[ad_1]

Wed, Sep 23, 2020-11: 00 am

KEPPEL Corp has sunk to an unwarranted trough valuation, presenting an opportunity to accumulate stocks now, CGS-CIMB said.

In a report dated Tuesday, the brokerage noted that Keppel’s shares were trading at a new low of 0.7 times the price-to-book value (P / BV) for 2020. The counter had closed at S $ 4, 12 on Tuesday.

This valuation is even lower than during the last oil crisis (0.82 times P / BV in January 2016) and the global financial crisis (1.33 times P / BV in January 2009).

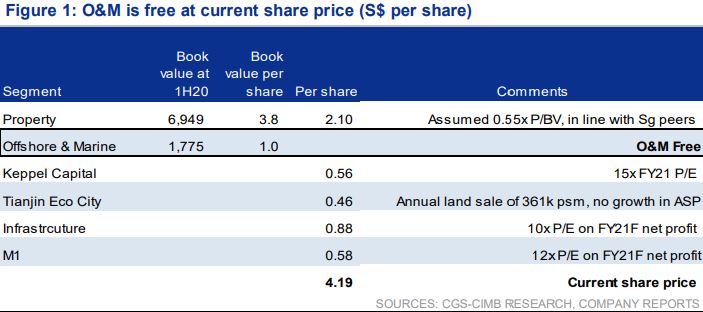

“At the current share price, the market is heavily discounting its marine and offshore (O&M) business at zero,” wrote analyst Lim Siew Khee.

“We believe this is not justified as the S $ 3.5 billion O&M order book (at the end of the second quarter of 2020) is in progress and should be able to guide the yard towards profitability in 2021.”

CGS-CIMB reiterated its “add” option on Tuesday and the S $ 6.46 price target based on the sum of the parts valuation.

At 10.31 am on Wednesday, Keppel’s shares rose 0.03 Singapore dollars or 0.7 percent to trade at 4.15 Singapore dollars.

CGS-CIMB said it has “conservatively factored” earned orders of S $ 500 million for 2020 and S $ 1 billion for 2021, below the average order earned of approximately S $ 1.9 billion in 2018 and 2019.

The conglomerate announced Tuesday that its O&M arm had closed two contracts worth about S $ 200 million in total. For the US project, the Texas shipyard will build a high specification trailing suction hopper dredger, while the Singapore contract is for the conversion of a liquefied natural gas carrier into a floating storage unit and regasification.

The award of these contracts brings Keppel O&M orders to S $ 307 million so far this year, in line with CGS-CIMB’s forecast of S $ 500 million for the full year.

Assuming there is no significant impairment, CGS-CIMB expects Keppel to increase its long-term valuation by 12.8 times the price-to-earnings (P / E) going forward. It is now roughly 10.7 times the 2021 P / E.

As for the Keppel shipyards in Singapore, Ms Lim said she believes there are fewer than 10,000 employees there at the moment, gradually increasing from the 5,000-person workforce in the yard to the July earnings update, given that the number of new COVID-19 cases in bedrooms has been falling.

Keppel’s total workforce at the Singapore shipyard was around 24,000 before the country’s “circuit breaker”, which started in April.

Meanwhile, DBS Equity Research maintained its “hold” rating on Keppel on Wednesday, with a price target of S $ 5.50, an increase of about 33.5 percent.

DBS noted that the conglomerate’s asset management arm is turning to the private education sector.

On Tuesday night, Keppel Capital said it had raised half of its target commitments for a $ 500 million regional real estate investment fund focused on private education assets in Asia-Pacific.

[ad_2]