[ad_1]

17:40

Italian interest rates rise against Eurozone trend and rise after Fitch review

Transalpine interest for ten years increased 2.7 basis points to 1,750%, one day after the FThe itch has lowered Italy’s sovereign debt rating.

The financial rating agency it reduced the “rating” by one level, to BBB-, thus remaining at the last level of the quality investment level, that is, at a level of return to the category of “garbage” (speculative investment).

In the rest of the Eurozone, the scenario is the opposite. The benchmark for the bloc, Germany, saw its 10-year interest rate drop 2.6 basis points to -0.499%, further widening the spread for Italian interest rates.

Here, Portugal’s interest rates lost 6.4 basis points to 0.890%.

17:08

The dollar falls for the fourth session before the Fed

The index that measures the performance of the dollar against the world’s major counterparts is devaluing for the fourth consecutive session, at a time when the gradual reopening of economies and optimism about a treatment for the new coronavirus are encouraging investors and take them to riskier assets, such as stocks, at the expense of safe-haven assets like the United States dollar.

This development takes place before the Fed announced its interest rate decision later today (in Lisbon), at the end of the two-day monetary policy meeting, and after the economy was announced. from the USA USA The US economy contracted more than expected in the first three months of this year.

Between January and March, the GDP of the world’s largest economy contracted 4.8%, the biggest drop since 2008.

The dollar fell 0.15% to trade near the lowest level since mid-month, while the euro appreciated 0.32% to $ 1.0855.

16:52

Galp’s nearly 6% gain boosts domestic stock market

The PSI-20 index ended the session on Wednesday, April 29, increasing 2.30% to 4,310.88 points, extending the earnings cycle for the third consecutive day.

With 17 shares listed on the rise and only one in negative territory, the highlight of the day is for the oil company Galp, which added 5.99% to 10.44 euros per share, which is a maximum since mid-February.

BCP also had a positive influence on the results of the national stock market, increasing 5.32% to 10.10 cents per share.

16:39

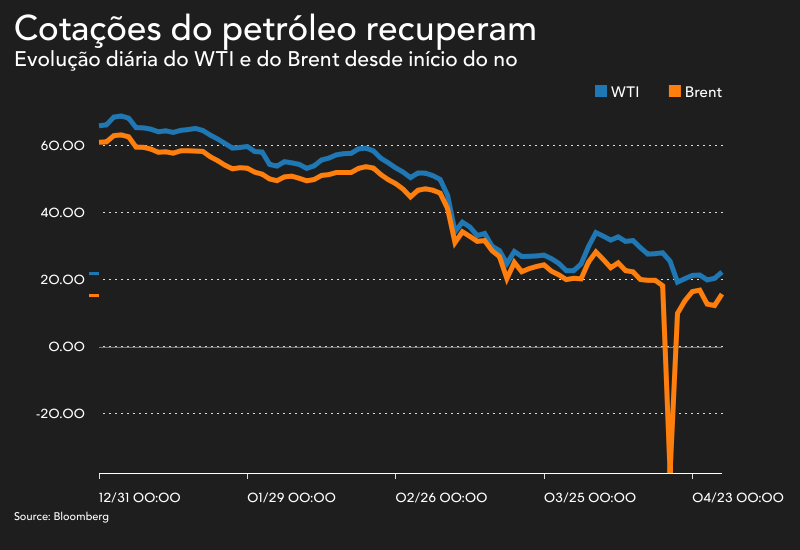

WTI soars 32% with signs of rising gasoline demand

Oil is experiencing increases in international markets, driven by signs of recovery in fuel demand in the United States.

According to data released this Wednesday, April 29 by the United States Energy Information Administration, the supply of gasoline registered the largest weekly increase since May last year, suggesting that demand may be recovering, with the economy gradually returning to normal.

Gasoline reserves decreased by 3.67 million barrels, above estimates that pointed to 2.49 million. This body also reported that crude oil reserves increased by 8.99 million barrels, a lower value than expected.

Encouraged by these data, the West Texas Intermediate (WTI), traded in New York, soared 31.77% to $ 16.26, having devalued 27% in the past two sessions.

Brent, traded in London, is worth 11.26% at $ 22.77.

16:06

European stock exchanges at seven-week highs

The main exchanges of the old continent traded higher for the third consecutive day in the trading session on Wednesday, April 29.

The benchmark Stoxx600 index rose to 1.75% to trade at the highs of March 10, benefiting from the increase in all European sectors and, in particular, the appreciation of more than 3% obtained by car manufacturers, the financial sector and also by the tourism and tourism sectors. raw material.

Lisbon’s PSI-20 peaked on March 11 and closed the day with a 2.30% gain at 4,310.88 points, especially driven by increases in Galp Energia (+ 5.99%) and BCP (+5, 32%).

At a time when many countries are gradually reopening their economies and economic stimulus measures are being unveiled, investor optimism was further fueled by the successful clinical trial of an experimental treatment with Covid-19 carried out by Gilead Sciences .

On the other hand, investors look forward to the decisions that will emerge from today’s meeting of the United States Federal Reserve and tomorrow’s meeting of the European Central Bank, with possible measures to respond to the economic shock caused by the health crisis. .

14:40

Wall Street turns a blind eye to GDP and focuses on the Federal Reserve and the possible cure for the virus

The New York Stock Exchange opened higher despite economic data showing that the United States contracted even more than expected in the first quarter of the year. Hopes that a US company is close to finding a treatment for the coronavirus pandemic are encouraging investors, who are still waiting for the Federal Reserve speech.

The generalist S & P500 advanced 1.84% to 2,916.21 points, the Nasdaq technology added 2.15% to 8,792.43 points and the industrial Dow Jones appreciated 1.63% to 24,495.60 points.

These three indices add up despite the fact that the United States’ gross domestic product (GDP) fell 4.8% in the first quarter, the first drop in US GDP. USA In six years and the biggest drop since 2008.

Futures contracts had already indicated the positive trend when they even recorded a pre-opening spike, after the North American company Gilead Sciences has shown encouraging results in the tests it is doing to discover a treatment for the new coronavirus. This company continues to increase 5.15% to $ 82.72.

In the tech world, the highlight is Alphabet, which had sales above expectations yesterday and is now testing a 9.41% rise to $ 1,348.56. Within the same sector, this Wednesday it is Microsoft and Facebook’s turn to present the accounts to investors. They add, respectively, 1.72% for $ 172.72 and 4.97% for $ 192.

Marking the day is the conclusion of the two-day meeting of the United States Federal Reserve, which is expected to keep interest rates close to zero and continue to support companies during the coronavirus pandemic.

09:18

Europe “doubts” about the profits that central banks expect

Most major European markets continue to win, although some exchanges range from green to red. Spain, Germany, the United Kingdom, Italy and Portugal are also joining, while France and the Netherlands show slight losses and Greece falls more sharply in the red.

The index that groups the 600 largest European companies, the Stoxx600, advanced 0.23% to 341.92 points, with the automotive, banking and real estate sectors increasingly prominent.

“Risk appetite is still alive this week, but investors continue to hesitate between more comforting data on the virus and, on the other hand, poor performance by companies,” says ActivTrades, cited by Bloomberg.

Pharmaceutical company AstraZeneca rose 1.7% after exceeding expectations in earnings and keeping the outlook for 2020, while retailer Next fell after announcing the suspension of the dividend and reporting a 41% drop in sales.

The decisions of the American Federal Reserve will mark the day, to be announced this Wednesday, the day before the European Central Bank publishes its own conclusions regarding its monetary policy.

09:07

The fall of the dollar before the Fed and the ECB

The dollar is trading lower against major currencies, and the central banks meeting puts pressure on the US currency. The dollar index was down 0.3% and the euro was up 0.4% to $ 1.0862. The pound (+ 0.2% at $ 1.2456) and the yen (+ 0.4% at 106.43 per dollar) are also gaining ground against the US currency.

The two-day Fed meetings returned this week, with Jerome Powell announcing the decisions on Wednesday, a day before it was known what the ECB would do. Today, the first quarterly indicators of economic activity in the United States will also be released, with the GDP release for the first quarter, which is expected to have fallen for the first time in six years.

08:58

Italian interest rates rise after rating cut

Italy’s sovereign bonds are reacting negatively to the rating cut that was announced last night by Fitch, which put the financial rating of the European country most affected by the covid-19 pandemic on the verge of falling to the “junk” level.

The yield on Italian 10-year bonds is increasing 6.8 basis points to 1.79%. In Portuguese debt with the same maturity, the worsening is 1.7 basis points to 0.97%, while the yield on 10-year bonds falls 1 basis point to -0.48%.

In an unscheduled announcement, Fitch lowered Italy’s sovereign debt rating by one level to BBB-, thus reaching the last grade of quality investment. The agency explains that it says this “downgrade” of the sovereign rating reflects the significant impact of the covid-19 pandemic on the country’s economy and budget situation.

08:46

Oil recovers with Brent above $ 21

Oil continues to fluctuate sharply in the markets, and today’s prices are recovering from the sharp falls of the last two sessions.

WTI in New York adds 13.78% to $ 14.04, after sinking 24.5% on Monday and down 3.4% in yesterday’s volatile session. Brent advanced 4.45% to $ 21.33.

Investors’ focus is now on oil contracts for June delivery, which are about to expire, prompting investors to sell to avoid sourcing the raw material. S&P Global yesterday told customers to quickly remove exposure to WTI for delivery in June, choosing to purchase the contract for delivery in July.

WTI’s most immediate delivery contract is June and expires May 19. Since most investors don’t want to keep physical oil on hand, many are already trying to liquidate their contracts to avoid the collapse that occurred early last week, when the May contract, which expired on Tuesday, negotiated in negative values. Brent’s contract in June expires on Thursday.

The date begins on Friday, May 1, when the production cuts defined within the scope of the Organization of the Petroleum Exporting Countries and its allies in this effort (the OPEC + group) will take effect, which may be somewhat encouraging. to the market. However, the expected withdrawal of crude from the market is only a fraction of the large decrease in demand.

07:34

Asia joins the bulls and already rises more than 20%

Asian equity markets generally appreciated, with an emphasis on the Asia-Pacific Index, whose stocks have already accumulated gains of more than 20% since the lows reached in March, a jump that is classified as a “bull market” or “market bullish “, for the optimism that comes with it.

Therefore, this index reflects the positive performance that had already been seen by other European and American benchmarks, which are also recovering from the large losses caused by the pandemic.

In China, Shanghai Composite was up 0.5% and Hong Kong’s Hang Seng was up 0.2%. In Australia, the S & P / ASX 200 gained 1% and in South Korea, Kospi managed to appreciate 0.7%, despite the fact that the telecommunications giant Samsung warned that it expects a drop in profits in the second quarter due to lower demand. No news from Japan, because markets closed on a national holiday.

In the United States, generalist S & P500 futures point to gains of 1.1% and tech Nasdaq futures add up to 1.3%. The day after the closing, the results of Google’s “mother”, Alphabet, which had sales above expectations were marked. This Wednesday continues the rain of technological results and it’s up to Microsoft, Facebook and Tesla to present accounts.

This Wednesday, eyes will continue to turn to the monetary policy decision of the North American Federal Reserve, to be announced today, a day before the European Central Bank decides on the measures to be taken in Europe. The sentiment of the USA USA It will continue to soften sentiment, which is expected to have declined for the first time in six years.

[ad_2]