[ad_1]

The chances that Jack Ma’s Ant Group Co. will be able to reactivate its huge stock listing next year are increasingly slim as China reviews the rules governing the fintech industry, according to regulatory officials familiar with the matter.

Ant is still in the early stages of reviewing the changes needed to appease regulators, who require its business to adhere to a series of new and proposed guidelines in areas including consumer loans, officials said. With so much work needed and some rules not yet detailed, officials said the initial public offering may not take place before 2022.

An additional delay of a year or more would be another setback for billionaire Ma, as well as early-stage investors, including Warburg Pincus LLC that they were counting on a windfall from what was about to be a record $ 35 billion initial public offering. It would also be a potential blow to Alibaba Group Holding Ltd., which owns a third of Ant and saw its shares drop after the deal was abruptly suspended this month. Alibaba fell 3% in Hong Kong on Monday, the biggest drop in nearly three weeks.

A representative for Ant declined to comment. Representatives for the central bank, the China Banking and Insurance Regulatory Commission and the China Securities Regulatory Commission did not immediately respond to faxes seeking comment.

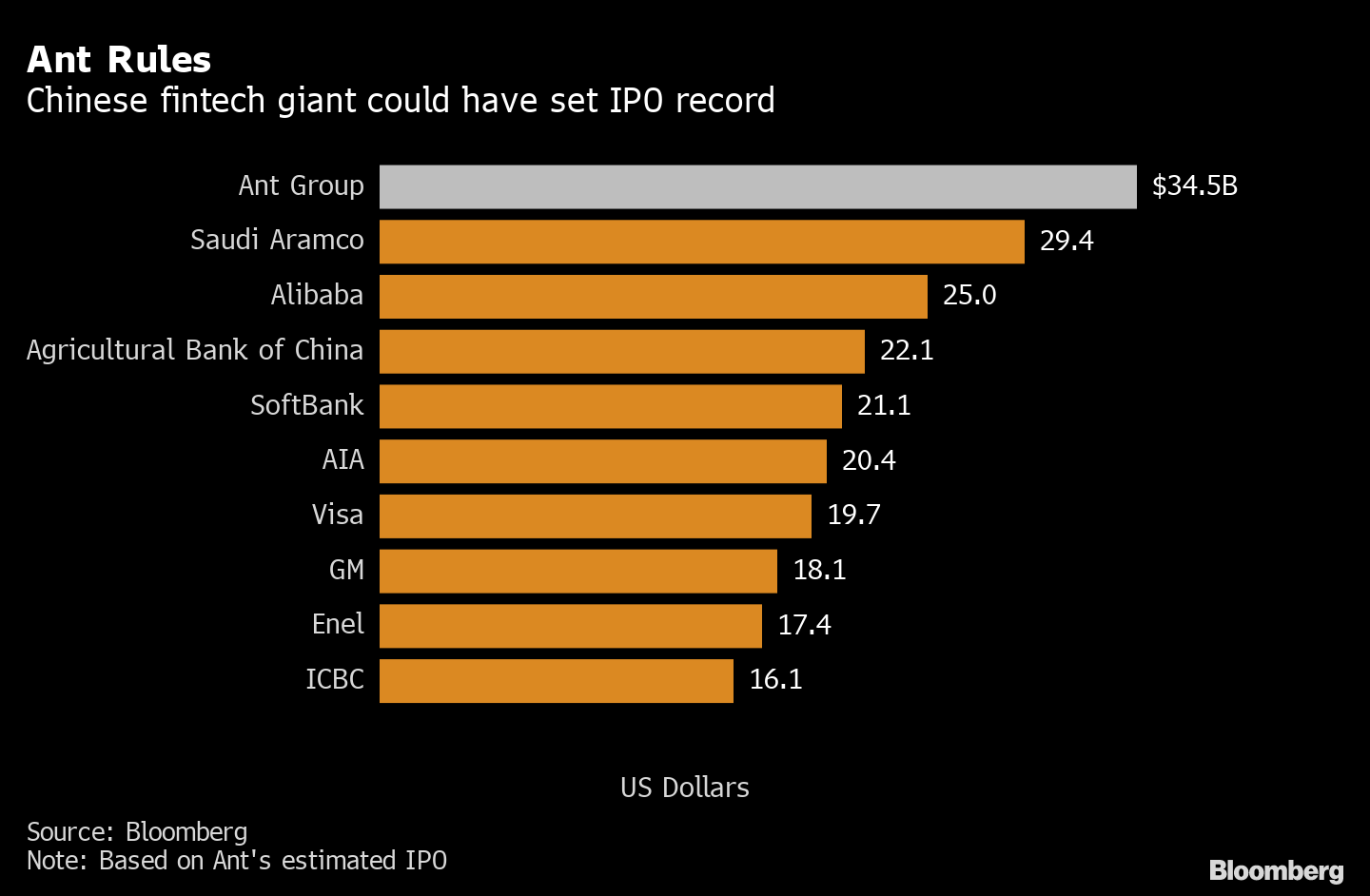

Ant rules

Chinese fintech giant could have set IPO record

Source: Bloomberg

The enormity of the challenge Ant faces in restarting its IPO stemmed from discussions with officials working at regulators with oversight of the financial services and securities industry. They emphasized that Beijing’s immediate priority was to ensure that the fintech giant aligned itself with the evolving regulatory environment.

China has established a joint task force to oversee Ant, led by the Financial Stability and Development Committee, a financial system regulator, along with various central bank departments and other regulators, said two of the people, who asked not to be identified discussing private matters. The group is in regular contact with Ant to collect data and other materials, study its restructuring and write other rules for the fintech industry, they said.

Fresh capital

Under the draft rules for micro-lenders issued in early November, Ant would be forced to replenish capital. That could mean the company needs around $ 12 billion to comply, according to an estimate from Bloomberg Intelligence.

“The hardest hit segment is Ant’s CreditTech business, which needs to go through material capital and funding overloads at its consumer loan subsidiaries or restructure its loan business,” said Francis Chan of BI in a research note Monday. “This could compromise the revenue outlook for the segment and therefore the entire company.”

The company must also apply to the China Banking and Insurance Regulatory Commission for new licenses for its two microcredit platforms: Huabei (Just Spend) and Jiebei (Just Lend). The banking regulator will limit the number of platforms allowed to operate domestically and is unlikely to approve two licenses for Ant, the people said.

Ant will also need to apply to the central bank for a separate financial holding company license, as its operations span more than two financial segments. Regulators have yet to provide clear and specific guidance to Ant, but they have told the company that it must comply with current regulations and operate under the framework of a financial holding company, according to people familiar with it.

The Hangzhou-based firm is awaiting the final version of the microloan rules and expects more regulations to be filed in the fintech sector, such as wealth management, in the coming months, one of the people said. Meanwhile, the IPO is not a priority.

There are still obstacles

Understanding the thinking of the authorities and navigating the complex rules, some of which are still subject to change, are the biggest hurdles facing Ant, whose trading was halted just two days before scheduled debuts in Hong Kong and Shanghai. The highly anticipated IPO had triggered an investment frenzy, with dizzying demand that took its valuation to $ 315 billion, more than JPMorgan Chase & Co. at the time.

With no viable plan agreed to by all parties, Ant faces a lengthy hiatus to revive the IPO, potentially longer than the few months late. pointed out by some analysts and Singapore’s top executive DBS Group Holdings Ltd., one of the bankers in the deal. If Ant fails to make the sale before his IPO application expires in October, he would have to go through the listing process again in Shanghai and seek new approvals.

The landscape is changing rapidly for China’s fintech industry, which until recently offered the most compelling evidence that tech giants are using their power – and a slight regulatory twist – to reconfigure traditional financial services. With the call for stricter oversight coming from top leaders, they are now rushing to shore up capital, mulling over trade reforms and bracing for further turmoil as industry watchdogs set their sights on areas encompassing lending, banking associations and data privacy.

Ant, the biggest player in online lending, has been the most visible victim given the abrupt cessation of its IPO, filed just weeks after Ma asked China’s regulators to adapt to the changing face of finance. In addition to the capital replenishment discussions, Ant is also slowing the pace at which it packages existing loans into asset-backed securities to sell to investors, said a person familiar with the matter.

Analysts including those from Morningstar Inc. has already cut its estimates for Ant’s valuation by up to half, eroding potential earnings for early investors such as Warburg Pincus, Silver Lake Management LLC and Temasek Holdings Pte. Chan on Bloomberg Intelligence. estimates Ant’s valuation could drop to $ 220 billion, compared to $ 320 billion when the IPO was stopped.

A smaller deal would also mean reduced fees for investment banks, including Citigroup Inc. and China International Capital Corp. that had an unexpected IPO. The downsized sale gives Ma’s company less clout to make acquisitions as it seeks to expand beyond its Chinese base and take the fight domestically to Tencent Holdings Ltd.

– With the help of John Liu, Haze Fan, Heng Xie, Zheng Li, Lulu Yilun Chen, April Ma, Jun Luo and Xize Kang

(Updates with Alibaba shares)