[ad_1]

Jack Ma

Photographer: Scott Eells

Photographer: Scott Eells

Two months ago, global investors were about to take advantage of a windfall from what would have been the world’s largest initial public offering. Now the returns on the hundreds of millions of dollars invested with Ant Group Co. is in danger.

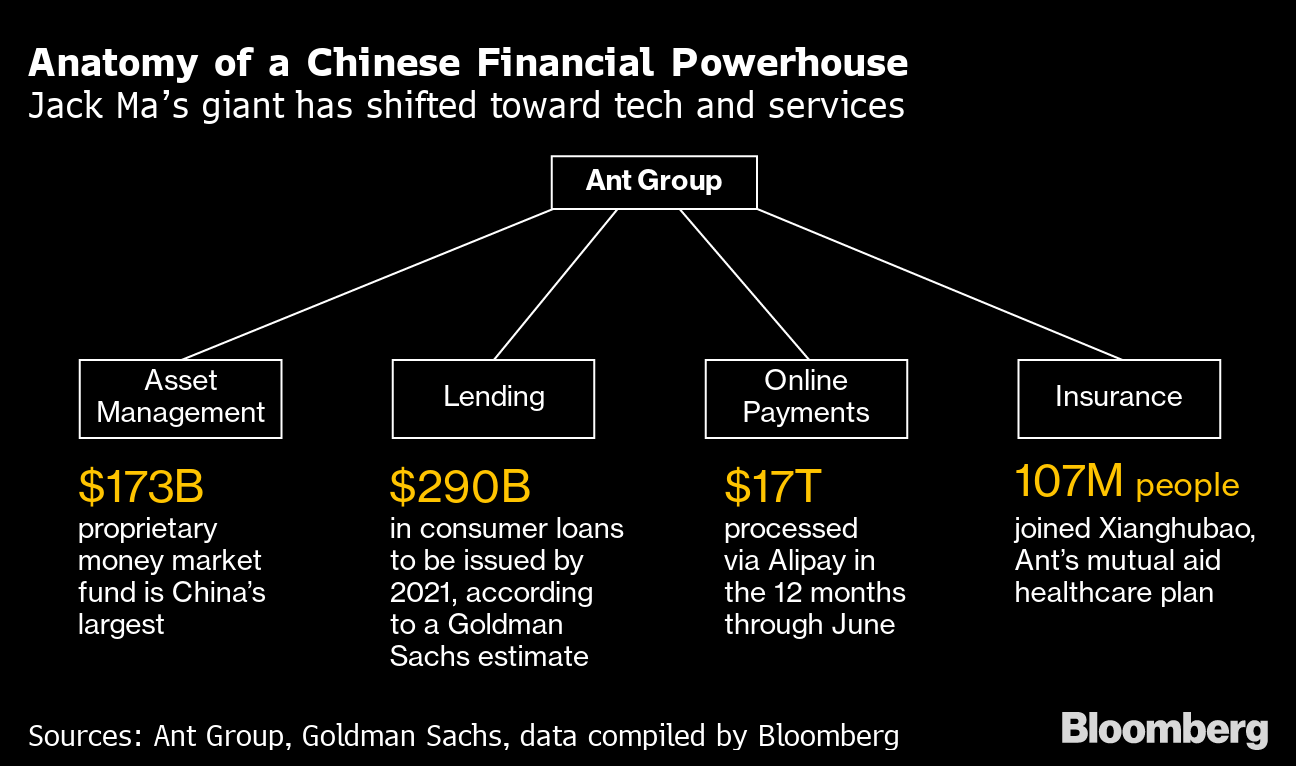

China ordered Ant to reexamine its fintech businesses, which range from wealth management to loans and consumer credit insurance, and return to its roots as a payment service.

While the central bank’s statement on Sunday was short on details, it poses a serious threat to the growth and more lucrative operations of billionaire Jack Ma’s online financial empire. Regulators did not go so far as to directly call for the breakup of the company, but They stressed that it was important for Ant to “understand the need to review his business” and told him to come up with a plan and timeline as soon as possible.

Photographer: Marlene Awaad / Bloomberg

Authorities also berated Ant for his poor corporate governance, his disregard for regulatory requirements and his involvement in regulatory arbitration. The central bank said Ant used its dominance to shut out rivals, hurting the interests of its hundreds of millions of consumers.

Ant said in response that he will establish a special team to meet the demands of regulators. It will keep business operations for users, promising not to increase prices for consumers and financial partners, while increasing risk controls.

The Hangzhou-based firm needs to establish a separate financial holding company to comply with the rules and ensure it has enough capital, regulators added.

Anatomy of a Chinese financial powerhouse

Jack Ma’s giant has been geared towards technology and services

Sources: Ant Group, Goldman Sachs, data compiled by Bloomberg

Here are some of the scenarios from investors and analysts on what the restructuring might look like:

Mild

Optimists say regulators are simply asserting their right to oversee the country’s financial sector, sending a warning to unintentional internet companies for a drastic change.

Beijing could be trying to make an example of Ma’s Ant, the largest among a number of new but ubiquitous fintech platforms. Previous crackdowns of this nature have dealt short-term blows to companies, leaving them virtually unscathed. Social media giant Tencent Holdings Ltd., for example, became a prominent target of a campaign to combat game addiction among children in 2018. While its shares took a hit, they eventually rebounded to all-time highs.

Ant affiliate, Alibaba Group Holding Ltd. similarly regained investor confidence after short-term liquidations following accusations by authorities about everything from unfairly pressuring traders to turning a blind eye to counterfeits on its trading platform. electronic commerce.

“I don’t think regulators are thinking of splitting Ant, as no fintech company in China has a monopoly status,” said Zhang Kai, analyst at market research firm Analysys Ltd. “The act is not just about target to Ant but also to send a warning to other Chinese fintech companies. “

Some see it as an opportunity for Ant. With the industry as a whole facing stricter oversight, Ant has more resources to meet the challenges as an industry leader, Zhang said.

Bad

A more troubling outcome would be if regulators decide to split Ant Group. That would complicate the shareholder structure and hurt the company’s fastest-growing businesses.

Valued at around $ 315 billion before its initial public offering was halted, Ant cornered investments from the world’s largest funds. Among them: Warburg Pincus LLC, Carlyle Group Inc., Silver Lake Management LLC, Temasek Holdings Pte and GIC Pte.

Global investors backed the company when it was valued at approximately $ 150 billion in its last round of fundraising in 2018. A breaking off It would make the return on its investments uncertain, with the timeline for an IPO due in November now moving forward into the distant future.

The government could ask Ant to spin off its most lucrative wealth management, credit loan and insurance operations and transfer them to a financial holding company that will face stricter scrutiny.

“The emerging reality is that China’s regulators are adopting similar regulation towards banks and fintech players,” said Michael Norris, manager of research and strategy at Shanghai-based consultancy AgencyChina.

Ant’s payment business leaves much less to the imagination. While the service handled $ 17 trillion of transactions in one year, online payments have been largely loss-making. The two largest mobile payment operators, Ant and Tencent, have heavily subsidized companies, using them as a gateway to win over users. To make money, they took advantage of payment services for cross-selling products, including wealth management and credit loans.

“Ant’s growth potential will be limited with the focus again on its payment services,” said Chen Shujin, Hong Kong-based head of China financial research at Jefferies Financial Group Inc. “On the mainland, the industry of online payments is saturated and Ant’s market share has practically reached its limit. “

Nightmare

The worst case scenario would be for Ant to give up its money management, credit and insurance businesses, shutting down its operations in units that serve 500 million people.

Its wealth management business, which includes the Yu’ebao platform that sells mutual funds and money market funds, accounted for 15% of revenue.

Lending technology, which includes Ant’s Huabei and Jiebei units, was the largest revenue driver for the group, contributing 39% of the total in the first six months of this year. Made loans to about 500 million people.

Read more about Jack Ma’s Ant Group business units

That result would be supported by the idea that China’s leaders have become frustrated with the boastfulness of tech billionaires and want to teach them a lesson by killing their businesses, even if it spells short-term pain for the economy and markets.

China’s private sector has had a delicate relationship with the Communist Party for decades, and only recently has it been recognized as central to the future of the nation. Many commentators have attributed the recent crackdown on fintech companies to comments Ma made at a conference in October, when he condemned attempts to control the burgeoning field as shortsighted and outdated.

Among them, Alibaba, Ant, and Tencent earned a combined market capitalization of nearly $ 2 trillion in November, outperforming state-owned giants like Bank of China Ltd. as the most valuable companies in the country.

The trio have invested billions of dollars in hundreds of internet and mobile phone startups, earning them king-maker status in the world’s largest internet and smartphone market by users.

China’s Internet Rulers

Tencent, Alibaba and Ant Group have invested in a wide range of Chinese startups spanning fields from social media to online commerce.

Sources: Bloomberg, CB Insights, Crunchbase

“The Communist Party is the end of everything and the absolute in China. It controls everything, ”said Alex Capri, a Singapore-based researcher with the Hinrich Foundation. “There is nothing that the Communist Party of China does not control and anything that appears to be spinning out of its orbit will somehow retreat very quickly,” he said, adding that “we can expect to see more of that.”

– With the assistance of Lulu Yilun Chen, Coco Liu, Jun Luo and Colum Murphy