[ad_1]

The world has changed and the concept of money may also change in the future. Although we are experiencing a troubled time on the economic front, this change had already started a few years ago. Therefore, this sudden increase in the value of Bitcoin may not be strange. According to the information, this change made the cryptocurrency the best performing asset of 2020, outperforming gold, silver and crude oil.

If oil falls more and more and precious metals are affected by the crisis in the financial markets, is Bitcoin a good investment?

Bitcoin rises and gold falls

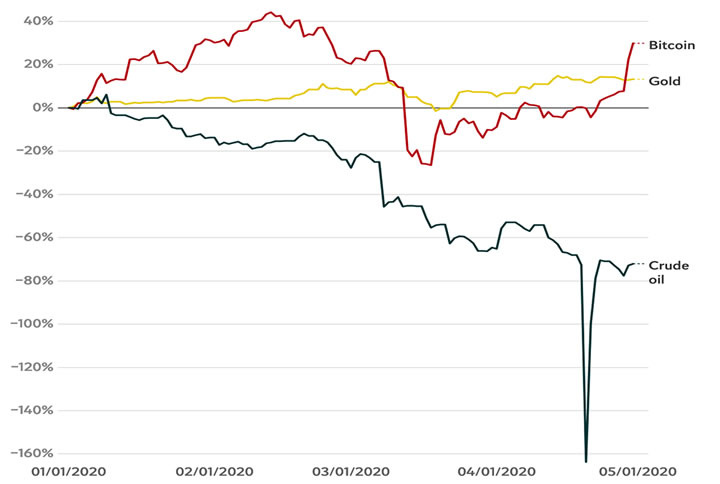

As we can see, in the last four months, the price of Bitcoin has risen almost a third, despite a large drop in March, which has taken more than $ 4,000 (3,600 euros) from its value. In the same period, gold rose just 13%, while silver fell 14% and crude oil fell more than 70% in value.

This Bitcoin recovery takes place less than two weeks before a rare event known as halve. This is a phenomenon that will cause the amount of new Bitcoins created to decrease by 50%. According to analysts, such a situation could increase the value of the cryptocurrency to levels never seen before.

The halving is just the third time in Bitcoin's 11-year history, and some market analysts believe that this year the price of the crypto currency may hit new highs.

Change in the prices of Bitcoin, gold and oil (%) from January 1, 2020

Chart: Anthony Cuthbertson source: CoinMarketCap, Nasdaq, Gold Price

As shown, both Bitcoin and gold have seen significant gains since mid-March, when countries around the world began introducing blocking measures in an effort to stem the spread of the COVID-19 outbreak.

Therefore, this caused a global economic slowdown and led to the collapse of the stock markets, as investors sought to secure their holdings in safe assets.

This has been the reason why gold has traditionally performed well in times of economic uncertainty. However, market data suggests that finite supply of the cryptocurrency means that it is increasingly seen as a safe asset.

Bitcoin has been on the rise before the May event, with investors eagerly anticipating the positive impact of a supply adjustment that occurs once every four years.

In the current situation, we are in line with the 182% increase in Bitcoin since the December 2018 lows. The increase we are currently seeing paints a picture of an increase in the months following this third halving.

Joshua Mahony, senior market analyst at financial services firm IG, told The Independent.

In the financial crisis, will it be safe to invest in Bitcoins?

Looking at the situation from a broader point of view, the massive growth in central bank and government debt relief is said to highlight the reason why many feel the need to store their wealth in alternative assets.

Other crypto currencies performed even better than Bitcoin. Therefore, the Ethereum example records earnings of over 60% since the beginning of the year.

Despite their recent gains, Bitcoin and Ethereum remain a long way from the highs of late 2017 and early 2018, when a Bitcoin was worth more than double its current value. Therefore, the question that many will ask themselves is whether it will be worth investing in gold or Bitcoins.

Also read:

[ad_2]