[ad_1]

Taiwan Semiconductor Manufacturing Co. raised its 2020 revenue forecast for the second time this year, reflecting strong demand for 5G mobile devices such as Apple Inc.’s new iPhones and high-performance computing in the post-pandemic era.

The world’s largest contract chipmaker now expects 2020 sales to rise more than 30% in dollar terms, compared to a Previous forecast of growth higher than 20%. For the current quarter, revenue should be between $ 12.4 billion and $ 12.7 billion, while gross margin will be between 51.5% and 53.5%, the chief financial officer told analysts. Wendell Huang.

The main chip maker for Apple’s iPhones continues to invest in expanding and upgrading the technology, anticipating strong demand for 5G smartphones and server chips as countries gradually emerge from the Covid-19 pandemic. Executives said Thursday they expect capex of about $ 17 billion in 2020, the upper limit of their previous forecast range.

Previously disclosed monthly figures showed that sales rose to a record NT $ 356.4 billion ($ 12.4 billion) in the three months through September, increasing earnings 36% more than expected. TSMC’s business generally picks up speed in the months before Apple unveils its new phones and the holiday season. It also received a boost during the quarter as the second largest customer. Huawei Technologies Co. was quick to stockpile supplies before a U.S. ban on shipments to the Chinese telecoms giant went into effect last month.

“Covid-19 is accelerating digital transformation, while 5G and HPC applications continue to drive demand,” CEO CC Wei said in a briefing. “Strong demand for our industry leading 5nm technology” will drive growth in the fourth quarter, he added.

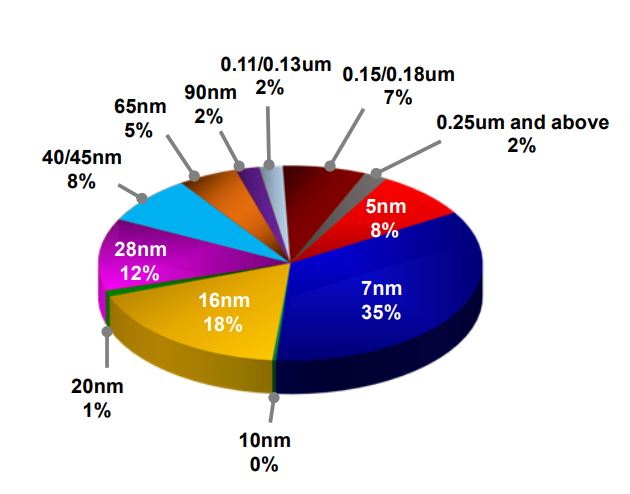

TSMC Third Quarter Revenue by Technology

Third-quarter net income rose to an all-time high of NT $ 137.3 billion, compared to the average analyst estimate of NT $ 126 billion. The gross margin improved slightly to 53.4%, beating the company’s own guidance.

The most advanced 5-nanometer process technology, used to make Apple’s A14 chips, accounted for approximately 8% of total revenue during the quarter, while 7nm and 16nm accounted for 35% and 18%, respectively. By business segment, TSMC’s smartphone business expanded 12%, while HPC posted the strongest growth, with an increase of 25%.

Overall inventory for customers, including smartphone makers, will remain above seasonal levels for some time due to lingering concerns about the reliability of supply chains, TSMC said. Still, executives sought to allay concerns about inventory levels, citing expectations that more manufacturers will launch new 5G devices and an acceleration in technology adoption amid shelter-in-place measures.

The company reiterated that it was complying with the US government. restrictions on Huawei and had stopped shipments to the telecommunications giant after mid-September. Wei declined to comment on “unfounded speculation” that TSMC may have received licenses to supply the Chinese company.

On Tuesday, Apple unveiled its latest iPhone lineup, saying that two new models will come out on October 23, while another two models will arrive three weeks later. The Cupertino, California-based company expects It will build at least 75 million new 5G iPhones this year, roughly in line with its previous flagship launch, Bloomberg News reported.

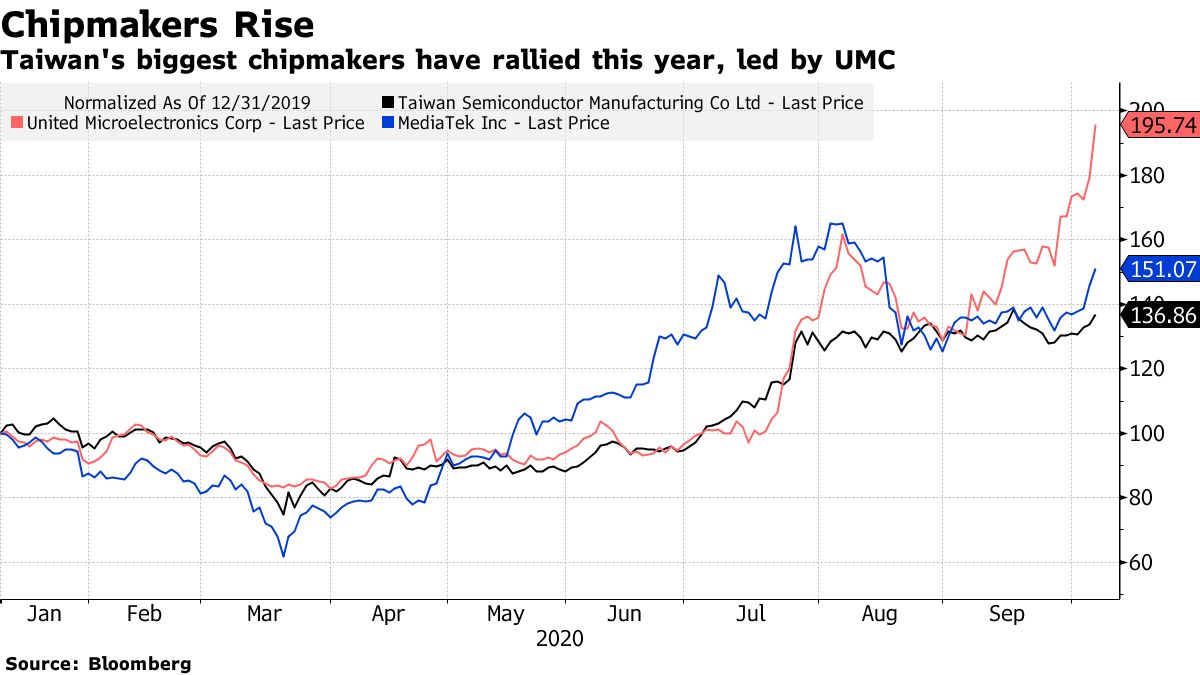

TSMC shares are up about 83% from their March lows amid signs that the company is recovering from the worst of the coronavirus-induced disruptions.

“Market players have anticipated that 5G will be a major growth engine,” said GF Securities analyst Jeff Pu. TSMC’s fourth-quarter guidance is in line with average analyst estimates, although it is slightly lower than buyers’ expectations, he added.

Read more: TSMC domain highlighted in single number: Tim Culpan

– With the assistance of Yuan Gao, Vlad Savov, Cindy Wang, Chris Horton, Peter Elstrom and Argin Chang

(Updates with CEO comments in the fourth paragraph.)