[ad_1]

Nasdaq MarketSite in New York on December 21.

Photographer: Michael Nagle / Bloomberg

Photographer: Michael Nagle / Bloomberg

This has been a year like no other.

Hammered by a unprecedented health crisis, global stocks fell into a bear market in record speed, then bounced back to new highs thanks to a rush of money from the central bank. Bond yields fell to unexplored lows and the global reserve currency rose to record highs, only to then retreat to its weakest level in more than two years, as 2020 draws to a close.

Global asset allocators from BlackRock Inc. to JPMorgan Asset Management have outlined their takeaways for investors from the volatile year. These are some of his reflections:

Rethinking the role of bonds in portfolios

The massive stimulus distributed by global policy makers when markets came to a standstill in March led to a case of a breakout of what has long been a negative correlation between stocks and bonds. The yield on 10-year US Treasuries rose from 0.3% to 1% in one week, and at the same time, equity markets continued to decline.

Now, as investors grapple with lower rates for longer even as growth picks up, questions are being raised as to whether developed market government bonds can continue to provide protection and diversification, as well as satiate profit-seeking investors. from income. There’s also a debate over the traditional investment policy of putting 60% of funds in stocks and 40% in bonds, although the strategy proved resilient during the year.

“We expect a more active fiscal stimulus than any other modern period in history in the next business cycle, as monetary and fiscal policies align,” said Peter Malone, portfolio manager at JPMorgan Asset’s. multi-Asset Solutions team in London. “Future returns on a simple, static portfolio of stocks and bonds will likely be limited.”

Some Wall Street giants advising investors to take a pro-risk stance to adapt to the changing role of bonds. Among them, BlackRock Investment Institute advised investors to turn to high-yield stocks and bonds, according to a note published in early December.

‘Don’t fight the Fed’

Few would have expected the rapid change in markets we saw in 2020. As Covid-19 spread, the S&P 500 Index plunged 30% in just four weeks earlier in the year, a much faster decline than the one-and-a-half-year median that had taken it to bottom in previous bear markets.

Then, when governments and central banks propped up economies with liquidity, equity prices rallied at an equally staggering rate. In about two weeks, the US benchmark was up 20% from its March 23 low.

“You usually have more time to position your portfolio in a correction,” said Mahesh Patil, Co-Chief Investment Officer at Mumbai-based Aditya Birla Sun Life AMC Ltd. With markets moving so fast, someone in cash “would have been caught taking a nap at this rally and it would have been difficult to catch up.”

Being a bit contradictory helps, Patil said, adding that it’s best for investors not to make too big of a decision by keeping cash. They should also focus on an ascending portfolio so that they can cycle through both ascending and descending cycles, he said.

SooHai Lim, Head of Asia Ex-China Equities at Barings, said the market’s rapid recovery demonstrated the strength of the old saying “Don’t fight the Fed.”

That said, some fund managers cautioned that investors should not consider swift support from central banks guaranteed.

“It was a coin toss from there and if they had intervened early enough,” said John Roe, director of multi-asset funds at Legal & General Investment Management in London. “The downside could have been unprecedented.”

Teflon technology

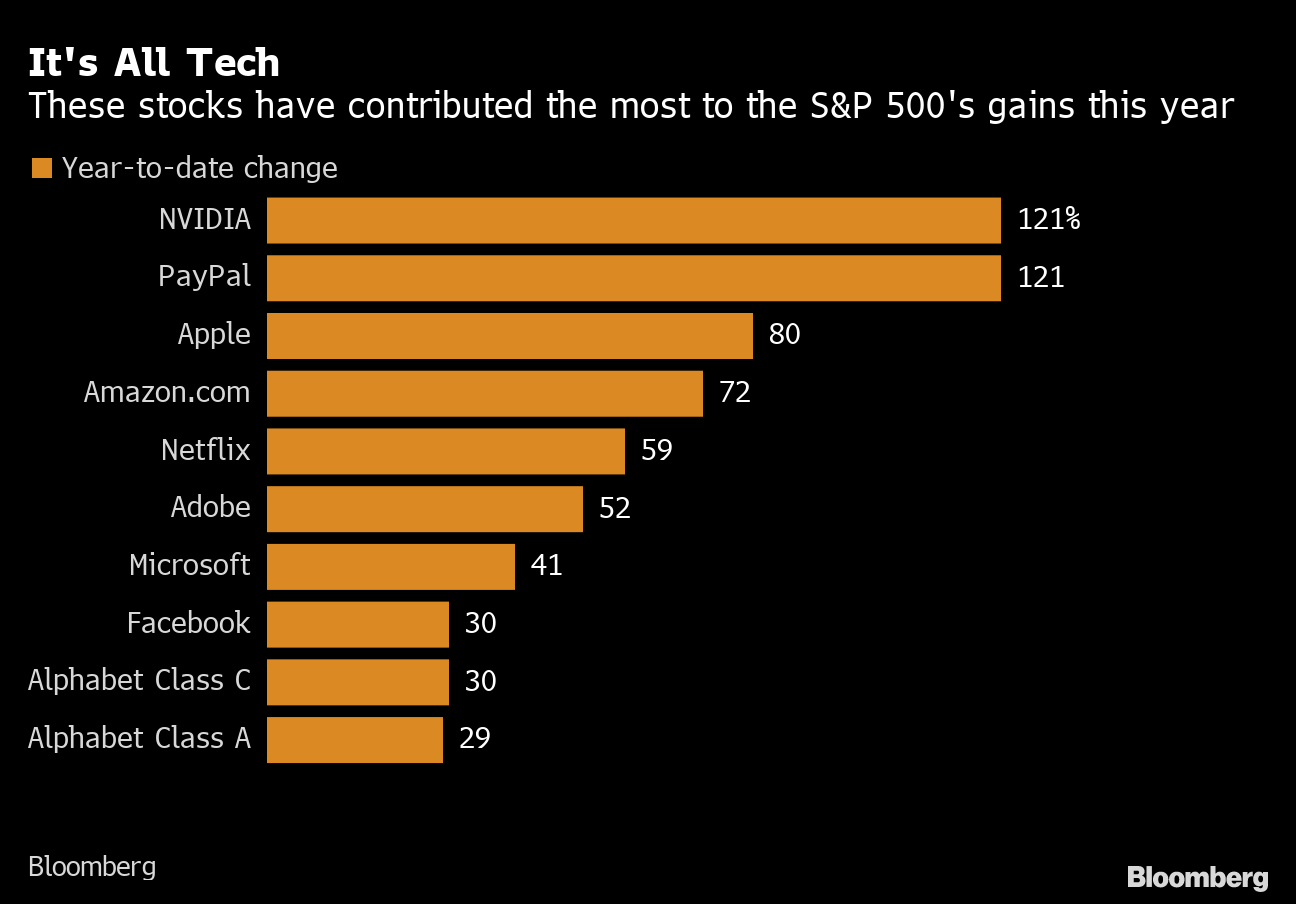

The soaring rally in tech stocks this year gave investors the opportunity of a lifetime. Anyone who has missed this topic and who has benefited greatly from digitization trends and staying at home in the pandemic will likely find that their portfolios lag behind in benchmarks. The top ten US companies that have contributed the most to the S&P 500 this year are all tech-related stocks, ranging from cloud computing pioneer Amazon.com Inc to chip maker NVIDIA Corp.

Everything is technology

These actions have contributed the most to the S&P 500’s earnings this year.

Bloomberg

Even with a brief hiatus in November, when positive results from a Covid-19 vaccine trial spurred a shift toward lagging cyclical holdings, the technology has ended up as the top-performing sector in Asia and Europe. Followers of the value strategy saw Multiple false starts throughout the year as investors bet the stock group, defined by cheapness and mostly made up of names sensitive to business cycles, would finally have its day. They were disappointed.

“Never underestimate the impact of technology,” said Alan Wang, portfolio manager at Principal Global Investors in Hong Kong. Thanks to low borrowing costs, “a lot of new technologies have been re-evaluated and this (pandemic) just created a great opportunity for us to reinvent our lives.”

Innovative stocks are now valued based on intangible factors like goodwill and intellectual property rather than traditional methods like price-earnings ratio, Wang said, adding that investors should adopt such valuation strategies.

Cash is the king of business

The pandemic and the speed with which it shook markets showed investors that they should stick with companies with strong balance sheets that can withstand the waves of uncertain times.

“The resilience of stocks in a year like this helps demonstrate their value and justify their higher valuation multiples in a world of low rates,” said Tony DeSpirito, director of US fundamental equity investments at BlackRock.

2020 reaffirmed two important lessons DeSpirito has learned Over the years: Investors should stress-test companies to see if the earnings and balance sheets of those companies are strong enough to survive recessions in normal times; and they should diversify investment risks and also increase sources of alpha potential.

Be aware of collateral damage

The decisive bailouts of policy makers came at a cost to investors in some sectors. European banking stocks plunged after ordered to stop dividends to preserve capital. In Asia, real estate became the second worst performing industry after energy stocks this year, weighed down by owners when some markets such as Singapore passed laws asking landlords to provide some tenants with rent relief.

“The government has been pretty tough this time,” said SooHai Lim, head of Asia Ex-China Equities at Barings. “They have been more coordinated, much faster and more decisive.”

Lim said he will price a higher risk level by investing in certain sectors such as banks, which are “definitely more exposed to regulatory intervention.”

Double ESG

ESG-related assets managed to outperform in many market sectors during the volatility, proving that the skeptics were wrong. For example, an FTSE index of global equities with a significant share in environmental markets rose 35% this year, outperforming the benchmark index of global equities by more than 20 percentage points.

“The Covid crisis has highlighted the need for faster change and we are seeing clients of all stripes reassess their long-term goals and the required results of their investments,” said Harriet Steel, Federated Hermes Head of Business Development .

In fact, the pandemic has led to massive influxes of ESG-related products. Global funds that invest or adopt strategies related to clean energy, climate change and ESG have increased their assets under management by approximately 32% over the previous year to a new record $ 1.82 trillion in 2020, according to data compiled by Bloomberg.

– With the assistance of Moxy Ying, Ksenia Galouchko, Elena Popina, Bailey Lipschultz, Ishika Mookerjee, Ronojoy Mazumdar, Macarena Munoz Montijano, Zijing Wu and Sunil Jagtiani