[ad_1]

Photographer: Andrey Rudakov / Bloomberg

Photographer: Andrey Rudakov / Bloomberg

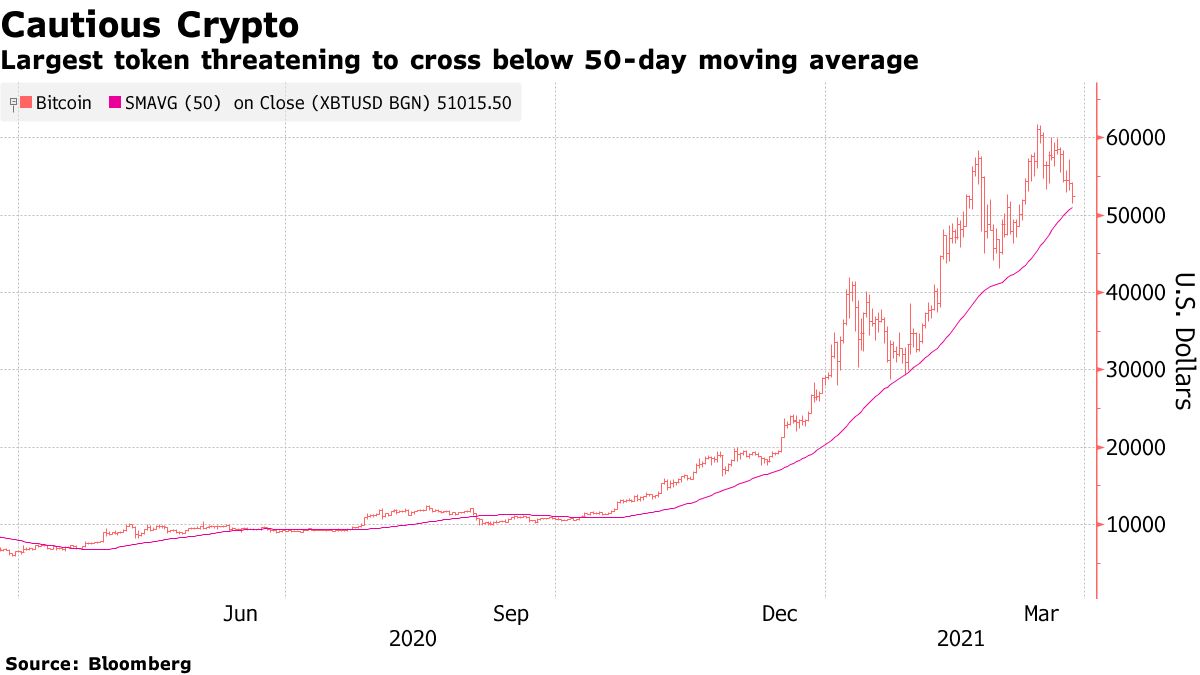

Bitcoin fell amid a broader pullback in assets that had previously ridden a wave of stimulus-infused optimism among retail traders.

The largest cryptocurrency fell 2% to roughly $ 52,950, a two-week low, at 7:02 a.m. in New York. The token is mired in its longest losing streak since December. The broader Bloomberg Galaxy Crypto Index is also struggling.

Speculation is growing that the latest stimulus checks in the US will be spent in the real economy rather than markets, as vaccines help bring life back to something closer to normal. The number of call options traded in the US has fallen from records earlier this year and high-profile investments such as GameStop Corp. and the ARK Innovation ETFs are sliding.

A general downtrend for Bitcoin is being “exacerbated by movement toward value across all asset classes” and away from areas like technology, said Vijay Ayyar, head of Asia Pacific with crypto exchange Luno in Singapore. The upcoming expiration of derivatives contracts adds to the volatility, he said.

Read More: Army of Retail Traders Announcing Recall in Latest Wave of Stimulus

Bitcoin is roughly $ 9,000 below the record of $ 61,742 set in early March, but it is still 700% higher over the past year. The coin briefly spiked on Wednesday after a series of tweets from Tesla Inc. CEO Elon Musk announcing that the automaker will accept the digital asset. How paid.

The token is still primarily a vehicle for speculation and is unlikely to crowd out alternative stores of value, according to Blythe Masters, a former JPMorgan Chase & Co. executive who is now CEO of Motive Capital. Benoit Coeure of the Bank for International Settlements said the currency’s volatility makes it impossible to act as a currency.

Benoit Coeure, director of the Innovation Center at the Bank for International Settlements, discusses bitcoin and central banks that offer a regulatory framework for digital currencies.

Others argue that institutional adoption of Bitcoin is expanding as part of efforts to diversify portfolios and hedge risks such as faster inflation.

“The color and information that we see on the street comes largely from the institutional part of the market, and nothing has really changed in their opinion about the impact of the stimulus on inflation in the longer term and the role of digital assets as hedging, “said Matt Long, head of distribution and lead brokerage at the OSL digital asset platform in Hong Kong.

– With the help of Emily Barrett