Welcome to the serious edition of Oil Markets Daily!

After today’s JMMC meeting, there are journalists who are completely ruining the story. For example, OPEC + already agreed to reduce the production cut to ~ 7.7 mb / d last month, but some media outlets such as WSJ reported over the weekend that this was some kind of “exclusive” networks. It is not.

Secondly, the fact that OPEC + has agreed to reduce cuts does not imply that supplies would increase immediately. Not satisfied Producers are ready to make up for the default in August and September with a figure of ~ 842k b / d.

Finally, it is the quantity of crude oil exports that ends up influencing the balance of the world oil market. Whatever they communicate through production is actually false at the end of the day. Like the saying, “show me the money,” in this case, is “show me the exports.”

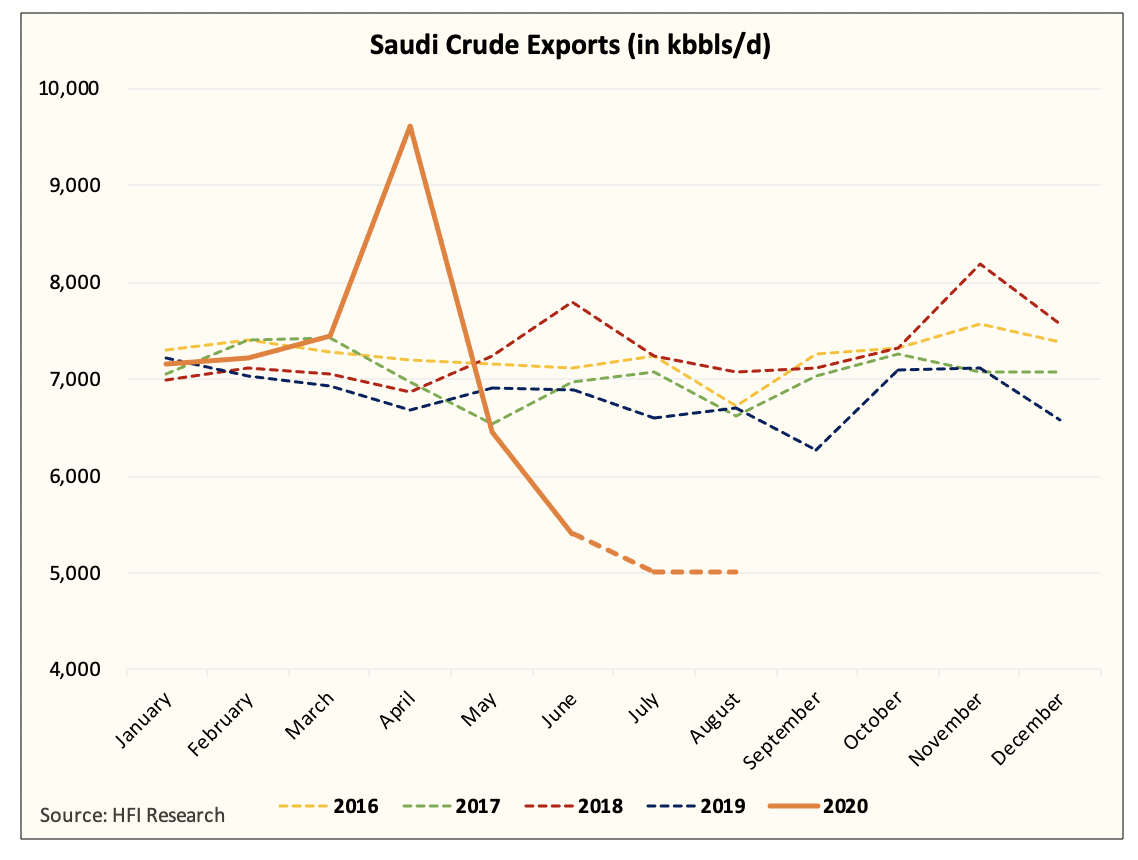

And based on everything the Saudi Energy Minister said today and in recent weeks, Saudi crude exports for July and August will remain even lower than the level exported in June. One reason for this is that during the summer with increased domestic energy burning needs, Saudi Arabia has to use its oil production for energy burning. This results in lower crude oil exports.

Either way, Saudi Arabia will only export ~ 5 mb / d in July and August, representing a delta of -4.6 mb / d compared to what it exported in April. Most of this export deficit will be seen in the US, and given the drop in production in the US, the drop in imports will have a bigger impact on US crude oil storage balances. This time.

And since the Saudis and their GCC allies account for more than 1/3 of world exports of maritime crude, the low volume of Saudi exports will mean that world crude exports will remain stubbornly low.

The severity of the drop in world crude oil exports is another reason why the oil in the water has fallen so much and floating storage is starting to drop like a moth to a flame.

conclusion

The Saudis take very seriously the fact of increasing oil prices and eliminating excess storage. Don’t listen to what the media is trying to report on how OPEC + is cutting cuts in August. Instead of looking at the headlines, seeing the flow of crude, and as far as we can tell, nothing is changing for August. Saudi exports will remain low and others are likely to follow suit.

With global oil inventories beginning to accelerate downward, energy stocks have also skyrocketed. Get on the train before I leave you behind.

We are now finally entering the bullish phase of the recovery in energy stocks. With valuations still completely disconnected from the fundamentals of the oil market, we believe investors should be positioned to take advantage of the oil bull market. We are now offering a 2-week free trial and if you would like to read our WCTW this week please check here.

Divulge: I / we have no positions in any mentioned action, and we have no plans to initiate any positions within the next 72 hours. I wrote this article myself and express my own opinions. I receive no compensation for it (other than Seeking Alpha). I have no business relationship with any company whose shares are mentioned in this article.