[ad_1]

A strong recovery from the Covid-19 recession is likely to lead Federal Reserve Chairman Jerome Powell and his colleagues to raise interest rates in 2023, but that will not appear in their forecasts this week, a survey showed. .

Economists polled by Bloomberg News see two rises of a quarter point in 2023. But they also expect the US central bank’s own forecast, released at the same time as its policy statement at 2 p.m. in Washington on Wednesday. , show the median official Fed projection rates remaining on hold near zero for that year.

Such a result would coincide with the Fed’s December projections, even though US lawmakers have backed nearly $ 3 trillion in fiscal stimulus since then, including $ 1.9 trillion that President Joe Biden enacted Thursday, which, along with the acceleration of vaccines, is boosting the economic outlook.

‘Powerful trio’

“The Fed is now investigating the unknown as a powerful trio of massive fiscal stimulus, monetary support and stifled demand impact an economy liberated by the widespread dissemination of vaccines,” said economist Lynn Reaser of Point Loma Nazarene University in a response to the survey.

The Federal Open Market Committee will almost certainly keep rates near zero and commit to continuing its asset purchases at the current monthly rate of $ 120 billion at its second meeting of the year.

Powell has repeatedly emphasized that the US labor market remains far from the Fed’s full employment target, so it is too early to discuss reducing the Fed’s support as the world marks the first anniversary of the Fed. pandemic.

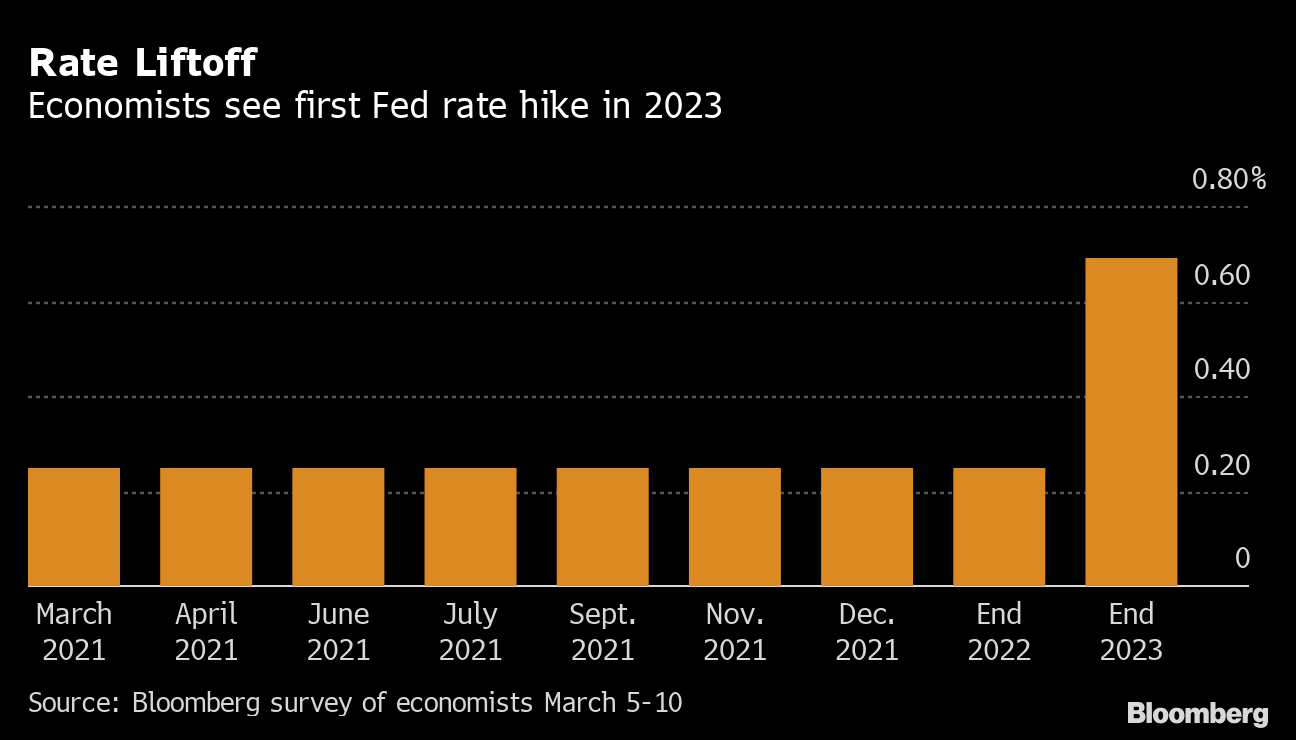

Take-off rate

Economists see Fed’s first rate hike in 2023

Source: Bloomberg Survey of Economists March 5-10

Still, three-quarters of economists forecast that the central bank will have to raise rates by the end of 2023, where the average respondent has estimated around 50 basis points of adjustment. In contrast, the median in the December Bloomberg survey had no rate changes until 2024 or later.

What Bloomberg economists say …

“While economic projections will change, we don’t expect rate expectations to move much at all. In fact, although some points may move further up the dot plot, we expect the center of the Committee to hold the line in terms of not recognizing any change in the exit schedule. “

– Carl Riccadonna, economist

FOMC forecasts

The committee, when making its first quarterly economic projections of the year, will raise its growth estimates for 2021 and increase the call for inflation, without advancing a liquidation of asset purchases or interest rate increases, in the opinion of the 41 economists. , who were surveyed from March 5 to 10.

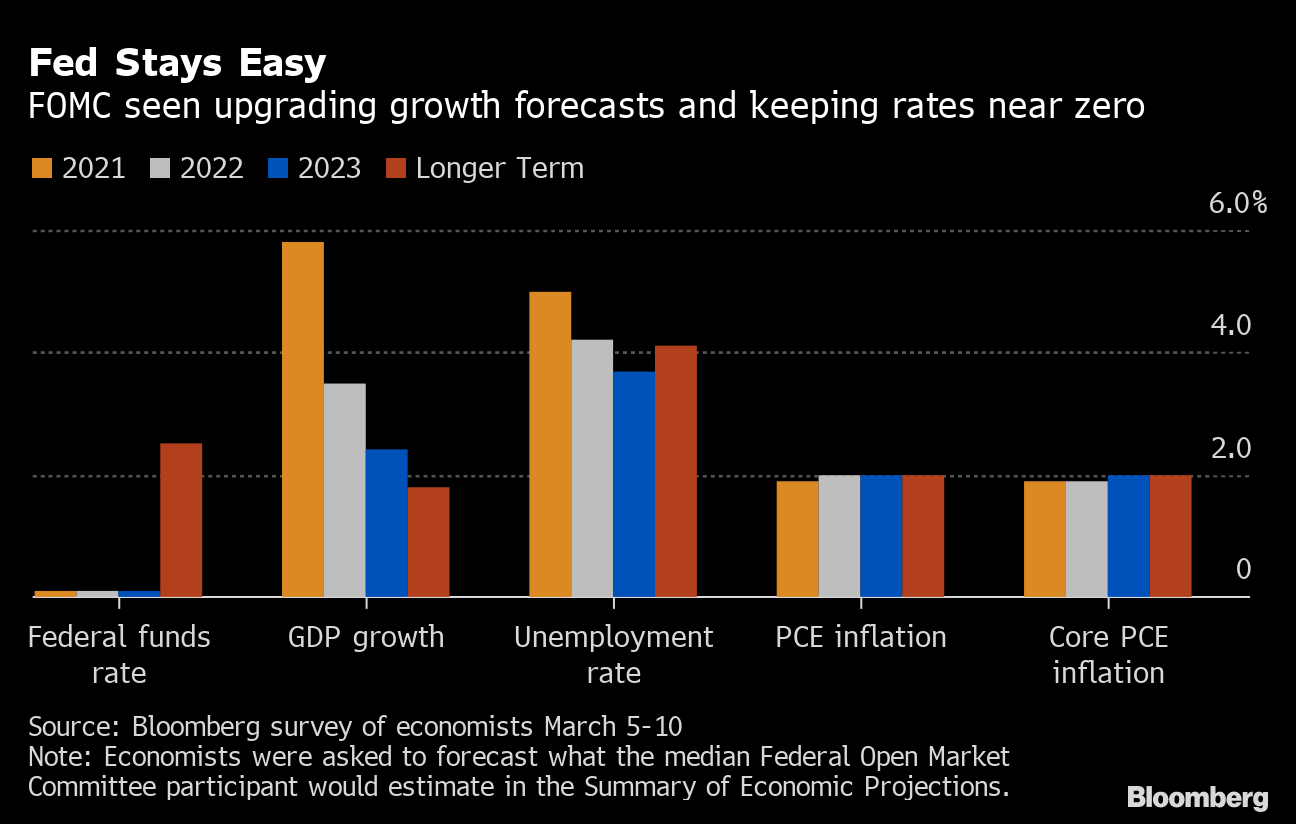

Fed stays easy

The FOMC is expected to improve growth forecasts and keep rates close to zero

Source: Bloomberg Survey of Economists March 5-10

Forecasts closely followed by the Fed are likely to show a 5.8% increase in gross domestic product in 2021, according to the survey, compared to 4.2% in the Fed’s December projections. Inflation is seen mildly higher than three months ago, with the unemployment rate falling to 5.0% by year-end, the same as in the December projections.

The FOMC is likely to continue to forecast near-zero rates through 2023, though it’s a close call, as a third of the economists surveyed look for a median Fed projection of higher rates by then.

In December, one official posted a quarter-point increase during 2022, and five posted increases in 2023.

“Having a forecast for rising rates seems highly unlikely when we are just beginning to discuss how much inflation will increase, for how long, how much the unemployment rate will drop,” said Nathaniel Karp, chief economist at BBVA in the United States. “The Fed has to see it, feel that, not just dreaming about it. “

Increasing returns

A sharp rise in U.S. Treasury yields in the past month as economic growth forecasts rose caught the attention of the central bank. Powell and others have attributed the increases to the improving outlook and said they do not appear to be worrisome.

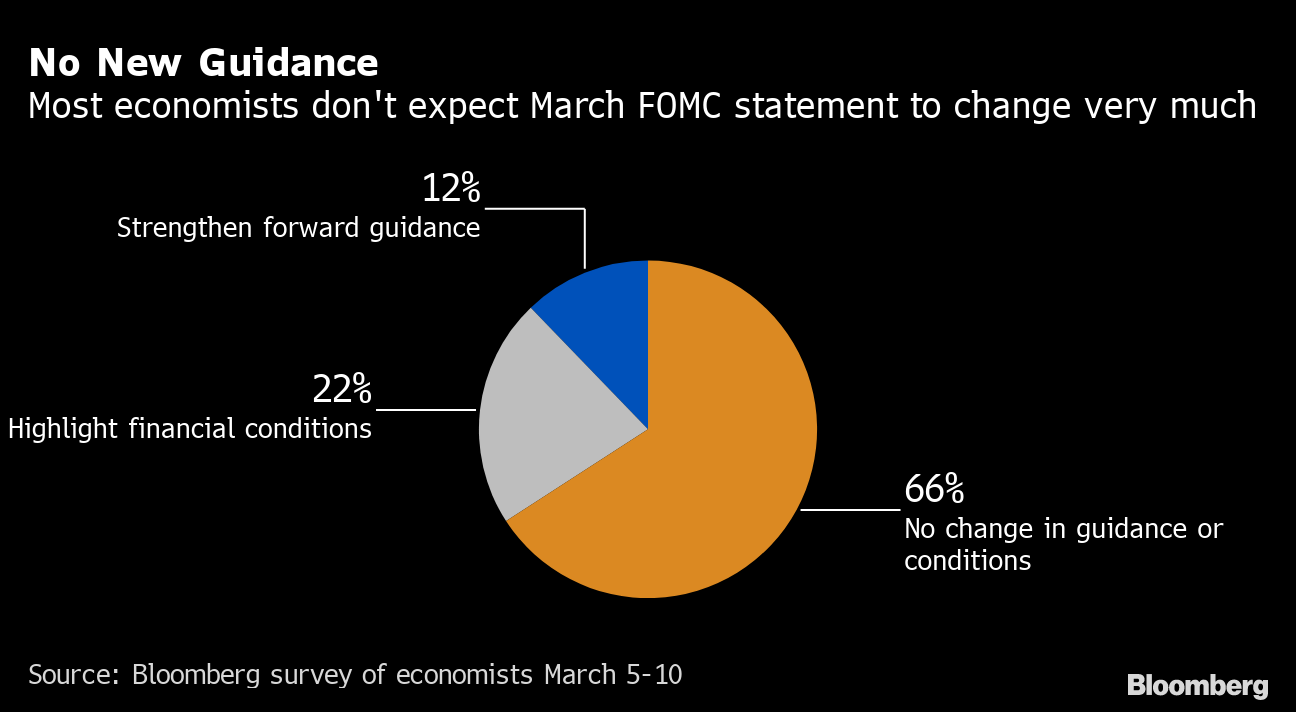

No new orientation

Most economists don’t expect the March FOMC statement to change much

Source: Bloomberg Survey of Economists March 5-10

The FOMC is unlikely to highlight the risk of tightening financial conditions in its statement or strengthen its forward guidance on interest rates or bond purchases, according to the survey.

The committee has pledged to continue the current pace of asset purchases until there is “further substantial progress” in employment and its 2% inflation target.

“The FOMC will remain in standby mode for the time being, with no major changes to the statement, the rate hike schedule or the inflation projections expected at this meeting,” said Scott Anderson, chief economist at the Bank of the West. in a response to the survey.

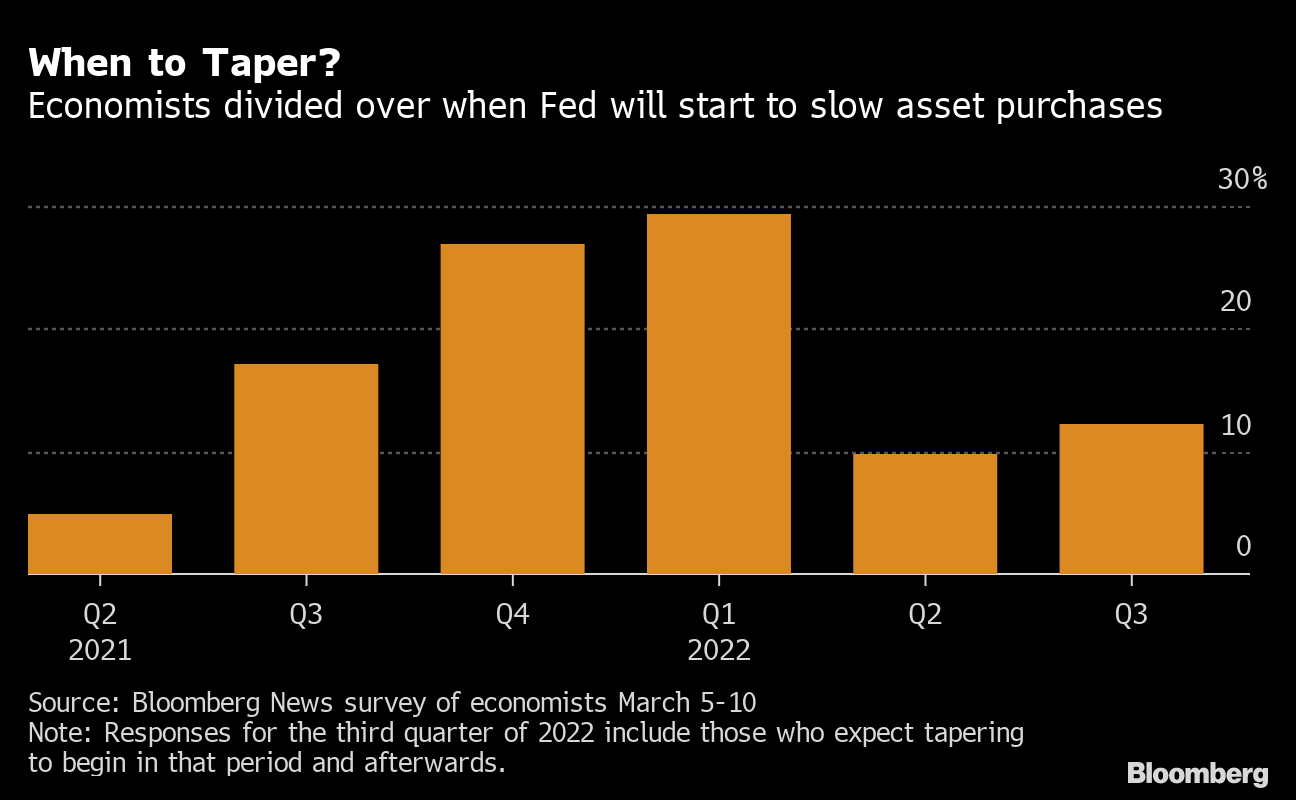

When to reduce

Powell has said the economy is not close to making the progress necessary to trigger a change in bond buying and that he will signal any downsizing well in advance. That won’t happen until 2022 in the view of a narrow majority of economists.

Most economists surveyed also do not expect any short-term changes, such as a switch to buying long-term Treasuries. Even less likely would be to alter the mix of Treasury and mortgage-backed securities, or to place a numerical target on Treasury yields, known as a yield curve control, they said.

When to reduce it?

Economists are divided on when the Fed will start slowing asset purchases

Source: Bloomberg News Survey of Economists March 5-10

Powell’s current term as president is scheduled to end next February. His highly accommodative policies could win him a second season, according to economists. About three-quarters expect you to continue at work, which is roughly the same finding in the previous survey.

The central bank has occasionally made a technical change in its interest rate on excess reserves, which would not affect monetary policy. However, most economists do not expect a change in March.