[ad_1]

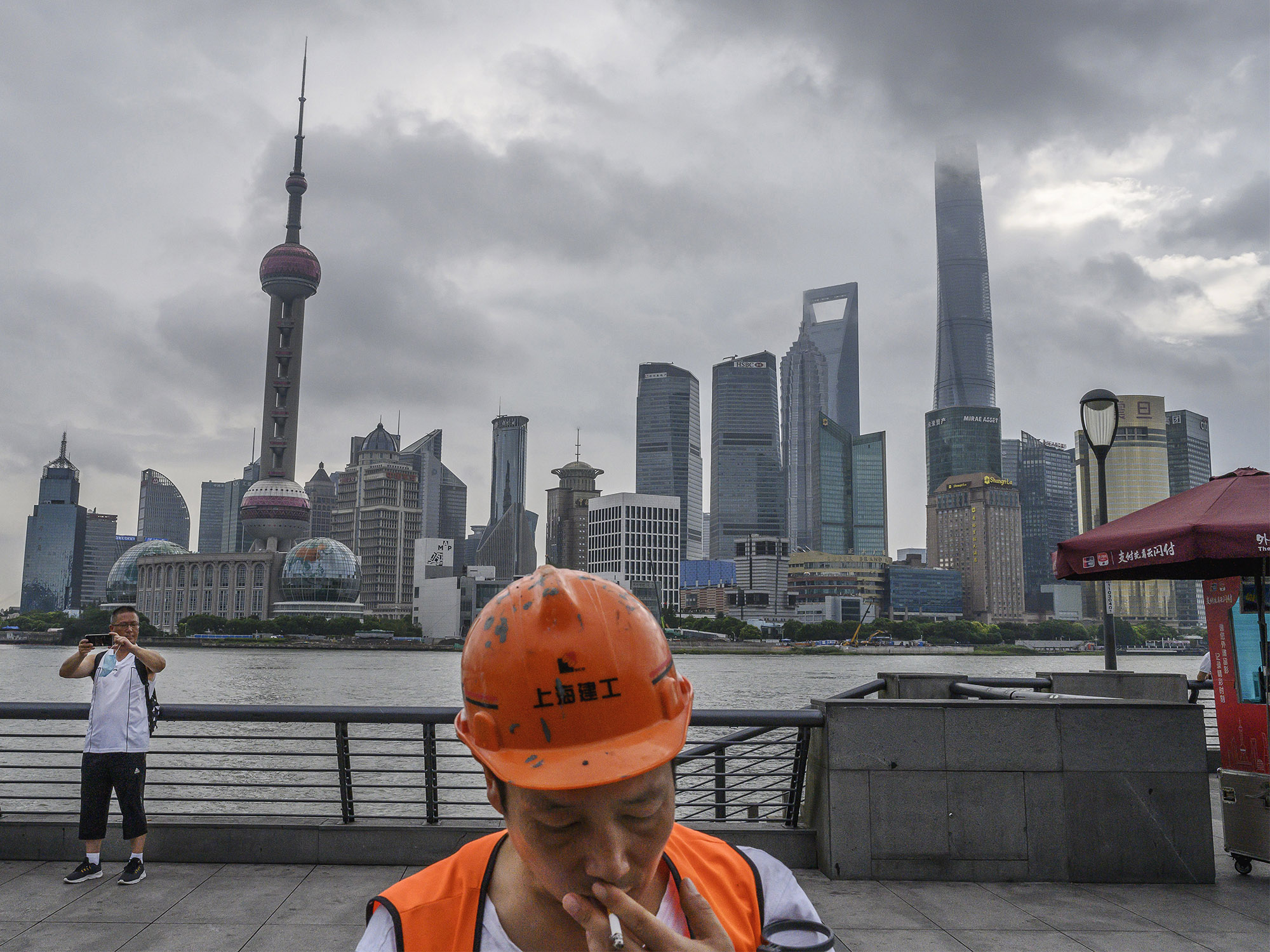

Photographer: Kevin Frayer / Getty Images

Photographer: Kevin Frayer / Getty Images

China’s largest banks suffered their worst profit decline in more than a decade as a cascade of business loans in China is deteriorating.

Reporting your first semester earnings on Sunday, Industrial & Commercial Bank of China Ltd., the world’s largest lender by assets, China Construction Bank Corp., the second largest, Agricultural Bank of China Ltd. and Bank of China Ltd. all saw earnings drops of at least 10%. Provisions for bad debts increased between 27% and 97% in the four banks.

China’s $ 45 trillion banking system has been put on the front line to help ease the worst economic recession in 40 years, triggered by a large-scale shutdown due to the virus outbreak. Authorities have required lenders to give up 1.5 trillion yuan ($ 218 billion) in profits by providing cheap financing, deferring payments and increasing loans to small businesses battling the pandemic.

| First Half Earnings Highlights |

|---|

| ICBC net income 148.8 billion yuan vs 167.9 billion yuan the previous year |

| CCB net income 137.6 billion yuan vs 154.2 billion yuan |

| AgBank net income 108.8 billion yuan vs 121.4 billion yuan |

| BOC net income 100.9 billion yuan vs 114.0 billion yuan |

In total, the country’s more than 1,000 commercial banks posted a 24% decline in second-quarter earnings, and non-performing loans reached a record 2.7 trillion yuan. Citigroup Inc. last month slashed its 2020-2022 earnings forecast for major Chinese banks by more than 10 percentage points and expects them to see a 13% drop in earnings this year.

“Under mounting political pressure, Chinese banks have not only had to cut loan yields further to subsidize the real economy, they also need to accelerate countercyclical provisioning and adopt more conservative NPL assumptions when setting provisions,” they wrote Citigroup analysts led by Judy Zhang. . “The potential negative earnings growth will outpace the short-term equity performance of Chinese banks.”

Pressured by the government to lend to distressed companies, loans and advances at the big four banks increased between 7% and 10% in the first half, even as bad debts increased.

Investors have never been so depressed about the prospects for Chinese lenders. Shares of the largest banks are trading at about 0.45 times their expected book value, a record low valuation, after underperforming benchmark indices in Hong Kong and on the mainland for most of the past five years.

Moody’s Investors Service expects pressure on bad loans to remain high amid weak consumer confidence, putting banks’ profitability under pressure for the remainder of 2020. Economists forecast gross domestic product to grow 2% this year, slowing from 6.1% in 2019.

Chinese banks have joined the chorus of global lenders warning of a difficult economic outlook. HSBC Holdings Plc said the fallout from the pandemic could trigger credit losses of up to $ 13 billion this year, while JPMorgan Chase & Co. spoke of a prolonged recession and said government stimulus was making it difficult to measure economic damage.

In the worst case, Chinese banks could be guided to cut profits by 20-25% in 2020, according to Jefferies analyst Shujin Chen. Further reduction would damage banks’ capital even without any dividend payments and would be detrimental to financial stability, he said.

“The banking industry is facing a more complex and uncertain external environment,” CCB said in its report, citing the pandemic, economic “downward pressure” in China, “geopolitical tensions” and the potential for disruption in the globalization.

China is slowly recovering as President Xi Jinping is picking up his push to make the economy more independent amid a growing confrontation with the United States on everything from trade to finance to technology.

Tensions between the world’s two superpowers over Hong Kong have prompted tit-for-tat sanctions on politicians and officials on both sides in recent weeks. China’s largest lenders are reviewing their accounts so as not to jeopardize their access to crucial dollar funds. The big four banks had $ 1.2 trillion in such financing at the end of June and could face fines for doing business with any of the 11 Hong Kong and mainland officials targeted by US sanctions.

– With the help of Jun Luo and Alfred Liu

(Add earnings from ICBC, BOC.)