[ad_1]

Markets start the week nervous after last week’s tech sell-off. Hong Kong police make sweeping arrests when demonstrations return. The prospects for the world economy appear uncertain. These are some of the things that people are talking about in the markets today.

Actions were heading for a Monday’s cautious start after the biggest two-day slide for global stocks since June left investors nervous. The currencies started the week with little fanfare. S&P 500 and Nasdaq 100 futures started the week little changed, with US markets closed on Monday for a holiday after the worst week for the Nasdaq since March. Futures signaled a quiet opening in Japan and Hong Kong. The dollar was stable in the first currency exchange operations, while the euro rose. The oil opened weaker. Volatility remains high for equities as investors continue to chart the path of the global economy with the pandemic. Federal Reserve Chairman Jerome Powell responded positively to the US employment data on Friday, but reiterated his view that the economic recovery has a long way to go and that interest rates will remain low for a while. A big event later this week is the policy meeting of the European Central Bank.

Hong Kong Police Arrested Hundreds of people, including key activists, as protests erupted again on the city streets Sunday after weeks of relative calm since the implementation of a national security law. A total of 270 people were arrested for illegal assembly at 9 p.m. local time, and another 19 were arrested on charges including disorderly conduct, obstruction and assault on the police, Hong Kong police said in a Facebook post. Tension is rising amid the city’s plans to institute a health code that would allow travel between Hong Kong and nearby cities in mainland China, raising ethical concerns among medical professionals and fears of increased vigilance among activists. .

Chinese regulators promised to speed up the opening of the country’s capital markets and deepen reforms to attract more foreign investors. The regulator will expand the scope of investments allowed in the Hong Kong equity connection program link and allow foreign investors to trade more commodity futures products, the vice chairman of the China Securities Regulatory Commission said on Sunday, Fang Xinghai. Officials are planning to announce the revised rules on qualified foreign institutional investors as soon as possible to increase their “willingness and confidence” to invest in China, she said. Foreigners currently own just 4.7% of outstanding Chinese shares, well below the more than 30% in markets such as Japan and South Korea, he said.

The world economy The rebound from the depths of the coronavirus crisis is fading, setting a uncertain end of the year. The concerns are manifold. The upcoming northern winter may unleash another wave of the virus as the wait for a vaccine continues. Government support for workers on leave and bank moratoriums on loan repayments will expire. They are between the US and China could get worse in the futureuntil November presidential elections and undermine business confidence. “We have seen a maximum rebound”, Joachim fels, PIMCO’s global economic advisor, told Bloomberg Television.

In January, a group of chat room dwellers got it into their heads that they could accelerate the returns on a portfolio of stocks by cornering option dealers by your side. It’s starting to look like they were onto something. While not new and a long way from risk-free, the strategy celebrated on the Reddit r / wallstreetbets forum is at least pretty simple. Spend some money on bullish options on the stocks you own in hopes of forcing sellers to buy the same stocks as hedges. A resulting feedback loop drives everything higher, or so the theory goes. Now, by chance or design, something like this appears to be happening on a large scale in US tech stocks, marking a skyrocketing rally and possibly making last week’s decline worse.

What have we been reading

This is what caught our attention in the last 24 hours:

And finally, this is what Adam is interested in this morning

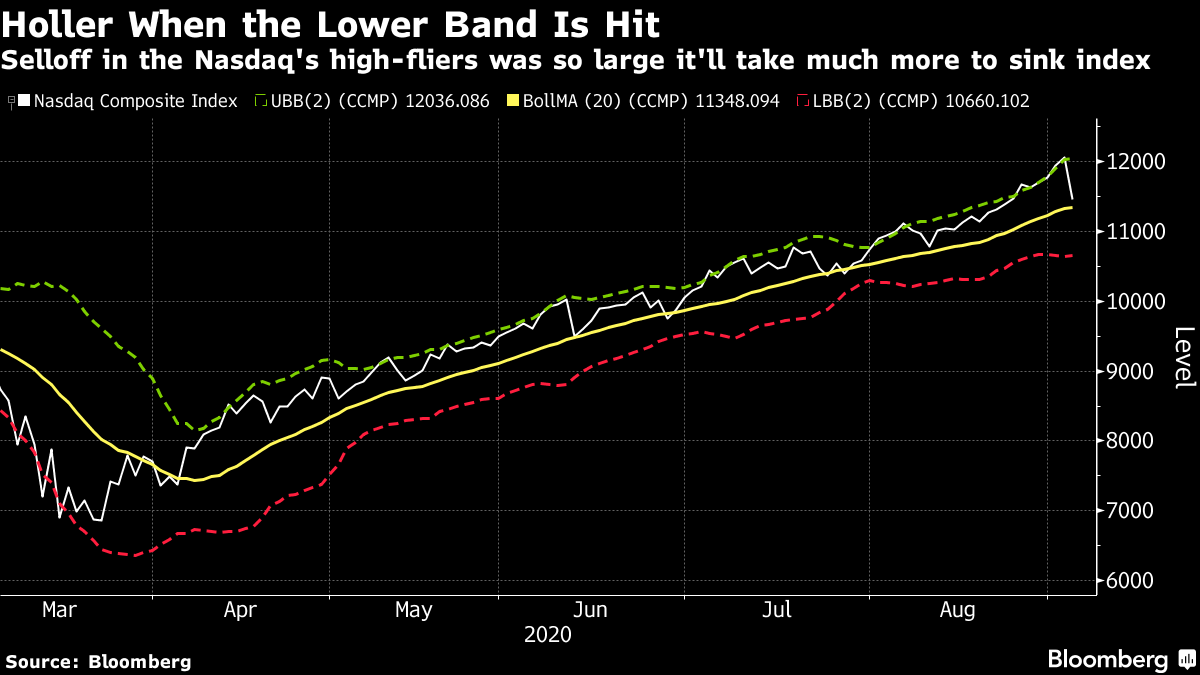

It is a marathon, not a sprint. The Nasdaq 100 ended last week with its biggest two-day drop since March, and it’s easy to get caught up in the drama of a more than 5% drop in one day. Of course, the index was up 42% this year before Thursday. As the Bloomberg Markets Live team has noted, the tech heavy stock indicator would have to sink to 10,660 to hit its lowest Bolinger band. This is a technical indicator that tries to separate the typical from the atypical. In uptrend markets, the “average” line, in yellow on this chart, is usually where the selloffs end.

The longer-term outlook for many tech giants remains favorable, but at what rate? Maybe a little price reset to focus the mind isn’t a bad thing after all.

Adam Haigh is a reporter for Cross-Asset and editor of Bloomberg News in Sydney.

They are recent earnings in emerging market currencies about to end? Join us virtually on September 9 at 1pm GMT + 8 to learn about the future of FX from JP Morgan, Westpac, Royal Bridge Capital and more. Sign up here to be part of this interactive live conversation.