mini EV’s appeal comes as no surprise, said Gu Zhihong, vice president of rival mini-vehicle maker Fulu Group.

“Like QQ and Alto before it, the Mini EV will become a means of transportation for many lower-tier cities and towns, the first car for young people or the second car for families,” he said, referring to two mini cars. previous years that also enjoyed strong demand.

General recovery

SGMW’s Mini EV sales have been boosted by the overall recovery in China’s electric vehicle market, which rebounded and grew again in July after a dramatic 75% year-on-year drop in February, when the coronavirus outbreak of the country was more severe. CAAM data suggests that a total of 138,000 NEVs were sold last month, an increase of 67.7% compared to the same period in 2019.

The Chinese government’s push for wider adoption of NEV in the field has contributed greatly. A July decree the Ministry of Commerce and two other departments instructed local governments to formulate policies to support NEVs in rural areas.

In April, the central government extended generous state subsidies and tax breaks to NEV manufacturers, who had been fighting the ax, for two additional years in an attempt to counter the consequences of the Covid-19 pandemic.

With all of these incentives in place, Wuling was just one of the brands that posted brilliant results. Shenzhen-based BYD sold more than 19,000 of its handful of NEV models in September, beating Tesla to rank second on last month’s sales chart, according to figures from the CPCA. Sales of the Tesla Model 3 have stabilized at around 11,000 a month since July, while Chinese rivals such as Nio Inc. and Xpeng Inc., both listed in the US, more than doubled their sales during the same period.

Nio, Xpeng and Li Auto, which is listed on Nasdaq, broke all their monthly sales records in September. The latter delivered 3,504 NEVs, while Guangzhou-based Xpeng sold 3,478, an increase of 145%. Nio’s monthly sales increased 133.2% to about 4,700.

Limited alternatives

The growing interest in SGMW’s Mini EV also comes as Chinese authorities target its competitors in the lower-end motor vehicle space, such as closed tricycles and quadricycles, citing safety concerns. Those vehicles have long been used as an alternative to fuel-efficient cars due to their lower costs and fuzzy licensing requirements.

With a variety of shapes and sizes, the Mini EV’s traditional rivals typically cost between 10,000 and 30,000 yuan and travel at speeds of up to 70 kph (43 mph). They have lived in the regulatory shadows of China for years, neither strictly legal nor illegal, and do not require license plates, despite being large and fast enough to cause a lot of damage.

Data from the Ministry of Industry and Information Technology suggest that some 18,000 people were killed and 186,000 injured in quad-related incidents in the five years to 2018. Vehicles were involved in 830,000 traffic incidents recorded during the period.

No license is required to operate such vehicles, making them attractive, but also a risky investment if they are banned in the future.

The Chinese Ministry of Public Security, which has jurisdiction over traffic control, has opposed the idea of legalizing such vehicles, but has not reached a total ban.

However, some local authorities have taken their own measures. Several cities in Shandong province were among those that banned people from operating quadricycles this year.

An industry source said it was inevitable that regulatory changes would push people to buy Mini EVs, which are road legal and can obtain motor vehicle licenses. It could also entice other brands to launch their own similar models to compete in the low-end market, the person said.

“The Hongguang Mini EV has reshaped the low-end vehicle market with its low prices,” the person added. The automaker has announced that it will increase its manufacturing capacity for this model to 20,000 per month in an attempt to deliver orders on time.

Contact reporter Lu Yutong ([email protected]) and editor Flynn Murphy ([email protected])

to download our app to get breaking news alerts and read the news on the go.

You have accessed an article available only to subscribers.

SEE OPTIONS