[ad_1]

The PSI-20 ended the day gaining 0.84% to 4,222.02 points, with 11 rises, five down and two unchanged. European indices, after declines the previous day, accumulated gains above 1%, with the pan-European Stoxx600 marking an increase of around 2%.

European equities benefited from the continued movement to reopen economies on the continent, as well as a series of positive quarterly results in Europe (BNP Paribas, Total, Repsol) and also in the United States (Dupont)

Galp Energia fired in a strong bullish session for European oil companies. Stoxx Oil & Gas shot up more than 6%, benefiting from the positive results of several companies in the sector and the strong recovery in oil prices.

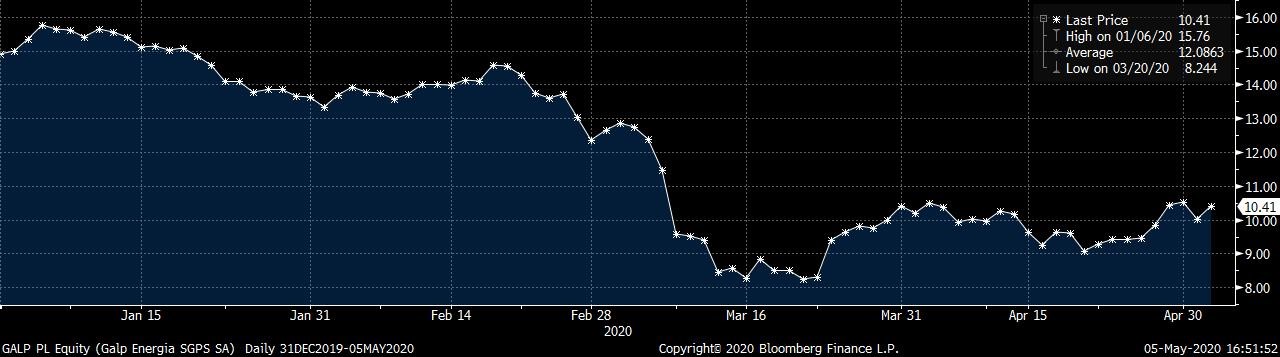

The shares of the company led by Carlos Gomes da Silva advanced 3.79% to 10.41 euros, after Total and Repsol announced declines in first-quarter earnings, but at values that exceeded analyst expectations. In addition, the French company maintained the value of the quarterly dividend, which was received by the market as a sign of confidence in the recovery of the industry.

Galp’s actions since the beginning of the year:

The rise in oil also boosted the sector as Brent in London traded above $ 30 for the first time since April 15, after a gain of more than 10%. WTI is valued at more than 15% and is trading above $ 23 in what is already the fifth session followed by consecutive gains (the longest period of increases in nine months).

Other publicly listed companies in the energy sector also contributed to the positive PSI-20 day. EDP appreciated 2.32% to 3,878 euros and EDP Renováveis gained 0.9% to 11.18 euros.

The Spanish press reveals that the Canadian funds Macquarie and First State presented an offer for a portfolio of wind assets in Spain with an installed capacity of 250 MW and for an amount of approximately 300 million euros. According to CaixaBank BPI Research, this possible agreement would be part of the EDP Group’s asset rotation strategy.

Jerónimo Martins (1.37% at 15,505 euros) and CTT (2.4% at 2,135 euros) also gave strength to the PSI-20, while BCP did not take advantage of the European sector trip, which took advantage of the favorable results of the French BNP Paribas. The bank led by Miguel Maya was mainly in negative territory and closed with a rise of 0.31% to 0.0978 euros, on a day when the European banking index rose close to 2%.

[ad_2]