[ad_1]

Photographer: Qilai Shen / Bloomberg

Photographer: Qilai Shen / Bloomberg

The relentless pace of inflows heading into China’s bonds and stocks has a yuan bullish predicting the currency could strengthen to a level not seen in nearly three decades.

A “flood” of foreign cash will haunt yuan-denominated assets in 2021 because they will perform much better than the rest of the world, according to Liu Li-gang, chief China economist at Citigroup Inc. He predicts the currency could rebound. 10% to 6 to the dollar, or even more, by the end of next year. The yuan hasn’t been this strong since late 1993, just before the unification of China’s official and market exchange rates triggered a currency crash.

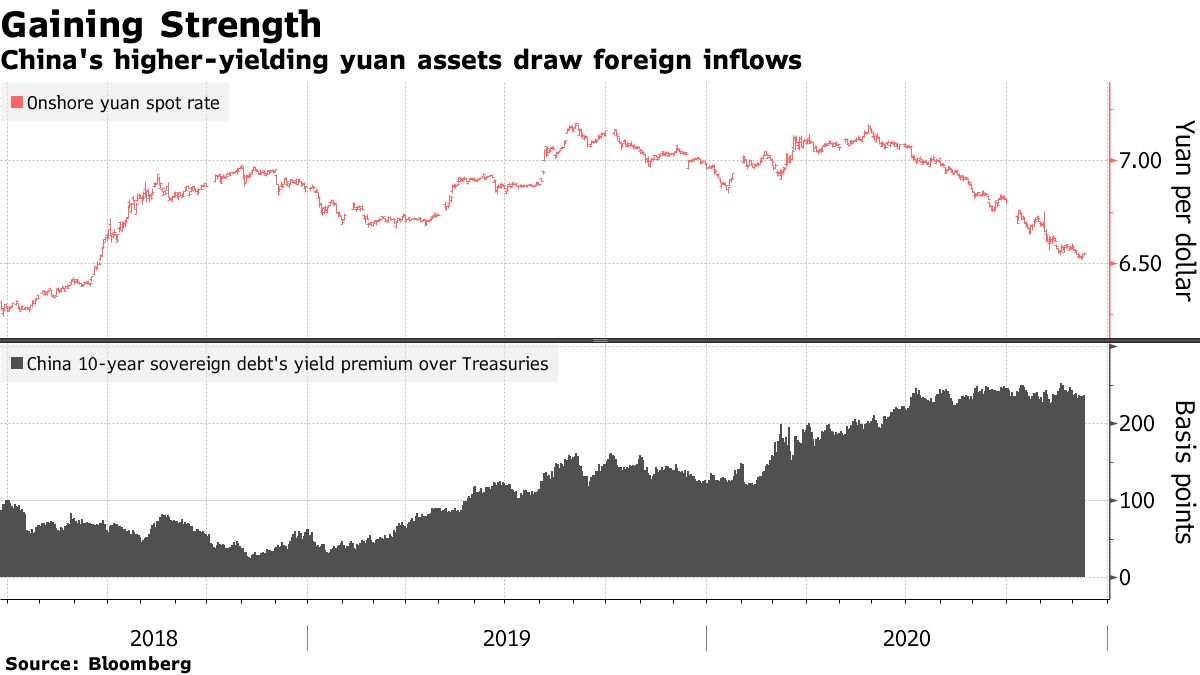

The yuan has skyrocketed since the end of May, rising to a more than two-year high as data showed that China’s economy was recovering from the virus pandemic. Foreign funds have increased their holdings of bonds and onshore stocks by more than 30% this year to records, official data showed, driven by index inclusions and the country’s broad interest rate premium over other markets. . TO slow down progress, Beijing has made it cheaper for traders to bet against the yuan and has relaxed capital restrictions to allow more outflows. But those measures have done little to curb optimism.

That puts the People’s Bank of China in a political dilemma. It needs to reduce the yuan’s yield premium over the rest of the world to slow appreciation, as too strong a currency could undermine its momentum to support an economic rebound that relies on global demand for Chinese exports. In the meantime, he wants to keep interest rates high, as previous stimulus from Beijing helped fuel a rapid build-up of leverage, sending a gauge of the country’s debt levels to a record high.

“The problem China faces next year will be a huge and relentless inflow of capital,” said Citi’s Liu. “The appreciation of the yuan will be a key threat to China’s macroeconomy.”

The Chinese currency has strengthened nearly 10% from this year’s low in late May, making it the second best performing in Asia after the South Korean won. The yuan was trading at 6.5460 on Friday.

The yield on Chinese 10-year government bonds rose in recent months on speculation that the People’s Bank of China will start to pull out of monetary stimulus. That has helped extend the yuan’s interest rate advantage over the dollar to the highest on record. Additionally, the coin is backed by bets that Washington may be less hostile toward Beijing under Joe Biden. A global index compiler The decision to add some ground notes to its flagship indices and a weaker dollar also contributed to the appreciation.

A rapid rise in the yuan could hurt Chinese exports by making them more expensive. That, in turn, will hurt China’s growth, because the nation’s outbound shipments have become a key economic driver of global demand for its pandemic-related products. Additionally, sustained currency appreciation could attract hot money inflows, fueling local asset bubbles and creating financial risks.

That’s why policy makers will seek to slow down progress, said Dariusz Kowalczyk, senior emerging markets strategist at Credit Agricole CIB. The People’s Bank of China may further relax restrictions on funds leaving China and guide the weaker exchange rate with its daily benchmark rates, it said, adding that the yuan could end 2021 at 6.35.

The last time the yuan approached 6 was in January 2014, when the currency was bolstered by hot money inflows. The central bank achieved reverse the course of the rally by sharply weakening its peg rate for two consecutive days.

“We still like the Chinese currency against the dollar, but we recognize that the pace of appreciation will be slower,” said Stephen Chang, portfolio manager at Pacific Investment Management Co. in Hong Kong. “We think it is worth having an overweight in Chinese government bonds.”

– With the help of John Liu, Fran Wang and Jing Zhao