[ad_1]

Photographer: Johannes Eisele / AFP / Getty Images

Photographer: Johannes Eisele / AFP / Getty Images

Earlier this month, Royal Dutch Shell Plc disconnected its Convent refinery in Louisiana. Unlike many oil refineries closed in recent years, Convent was far from outdated: it is quite large by American standards and sophisticated enough to convert a wide range of crude oils into high-value fuels. However, Shell, the world’s third-largest oil company, wanted to radically reduce refining capacity and could not find a buyer.

When Convent’s 700 workers learned they were out of work, their counterparts on the other side of the Pacific were starting a new unit at the giant Rongsheng Petrochemical. Zhejiang complex in northeast China. It is just one of at least four ongoing projects in the country, with a total of 1.2 million barrels per day of crude processing capacity, equivalent to the entire UK fleet.

The Covid crisis has accelerated a seismic shift in the global refining industry as demand for plastics and fuels grows in China and the rest of Asia, where economies are rapidly recovering from the pandemic. By contrast, refineries in the US and Europe are grappling with a deeper economic crisis, while the transition from fossil fuels dampens the long-term outlook for oil demand.

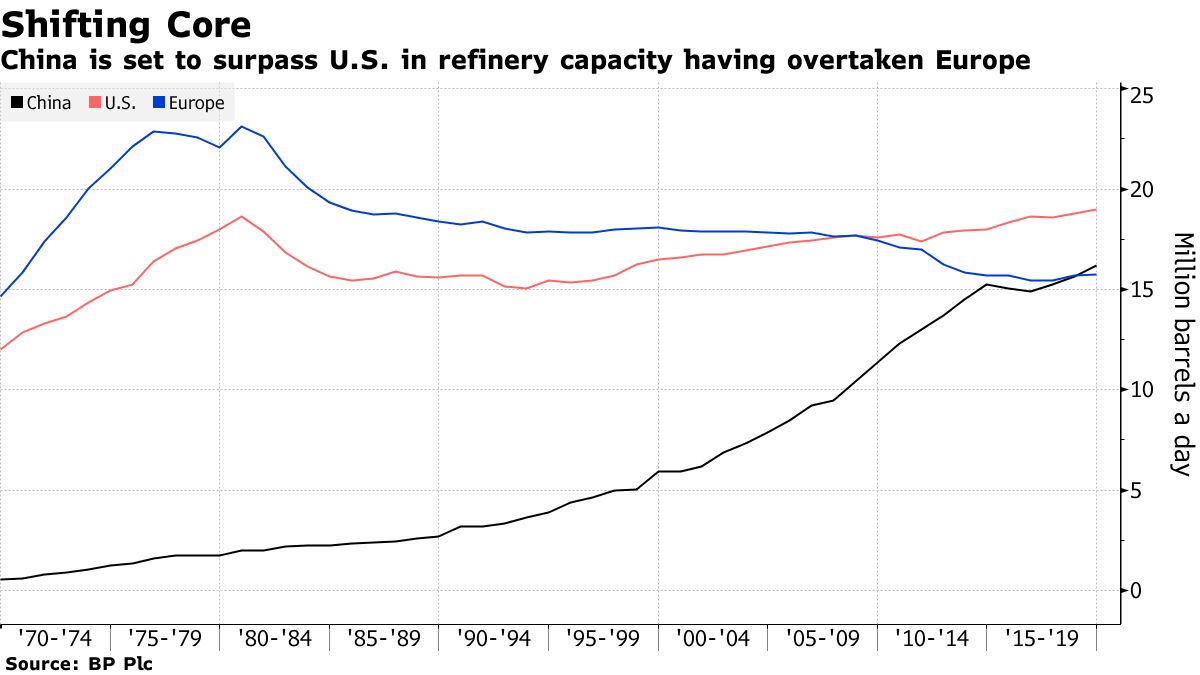

The United States has been at the helm of the refining group since the beginning of the oil era in the mid-19th century, but China will dethrone the United States next year, according to the International Energy Agency. In 1967, the year Convent opened, the United States had 35 times the refining capacity of China.

The boom in China’s refining industry, combined with several large new plants in India and the Middle East, is having an impact on the global energy system. Oil exporters are selling more crude to Asia and less to old customers in North America and Europe. And as they add capacity, China’s refineries are becoming a growing force in the international markets for gasoline, diesel and other fuels. That even puts pressure on older plants in other parts of Asia: Shell also announced this month that halve the capacity of its Singapore refinery.

See also: Europe accelerates the switch to electric vehicles with subsidies and bans

There are parallels to China’s growing dominance in the global steel industry at the beginning of this century, when China built a handful of massive modern mills. Designed to meet growing domestic demand, they also made China a force in the export market, putting pressure on higher-cost producers in Europe, North America and other parts of Asia and forcing the closing old and inefficient plants.

“China is going to put another million barrels a day or more on the table in the next few years,” said Steve Sawyer, director of refining at industrial consultancy Facts Global Energy, or FGE, in an interview. “China will probably overtake the United States in the next two years.”

Asia on the rise

But while capacity will increase in China, India and the Middle East, it can take years for oil demand to fully recover from the damage inflicted by the coronavirus. That will put a few million barrels a day more refining capacity out of business, plus a record 1.7 million barrels per day of processing capacity has already been suspended this year. More than half of these closures have occurred in the United States, according to the IEA.

About two-thirds of European refineries are not making enough money on fuel production to cover their costs, said Hedi Grati, Europe-CIS head of refining research at IHS Markit. Europe still needs to reduce its daily processing capacity by an additional 1.7 million barrels in five years.

“There’s more to come,” Sawyer said, anticipating the closing of another 2 million barrels per day of refining capacity until next year.

China’s refining capacity has nearly tripled since the turn of the millennium as it tried to keep up with the rapid growth in diesel and gasoline consumption. The country’s crude processing capacity is expected to increase to One billion tons a year, or 20 million barrels per day, by 2025 up from 17.5 million barrels at the end of this year, according to the China National Petroleum Corp. Research Institute of Economics and Technology.

India is also increasing its processing capacity by more than half to 8 million barrels per day by 2025, including 1.2 million new barrels per day mega project. Producers in the Middle East are joining the spree, building new units with at least two projects totaling more than a million barrels per day that will begin operations next year.

Driven by plastic

One of the key drivers of the new projects is the growing demand for petrochemicals that are used to make plastics. More than half of the refining capacity coming online from 2019 to 2027 will be added in Asia and 70% to 80% of this will be focused on plastics, according to industry consultant Wood Mackenzie.

The popularity of integrated refineries in Asia is driven by the region’s relatively rapid economic growth rates and the fact that it remains a net importer of raw materials such as naphtha, ethylene and propylene, as well as liquefied petroleum gas, which is used to make various types of plastic. The United States is a major supplier of naphtha and LPG to Asia.

These massive, integrated new plants make life more difficult for their smaller rivals, who lack their scale, flexibility to switch between fuels and the ability to process dirtier and cheaper crudes.

See also: Chinese megarefinery shows the advantages of integration: BNEF

The refineries that are closed tend to be relatively small, not very sophisticated and typically built in the 1960s, according to Alan Gelder, vice president of refining and oil markets at Wood Mackenzie. You see an excess capacity of around 3 million barrels per day. “For them to survive, they will need to export more products as their regional demand declines, but unfortunately they are not very competitive, which means they are likely to close.”

Demand trap

Global oil consumption is on track to fall by a A record 8.8 million barrels per day this year, averaging 91.3 million per day, according to the IEA, which expects less than two-thirds of this lost demand to recover next year.

Some refineries were scheduled to shut down even before the pandemic, with a global crude distillation capacity of about 102 million barrels per day so far. exceeded 84 million barrels of demand for refined products in 2019, according to the IEA. The destruction of demand due to Covid-19 pushed several refineries to the brink.

“What was expected to be a long, slow adjustment has turned into a abrupt shock, ”said Rob Smith, director of IHS Markit.

Adding to the pain of refineries in the United States, there are regulations that drive biofuels. That encouraged some refiners to reuse your plants to produce biofuels.

Even China may be getting ahead of itself. Capacity additions are outpacing growth in demand. An excess supply of petroleum products in the country may reach 1.4 million barrels per day in 2025, according to CNPC. Even as new refineries are being built, China’s demand growth it may peak by 2025 and then slow down as the country begins its long transition to carbon neutrality.

“In an environment where the world already has enough refining capacity, if you build more in one part of the world, you need to shut down something in another part of the world to keep the balance,” said FGE’s Sawyer. “That’s the kind of environment we find ourselves in today and we are likely to find ourselves for the next 4-5 years at least.”

– With the assistance of Javier Blas