[ad_1]

Photographer: Michael Nagle / Bloomberg

Photographer: Michael Nagle / Bloomberg

China’s state telecommunications companies declined in Hong Kong after the The New York Stock Exchange said it is delisting them to comply with a U.S. executive order that sanctioned companies identified as affiliated with the Chinese military.

Actions of China Mobile Ltd., the largest of the three, fell as much as 4.5% on Monday to its lowest level since 2006, while China Telecom Corp. fell 5.6%. The two posted their biggest intraday losses since mid-November. China Unicom Hong Kong Ltd. fell 3.6%. Trading of the three firms’ US depository receipts will be suspended between Jan.7-11, and the delisting process has begun, the NYSE said.

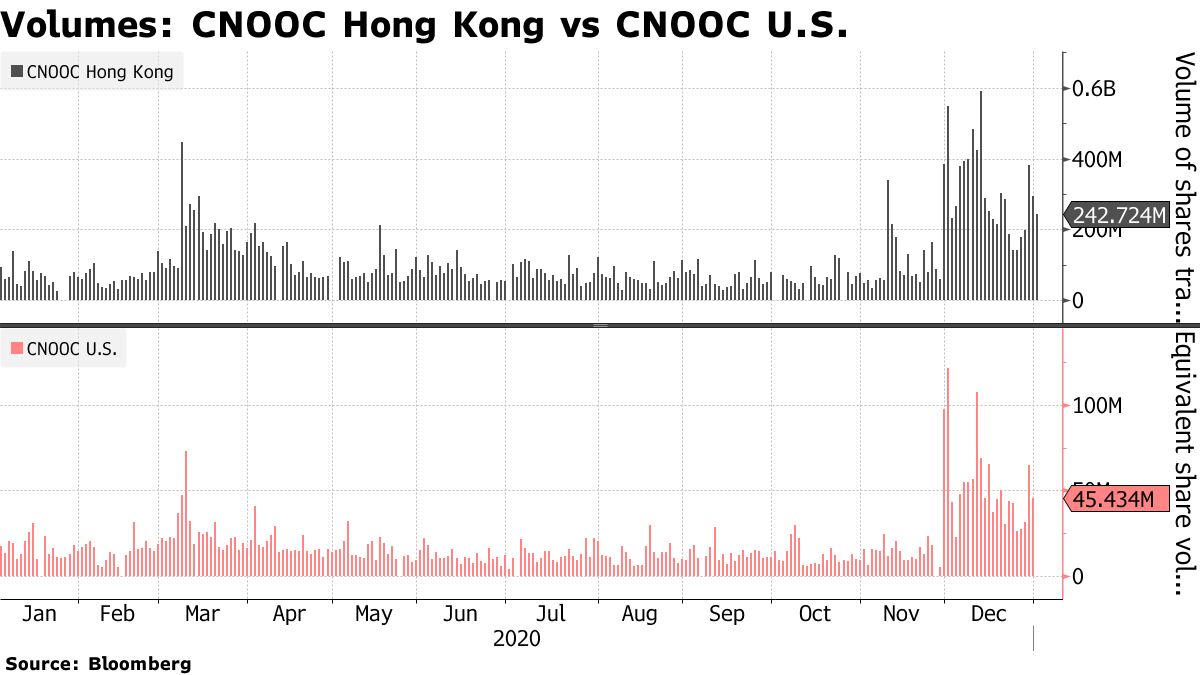

The nation’s major oil companies, including CNOOC Ltd. also fell into concerns that they will be the next target for removal in the US.

“It’s largely a blow to sentiment” that could be temporary, said Mark Huang, an analyst at Bright Smart Securities in Hong Kong. “Although ADRs are not exceptionally large, there is some impact on fundraising. Some passive index tracking funds can be sold to avoid risk. More importantly, this is another reason to download telecommunications and pursue higher performance sectors. “

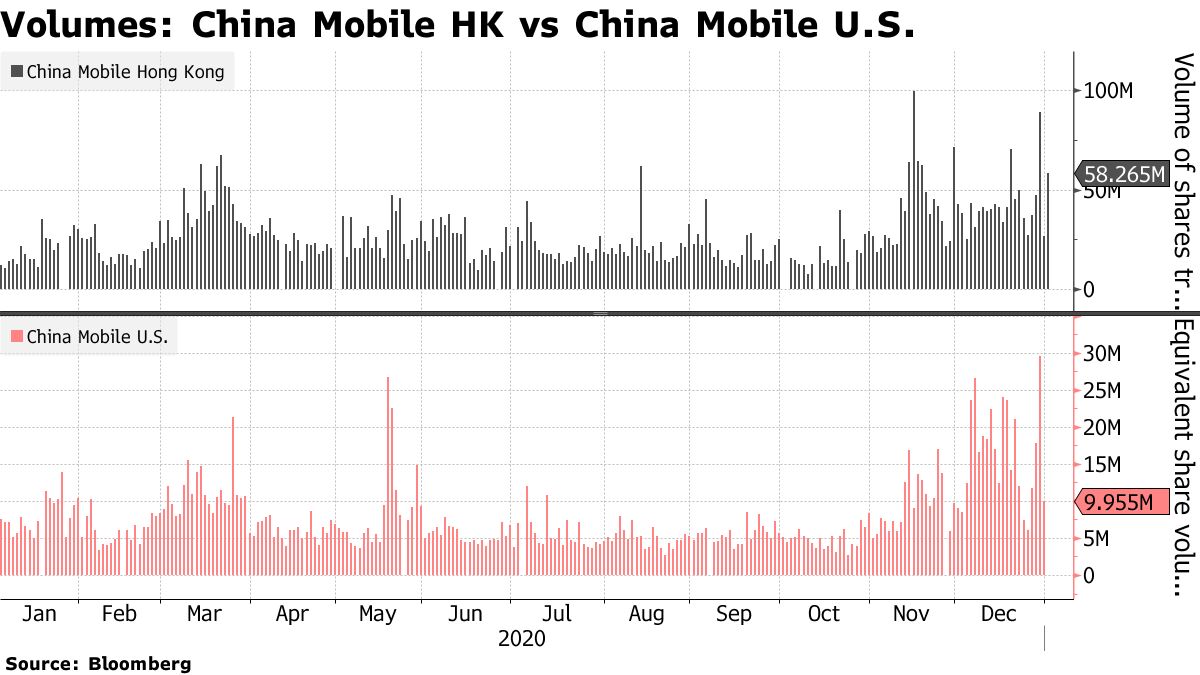

The NYSE move followed an order by US President Donald Trump in November to ban US investments in Chinese companies owned or controlled by the military, in an attempt to pressure Beijing for what it considers abusive business practices. China Securities Regulator He said that given the small number of shares traded in the United States in each of the three phone companies, the impact on them would be limited and they are well positioned to handle the consequences.

Symbolic blow

The delisting is more of a symbolic blow amid increased geopolitical friction between the world’s two largest economies, as they trade sparsely on the NYSE. The companies also derive almost all of their income from China.

The decision “may put short-term selling pressure on the shares,” Citigroup Inc. said in an investigative report. “However, the operations of Chinese telecommunications companies are mainly focused on the national level and, in our opinion, their strong fundamentals, together with recovery trends and positive cash flows, will not be affected by the foreclosure.” .

ADRs total less than 20 billion yuan ($ 3.1 billion) and represent a maximum of 2.2% of total shares each, the The China Securities Regulatory Commission said in a statement on Sunday. China Telecom has 800 million yuan of ADR and China Unicom has about 1.2 billion yuan.

“The recent move by some political forces in the United States to continually and unfoundedly suppress foreign companies listed on the US markets, even at the cost of undermining their own position in global capital markets, has shown that the rules and US institutions can become arbitrary, reckless and unpredictable, ”said the CSRC. “It is certainly not a success.”

FTSE Russell

Index provider FTSE Russell it said on Monday whether it plans to remove more Chinese stocks from its benchmark indices, after the United States added to its list of sanctioned stocks in recent weeks. FTSE Russell had already listed eight company divestitures as of early December, a decision that was later followed by their peers. MSCI Inc. and S&P Dow Jones. The FTSE Russell changes will be effective from the start of trading on Thursday.

In separate statements Monday, each telecom operator said it “regrets” the NYSE’s actions and said the decision could affect prices and the trading volume of the companies’ shares. The three companies said they had not received any notification from the NYSE about the delisting.

China Unicom and China Mobile said they are reviewing ways to protect the “legal rights” of companies. China Telecom said it is considering “corresponding options” to “safeguard the legitimate interests of the company.”

China’s Commerce Ministry said on Jan.2 that the country will take necessary actions to protect the rights of Chinese companies and hopes the two countries can work together to create a fair and predictable environment for companies and investors. China has tried to avoid an escalation of the dispute with Washington before Biden takes office in a few weeks. China’s Foreign Ministry did not immediately respond to a request for comment on Monday.

CNOOC fell as much as 5.7% in Hong Kong on Monday, its biggest intraday loss since Dec. 1. PetroChina Co. fell 2.9% and China Petroleum and Chemical Corp., also known as Sinopec, fell 1.4%.

China’s largest offshore oil producer CNOOC could be at higher risk as it is on the Pentagon’s list of companies it says are owned or controlled by the Chinese military, according to Henik Fung, an analyst at Bloomberg Intelligence. PetroChina and Sinopec may also be under threat as the energy sector is crucial for China’s armed forces, he said.

A spokesperson for Sinopec declined to comment. Cnooc and PetroChina did not immediately respond to emailed requests for comment.

– With the assistance of Shirley Zhao, April Ma, Kevin Kingsbury, Dan Murtaugh and Jing Li

(Updates with analyst comments in the fourth paragraph)