[ad_1]

Mon, Nov 02, 2020 – 2:10 pm

On Monday, DBS Group Research noted that the fortunes of Singapore-listed retail-focused real estate investment trusts (S-Reits) are “closely linked” to that of the troubled owner of Robinsons Singapore.

More brands from the Dubai-based conglomerate Al-Futtaim, which owns the now-liquidation department store operator, may also do the same with the closures, the research team wrote.

The Al-Futtaim group is bigger than most might think: it is the majority of Singapore’s biggest brand representatives. Its brands in the city-state include household names like Marks & Spencer, Zara, and Mango.

Across its 23 brands in Singapore, Al-Futtaim has 111 retail outlets, and about half (56) of these stores are located in S-Reits shopping malls, said DBS analysts Geraldine Wong, Derek Tan and Rachel. So on a note on Monday.

Robinsons’ departure may not be a unique occurrence among Al-Futtaim’s portfolio of brands, given ongoing pressures due to travel and capacity limits, the analysts added.

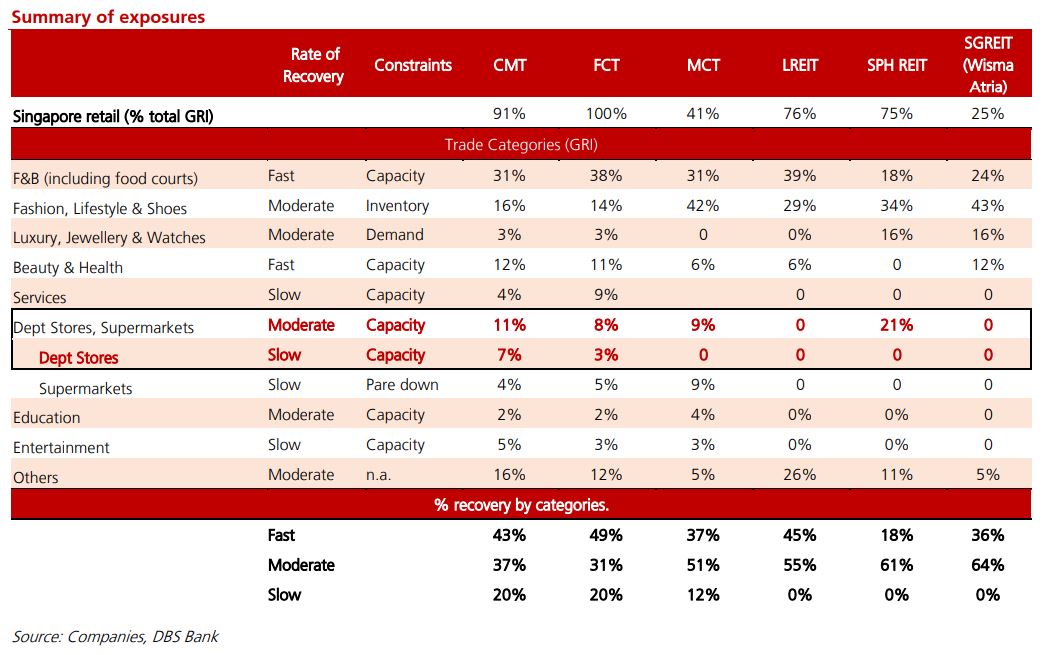

The retail S-Reits with the highest exposure to the group by store count are CapitaLand Mall Trust (CMT) with 15 outlets and Frasers Centrepoint Trust (FCT) with 11, according to DBS.

CapitaLand also rents to nine Al-Futtaim brands in total, at its Jewel Changi and Ion Orchard airports.

Similarly, mall owners in Orchard’s shopping belt, such as Starhill Global Reit with nine stores, Lendlease Global Commercial Reit with seven, and Mapletree Commercial Trust’s (MCT) VivoCity with eight, have close owner-retailer relationships. with the group, DBS said.

This occurs when fashion retailers remain in consolidation mode. The shift to work-from-home practices amid the coronavirus pandemic has led to a drop in retail portfolio sales in fashion.

Therefore, DBS believes that most retail brands may look to streamline their presence in 2021, and will likely carefully review any store-by-store and brand-by-brand store closings to maximize profitability.

“Over time, we believe that the dominant shopping malls in Singapore will continue to attract tenants to maintain their long-term occupations,” the research team wrote.

It favors CMT, FCT and Lendlease Reit, which have “dominant” shopping centers with features that allow them to attract tenants, maintain higher occupancies than the rest of the industry, and therefore navigate beyond the changing retail landscape.

Robinsons confirmed last Friday that it will close permanently after more than a century in business, weighed down by losses in recent years. Some 175 employees will be affected by the shutdown.

“While the timing was a surprise to many, we noted that department store formats have been struggling for years, and the inability to establish an omnichannel presence has resulted in department stores rationalizing their footprint over time,” wrote DBS .

The Covid-19 pandemic puts more pressure on their revenue, which has led to restrictions on department stores from conducting “atrium sales.”

Following the Robinsons collapse, the focus is now also on S-Reits department store exposure, which ranges from 7% to 21% of Singapore’s gross revenue.

Robinsons department stores contributed about 7 percent of CMT’s revenue, although Reit’s merger with CapitaLand Commercial Trust is estimated to reduce this exposure to less than 2 percent, DBS said.

Other department store operators in the Republic include Tangs from CK Tang Limited, which is a tenant of MCT, and Metro Holdings, which is listed on the main board, which is a tenant of FCT and SPH Reit. Isetan Singapore does not have S-Reits exposure, although it is listed on the Singapore Stock Exchange.

Department stores are often anchor tenants within shopping centers, given the large percentage of net leasable area that they rent. The departure of such anchor tenants can result in a “black hole” in shopping malls, DBS noted.

“Owners may need to get creative with the additional space parcel with the option of finding another anchor tenant to fill the entire space or splitting the retail parcel into smaller ones with rental potential and considering the overall positioning of the asset in march forward, “analysts said.

Among DBS stock picks, CMT, to be renamed the CapitaLand Integrated Commercial Trust on Tuesday, was trading at S $ 1.74 as of 1:29 pm Monday, an increase of S $ 0.01 or 0.6 percent.

FCT units fell S $ 0.01 or 0.5% to trade at S $ 2.10, while Lendlease Reit fell 0.5 Singapore cents or 0.8% to 60.5 cents.

[ad_2]