[ad_1]

Photographer: Samsul Said / Bloomberg

Photographer: Samsul Said / Bloomberg

Forced to stay home when Malaysia deployed its To ensure strict adherence to a virus-induced lockdown earlier this year, Victor Yap sat in his living room, listening intently to a March 27 speech from the nation’s prime minister.

When Prime Minister Muhyiddin Yassin presented the details of the government’s stimulus package, one thing in particular caught the eye of the 35-year-old Kuala Lumpur property appraiser: a six-month moratorium on loan repayments. Realizing that the relief measure was meant to leave him with extra cash given his two mortgages, Yap decided he would put the funds into stocks.

A screen shows an image of Muhyiddin Yassin on a nearly deserted road in Kuala Lumpur on March 22.

Photographer: Samsul Said / Bloomberg

“At first, I thought that the extra money would hardly help me survive these tough times, but then I saw that everyone was jumping into the stock market and making a lot of money,” he said by phone. “I also jumped and did well. It was better than just surviving. “

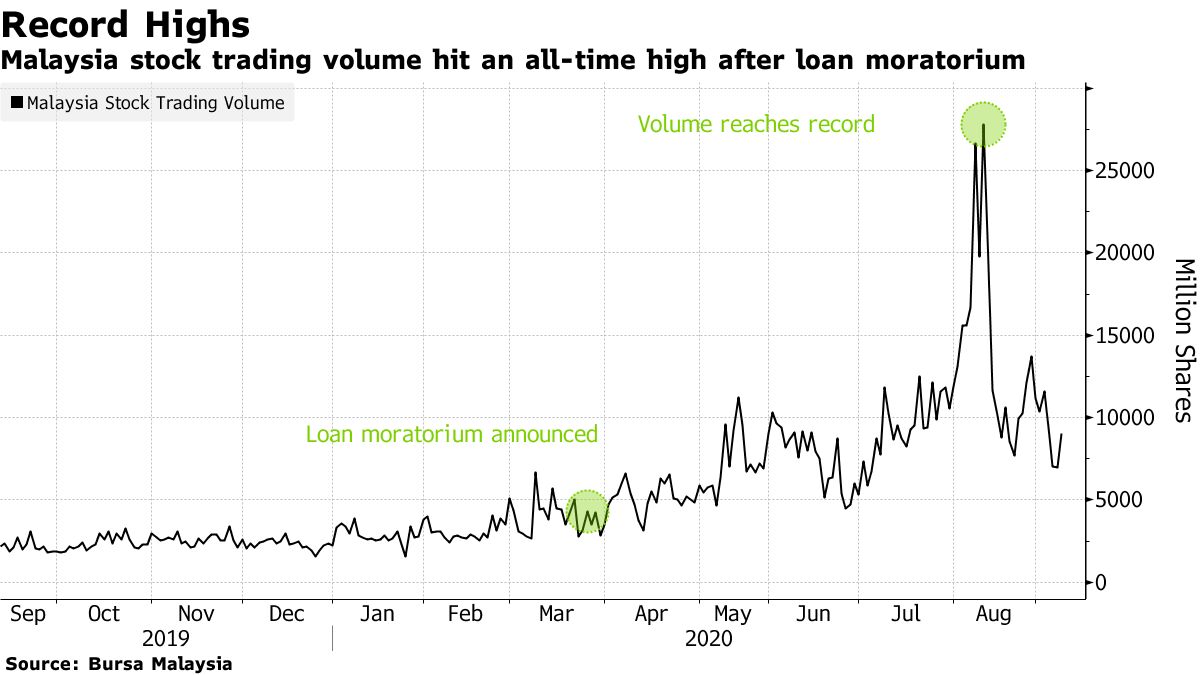

Now, with the moratorium set to expire at the end of September, the father-of-two is one of the hordes of individual investors looking to exit the market, a move that threatens the benchmark equity index rally from March lows and could further weaken trading volumes. , which reached a record in August.

“The only way was with everything, but now I have to do everything I can to get back to normal life” and prepare to resume loan payments, Yap said.

While stimulus measures and stay-at-home orders due to the virus outbreak have seen amateur investors storm the stock markets. Around the world, the retail frenzy has been particularly prominent in Malaysia. The investment boom by rookies has also been a factor behind the meteoric rise in glove manufacturers’ share and recent rise in little-known Malaysia jewelers, with several of these stocks up more than 400% since the beginning of the year.

Glove manufacturers

Yap said it used a portion of its leftover funds “to participate” in the glove makers’ rally. Some stocks in this space are among the best performers in the world this year, and their staggering gains have changed the contours of the broader Malaysian market.

The top three glove manufacturers have added around RM100 billion ($ 24 billion) in combined market value in 2020, with Top Glove Corp. remains the biggest winner in the MSCI Asia Pacific Index. About $ 1 out of every $ 10 invested in the Malaysian stock market is a gamble on gloves, a feat that turns the Southeast Asian nation into a global hygiene game, much like South Korea and Taiwan are for semiconductors.

Glove Mania raises Malaysia’s market value to challenge Singapore

“Cash on hand will be substantially reduced by the time the moratorium ends and they have to start repaying their loans,” said Tee Sze Chiah, head of Malaysian retail research at Maybank Investment Bank Bhd, referring to individual investors. “ME hope yes, but I don’t think so, ”he said, when asked if the recovery in Malaysian shares would hold.

He expects trading volumes, which hit an all-time high of 27.8 billion shares on August 11, to fall in the coming months.

Keep cash

That said, Yip Kit Weng, deputy general manager of the Affin Hwang Investment Bank group, which is home to Malaysia’s largest brokerage house, expects many of the amateur investors to stay in the market.

“With the market providing an attractive and positive return, it will continue to be an investment option,” he said.

But recent trends suggest that the frenzy in Malaysian equities is losing momentum, with volumes declining sharply in recent weeks. While the benchmark FTSE Bursa Malaysia KLCI index continues to rise nearly 23% from its March low, the indicator has fallen more than 7% since it reached its 2020 high on July 29. It slid 1.6% amid a broad regional selloff on Wednesday, more than the 1.3% decline seen in the MSCI Asia index.

Brokers are becoming cautious as well because the Malaysian stock exchange is prepare further measures to curb excessive speculation on share prices and ensure orderly trading after increased transactions.

RHB is said to require a 100% guarantee for warrants on Malaysian shares

Investors would be in a better position if they had a large chunk of cash, as well as dividend stocks and those in the consumer staples sector, said Danny Wong, CEO of Areca Capital Sdn.

– With the help of Abhishek Vishnoi, Sanjit Das, Tien Hin Chan and Yudith Ho

(Add additional comments in paragraphs 11 and 12, update prices at all times.)