(Bloomberg Opinion) – Saudi Arabia, for the second time in three years, hits the volume of crude it sends to the United States in an attempt to force supplies into the world’s most visible oil market, thereby rebalancing supply and demand. question to speed up.

Weekly oil inventory data from the US – normally published on a Wednesday and covering the period up to the previous Friday – are regularly provided by oil analysts and traders. Despite their shortcomings, the figures give the most current picture of changes in the oil balance and affect trade decisions and crude prices around the world.

Changes in the flow of raw materials into and out of U.S. ports can have a major impact on the level of U.S. inventories. Riyadh has clearly decided it’s time to do its bit to bring them down from heights reached in May and June, when the coronavirus pandemic and the kingdom’s own expedition combine to make the fastest transition into ‘ to drive the American commercial raw material. In the five weeks between March 20 and April 24, inventories increased at a rate of 2.1 million barrels per day and in the first week of June it reached a new high.

Excess stockpiles act as a drag for oil prices and the most visible stockpiles are in the US, as the Energy Information Administration of the Department of Energy reports weekly. This is in stark contrast to other places around the world where the data is much less time consuming, if at all. China, for example, stopped sharing official inventory data in 2017.

It is no wonder then that Saudi Arabia has to focus on the US. This is exactly the same policy they adopted three years ago, shortly after the broader OPEC + alliance was formed and their first output deal ran into trouble.

Currently, members of the Organization of Petroleum Exporting Countries and 10 non-OPEC allies, including Russia and Mexico, agreed to reduce their production by 1.66 million tonnes per day from the beginning of 2017 to swell global oil build up inventories as a result of the first U.S. scale boom. Poor implementation of the cuts and increasing US oil production meant that inventories continued to grow, despite OPEC making its first export reduction in eight years.

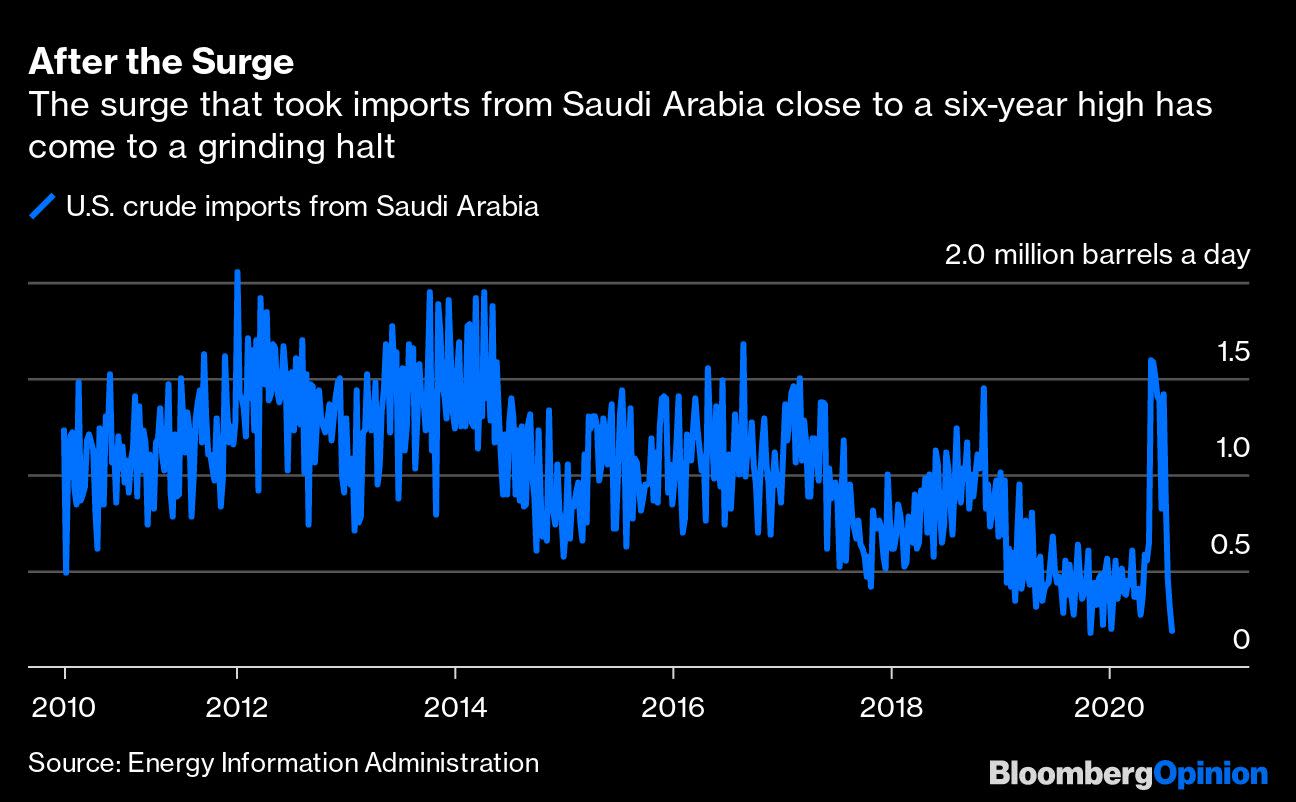

Fast forward to today and the reduction in the flow of Saudi oil to the US is dramatic. In May and June, almost daily tankers full of Saudi raw material arrived from the Gulf and West Coasts of the US, sometimes for more than a day. But in July and August, that has decreased to not much more than one per week, as the graph below shows.

That rise in ships, which I wrote about here, briefly drove U.S. imports of Saudi crude near a six-year high, adding to the upward pressure on supplies. But it was short-lived and imports in the last week of July were just 190,000 barrels a day, their second-lowest level in weekly data spanning a decade.

The figure could fall even further in the coming weeks. There are only 6 tankers carrying 9 million barrels of Saudi crude currently showing a U.S. port as their destination, according to tanker-tracking data verified by Bloomberg. With a travel time of about six weeks from the Persian Gulf to one of the major American oil ports, this is all the Saudi raw material that is likely to arrive by mid-September.

And things will probably not improve much. In setting its official crude prices for September, Saudi Arabia has made significant cuts to prices for European customers, where it competes with Russia, and smaller ones for buyers in Asia. But the kingdom has not changed prices for the US since last month.

In doing so, Saudi Arabia is keeping its crude uncompetitive against domestic heavy sourdoughs from the Gulf of Mexico, as well as imports from Canada, in a market where hopes of recovery in demand have been halted.

The leaders of Saudi Arabia and the US both want to see oil prices rise from current levels – the kingdom’s budget still depends on oil revenues and the US shale sector desperately needs higher prices to recover. President Donald Trump might be very happy to see raw imports from Saudi Arabia diminished – it would, in fact, fuel the rhetoric about US energy control.

By focusing again on its export cuts in the US market, Riyadh hopes to repeat the success of the second half of 2017, when oil prices rose by 51% from a low of $ 44.82 in mid-June to $ 67.87. the end of the year.

Unless the Covid-19 pandemic loses its grip on oil demand, Saudi Arabia may find 2020 more of a challenge.

This column does not necessarily reflect the opinion of the editors or Bloomberg LP and its owners.

Julian Lee is an oil strategist for Bloomberg. Previously, he worked as a senior analyst at the Center for Global Energy Studies.

Please visit us at bloomberg.com/opinion for more articles like this

Subscribe now to stay ahead with the most trusted business news source.

© 2020 Bloomberg LP