[ad_1]

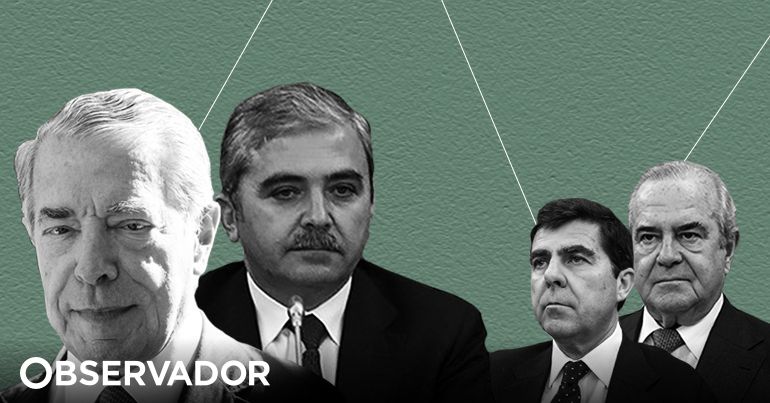

It has been known since 2013 that Ricardo Salgado had rectified his returns to the IRS three times in 2005, 2010 and 2012 but the records of the process of Universo Espírito Santo reveal the total of funds that the former leader of BES regularized: 34.1 million euros. This was the total amount that Salgado had hidden in Switzerland in various accounts of Union des Banques Suisses, Credit Suisse, and other large Swiss banks. Another 16 BES managers followed in his footsteps to avoid being accused of the alleged practice of tax crimes, reveals Correio da Manhã this Sunday.

The newspaper was able to determine the total amount of 54.5 million euros which were regularized by nine former managers of BES, missing the total legalized values of eight former administrators and former directors of the bank led by Ricardo Salgado.

All these fiscal adjustments were made under an instrument created by the Government of José Sócrates and was called the Exceptional Regime of Tax Regularization (RERT). It operated between 2005 and 2012 and served for many Portuguese and foreign residents to repatriate capital, pay a reduced rate (it varied between 5% and 7.5%) and legalize funds that they had hidden in international financial institutions. In practice, it was a tax amnesty, since it involved income that had been hidden from the tax authorities and represented a tax offense.

Most of the funds that were legalized resulted from payments made by the company offshore Espírito Santo Enterprises, the famous blue GES bag, as reported by The Observer since 2018.

GES ‘blue bag’ documents: from 20 million to more than 50 senior officials

For example, Ricardo Salgado paid a total tax of 2.3 million euros to ‘clean’ the aforementioned 34.1 million euros hidden in Switzerland. The other clans of the Espírito Santo family did the same. António Riccardi, president of the Superior Council of Espírito Santo and former director of several companies of the Espírito Santo Group (GES), legalized a total of 12.4 million euros and paid a total tax of 623,735 euros. José Manuel Fernando Espírito Santo, Former BES administrator and Salgado’s main ally in the Espírito Santo family for many years, paid 87,162 euros to legalize near 1.7 million euros, while his cousin Manuel Fernando Espírito Santo, of the Moniz Galvão clan, rectified on 1.6 million euros on his tax returns and paid a tax of 80 thousand euros. With the exception of António Ricciardi, all were accused in the Universo Espírito Santo case.

The BES and GES personnel, who did not belong to the Espírito Santo family, rectified smaller amounts. Isabel almeida, former director of BES and one of the main defendants in the Universo Espírito Santo case, rectified on 350 thousand euros on your income statements and paid an additional tax of approximately 26 thousand euros. Jose Castilla, a former GES controller who passed away earlier this year, legalized about two million euros and paid a total tax of around 103 thousand euros. Already João Martins Pereira, a former BES director who joined BES to create an Audit and Compliance Department, rectified a total of approximately 1 million euros and paid an extra tax of 47,683 euros, while Pedro Brito e Cunha, former president of Tranquilidade, legalized profits from around 873 thousand euros and paid 65,521 euros of taxes.

The whole story of the GES ‘blue bag’

The values rectified by Amílcar Morais Pires, former CFO of BES and Salgado’s right-hand man, Jose Maria Ricciardi, former leader of Banco Espírito Santo Investimento, Rui Silveira, former director of BES and responsible for legal affairs and five other former managers of BES and GES.