[ad_1]

The onshore bond trading of China Evergrande, the world’s most indebted developer, came to a halt after reports that it was seeking help from the government to avoid a cash crisis sent its stock and debt prices tumbling.

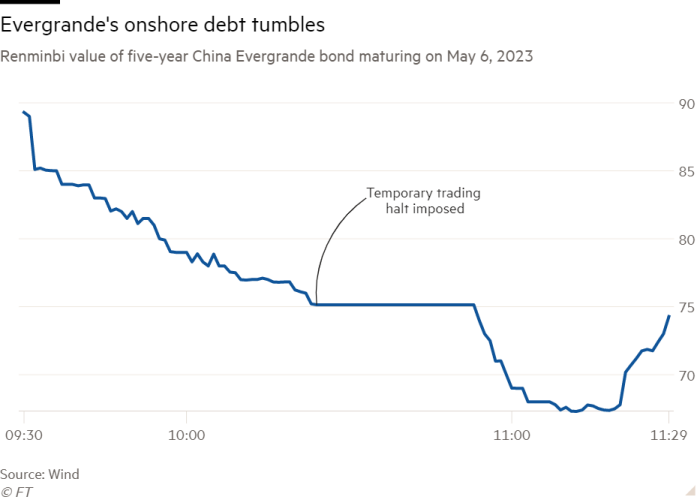

The Shanghai Stock Exchange suspended Evergrande bond trading for half an hour on Friday morning, citing “abnormal fluctuations,” after prices fell from just under Rs 90 ($ 13.19) to Rs 67.20. , compared to its face value of Rs 100.

Evergrande’s shares and debt tumbled after a letter, purportedly from the company, circulated on Chinese social media on Thursday requesting support for a previously planned reorganization of the provincial government in Guangdong, where Evergrande is based.

The company, which is more than $ 120 billion in debt, said in a filing to the Hong Kong Stock Exchange late Thursday that the documents were “false and pure defamation” and that it had reported the matter to the Chinese security authorities.

Evergrande also asked its employees to post a statement on the WeChat social media platform saying the letter was false, according to several people who work at the company. Evergrande did not immediately respond to a request for comment on the matter.

The company’s Hong Kong-listed shares fell more than 8 percent in volatile trading on Friday, adding to a 5.6 percent drop on Thursday.

Evergrande’s offshore debt, which is trading at a discount, also fell. A bond maturing in June fell 6 percent to 91 cents on the dollar. Longer-term bonds also fell, with those maturing in 2025 falling to 77 cents, pushing yields up to 15.7 percent.

In the alleged letter dated August 24, Evergrande asked the Guangdong government to approve a plan to float its subsidiary Hengda Real Estate on the Shenzhen Stock Exchange through a merger with an already listed company.

Evergrande reportedly added that failure to complete the reorganization would pose “systemic risks”, without specifying what they were.

The company has raised around 130 billion rupees ($ 19 billion) by selling shares in Hengda and needs to repay investors if it goes unlisted by the end of January. As of June, Evergrande had Rmb142.5bn in cash and cash equivalents.

Credit rating agency S&P downgraded Evergrande’s credit outlook to negative on Friday. “Evergrande’s short-term debt has continued to grow, in part due to its active acquisition of real estate projects,” he said. “We previously expected the company to address its debt in the short term, especially given the difficult economic climate.”

S&P also said it believes Evergrande will have to repay a portion of its investments in Hengda. However, he added that the risk of a liquidity crisis “is still low for now.”

Analysts have long been concerned that any problem at Evergrande could affect China’s financial system.

“Evergrande is a major source of systemic risk,” said Nigel Stevenson, an analyst at GMT Research. “There are huge debts at the publicly traded parent company that will ultimately need to be rolled over.”

In the wake of the coronavirus pandemic, investors have turned their attention to China’s heavily indebted real estate developers, who have huge volumes of outstanding debt in the hands of foreign entities.

Evergrande slashed the price of its properties in China this month by 30 percent. The company has said the discounts were a “normal sales strategy” for September and October, which are a peak time for home sales in the country.