[ad_1]

Photographer: Soichiro Koriyama / Bloomberg

Photographer: Soichiro Koriyama / Bloomberg

Foreign investors may finally be returning to Japan’s stock market after a six-year sell-off, amid the growing realization of an opportunity nowhere else can provide, says a top fund manager.

Comgest Asset Management Japan Ltd. expects Japan’s earnings growth to outpace that of the US, as corporate taxes will “almost certainly” rise under President Joe Biden. The Tokyo Olympics and the newly forged Asia The trade pact will serve as additional reasons for investors to seek specific exposure to Japan.

The euphoria that has been building since last month over hopes that the pandemic will end has driven US and global stock indices to all-time highs. While the Nikkei 225 stock average is up 13% this year, near the highest level since 1991, it is still 31% below its 1989 bubble-era record.

“This feeling of going back to the peak level of about 30 years ago, I think it makes Japan quite an exciting story right now that we are certainly not in any other major market in the world,” said Comgest portfolio manager Richard Kaye. . , of which $ 4.8 billion The Comgest Growth Japan fund has outperformed 97% of its competitors this year.

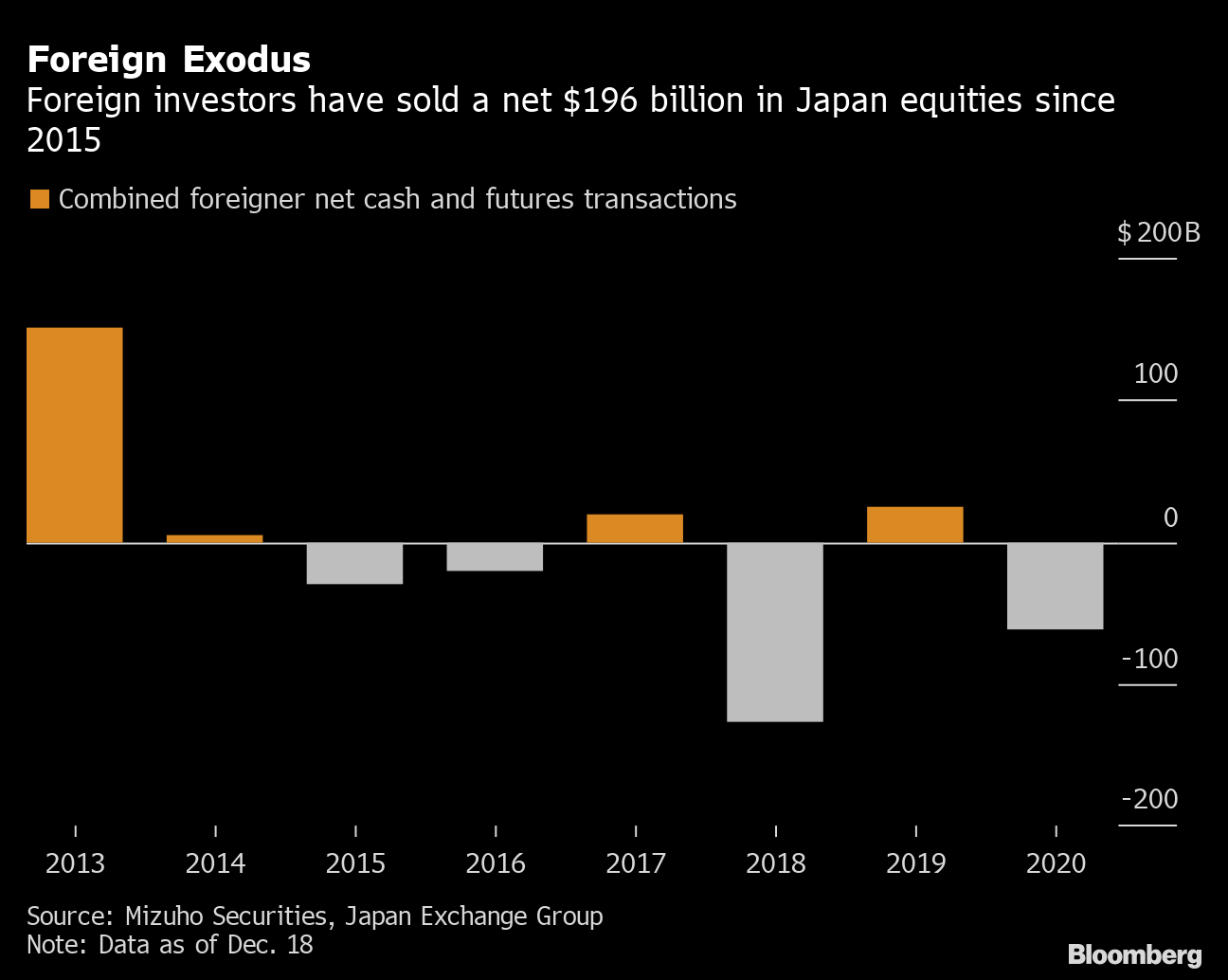

Foreign exodus

Foreign investors have sold $ 196 billion net worth of Japan stock since 2015

Source: Mizuho Securities, Japan Exchange Group

Nomura Securities Co. estimates that about 2 trillion yen ($ 19 billion) to 3 trillion yen will enter Japan’s stock market next year from abroad. JP Morgan Asset Management also expects tickets.

Foreign funds have made large purchases of Japanese stocks since early October, but their net sales in the cash and futures markets for the year still total about $ 62 billion. That is on top of the $ 134 billion they downloaded during 2015-2019, following heavy purchases that came in the immediate aftermath of Shinzo Abe’s rise to power in late 2012.

Japan’s slow economic growth, large national debt, and an aging population are often cited as culprits for liquidation by foreign investors. Some market watchers are now pointing to a number of reasons they may be considering a return, including earnings growth, relatively low valuations, and a high share of cyclical stocks.

The Topix index is trading at approximately 18 times the estimated 12-month earnings compared to more than 22 times for the S&P 500 index.

Toru Ibayashi, head of Japanese equities research at UBS Group AG’s wealth management division, warns that renewed interest from foreign investors may lose steam when earnings recovery peaks after the January quarter to March. He also notes that the attractiveness of Japanese stocks has been affected by their declining weight in the MSCI indices amid rallies in Chinese stocks.

Foreign investors flock to Japan with Buffett’s seal of approval

Comgest’s Kaye argues that bears must distinguish between Japan as a country and as a market. Local demographics and debt levels are not relevant when a growing share of earnings comes from outside Japan, and especially China, he said.

Alexander Treves, investment specialist at JP Morgan Asset, agrees that the nation is misperceived, noting that fewer stocks are “well covered” by analysts in Japan than in the United States or Europe.

“I think a lot of people get confused between economic growth and whether a stock market is attractive or not,” Treves said. “We can find misunderstood or misvalued opportunities that other people just aren’t seeing.”

Read about where Treves sees opportunities here.

– With the assistance of Ishika Mookerjee and Shoko Oda