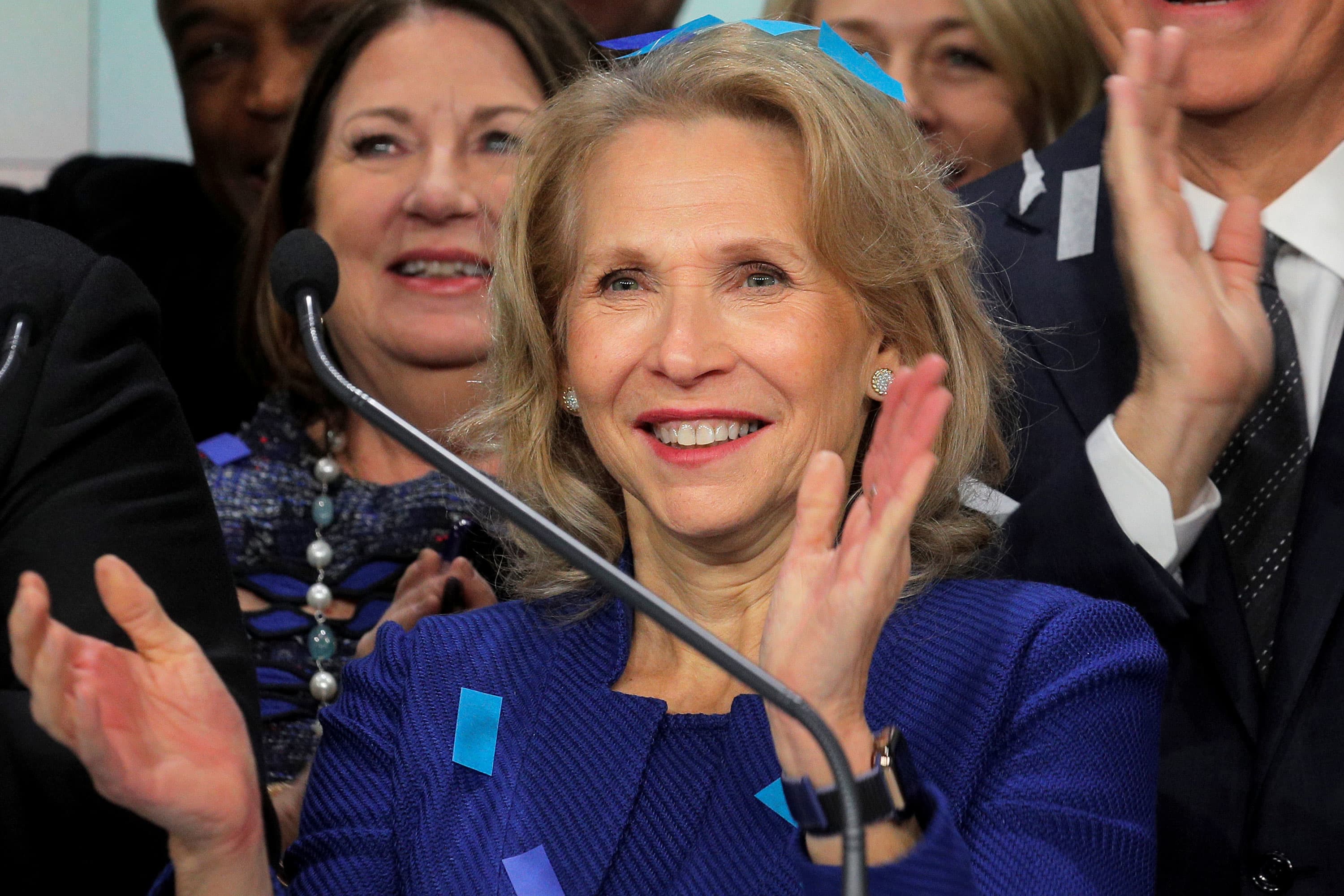

Shari Redstone, president of ViacomCBS and president of National Amusements, reacts as she celebrates the merger of her company on the Nasdaq Market site in New York, December 5, 2019.

Brendan McDermid | Reuters

Sumner Redstone, who died Tuesday at 97, built a sprawling media empire from the film chain founded by his father, Michael Redstone. It is now his daughter’s decision whether she wants to keep it.

The Redstone family’s holding company, National Amusements Inc., holds 79.4% of the total share of ViacomCBS ‘Class A rating – the owner of cable TV networks, Paramount Pictures, Simon & Schuster and the broadcasting agency CBS. Eighty percent of NAI’s voting power was controlled by Sumner Redstone.

That now goes to a trust of seven people that puts Sumner Redstone’s daughter, Shari Redstone, in charge of the company. The trustees are Shari Redstone, her son Tyler Korff, David Andelman, Norman Jacobs, Leonard Lewin, Tad Jankowski and Jill Krutick. Shari owns the other 20% through a separate trust.

ViacomCBS has a business value of about $ 35 billion and a market value of about $ 16 billion. That may sound big, but in today’s world, ViacomCBS is competing against behemoths.

Comcast, owner of NBCUniversal; AT&T, owner of WarnerMedia; Disney and Netflix all have enterprise values well over $ 200 billion. Amazon tops $ 1.5 trillion, and Apple closes a $ 2 trillion market cap.

A series of legal maneuvers and business announcements in 2016 paved the way for Shari Redstone to take over for Sumner as the decision-making for controlling interest of National Amusements in ViacomCBS. But it remains unclear if Shari has the same empiric-building ambitions as her father.

Sumner Redstone successfully acquired Paramount in 1994 for $ 10 billion. He then raised CBS in 1999 for $ 37.3 billion in what was the largest media merger ever at the time.

You do not have to be a math major to find out that something went wrong with that deal, given the value of ViacomCBS in 1999 was higher than it is today. The company split in two – Viacom and CBS – in 2006, which, in hindsight, seems like a mistake. While CBS flourished under CEO Les Moonves, Viacom eventually whispered as MTV, Comedy Central and VH1 lost cultural importance through the 2000s. Both companies found themselves underestimated in recent years, eventually culminating in a December merger that reunited them as ViacomCBS, with the blessing of Shari Redstone.

Shari Redstone pushed Viacom and CBS together to merge and has her eye set on getting even bigger, according to people familiar with her thinking. But ViacomCBS ‘next goal is unclear, especially since long quarantines and 10% unemployment are removing traditional dollars for TV commercials, while audiences are pushing for less expensive streaming options. ViacomCBS is advancing with its own streaming ambitions, adding content to the already existing CBS All Access and officially rebranding in early 2021.

Next steps from ViacomCBS

Being a mogul may not be Shison Redstone’s raison d’etre, although she is probably the most powerful woman in media. She works with her sister-in-law, Jason Ostheimer, a small media venture capital firm called Advancit. However, Redstone fought for years to regain ownership of the company after a series of estate changes threatened to cut it out.

“I really respect how she got control of the company, which at the time was not very run, to be honest,” former Viacom board member and current New England Patriots owner Bob Kraft said in a CNBC interview last year. “She has gone through some difficult situations and has handled it really beautifully. I do not know that many people can do it and succeed and have the mental toughness and ability.”

Its mission to grow ViacomCBS can take several paths. It can continue to acquire smaller companies, such as Discovery, Univision, LionsGate, MGM, AMC and other smaller media companies. But even if ViacomCBS were to buy all of these companies, an achievement that would last for many years with potentially painful integrations, the combined company would probably still be significantly smaller than Disney, Comcast, AT&T, Amazon, Netflix and Apple.

It could try to merge ViacomCBS with a company like Sony Pictures, a deal that could be structured so that Redstone transfers control of ViacomCBS shares to Sony over time.

Or, they could just sell ViacomCBS to a bigger player in search of more content in a world where only so many great streaming services can survive and flourish.

While Shari Redstone was effectively in control of Viacom and CBS for several years, her father was still able to communicate via an iPad. He had continued to express wishes over business decisions, such as opposing a deal to sell part of Paramount in 2016.

His death shifts full decision-making authority to Shari. If selling ViacomCBS is the end game, that concept probably became a lot more palatable with the passing of her father.

Correction: This story has been updated to reflect that Sumner Redstone died Tuesday and that although he built National Amusements in a media empire, his father, Michael Redstone, founded the company.

WATCH: Jim Cramer and David Faber on Sumner Redstone’s legacy

.