[ad_1]

Do you want to know how much you will actually earn in 2021? To do this, you will need to know how much of your monthly salary or pension will be withheld.

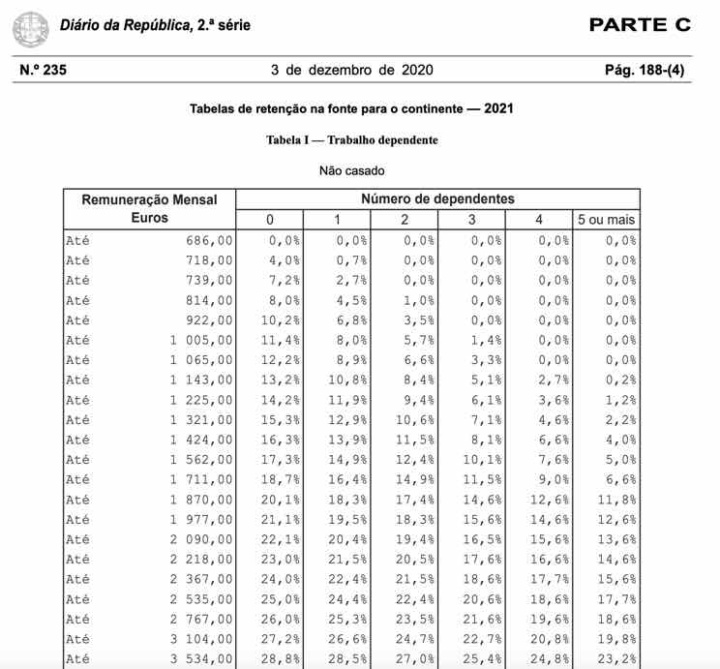

This Thursday the retention tables for 2021 were published in the Diário da República. Find out now the withholding rate that applies to your salary.

The tables for withholding taxes on income for dependent work and pensions earned by holders residing in the continent are now available and will be in force during 2020.

In compliance with the provisions of the Personal Income Tax Code (IRS), the withholding tables referred to in articles 99-C and 99-D of said statute are approved.

The tables now approved reflect the Government's option of progressive adjustment between withholding tax and the amount of tax to be paid, which is particularly noted in the tables related to dependent work, can be read in Order No. 11886-A / 2020.

New retention tables

IRS withholding is a way for the state to collect revenue throughout the year through a monthly discount for workers, trying to anticipate what the annual tax payable by taxpayers should be. To find out how much you will actually earn, just get the tables here and check your family's situation.

The new withholding tax tables exempt IRS salaries and pensions up to 686 euros. The amount from which salaries and pensions begin to be deducted by the IRS in 2021 will increase to 686 euros per month, rising 27 euros compared to the 2020 limit.

In addition to the increase in the amount exempt from the monthly tax discount, the new tables published in the Diário da República reduce the withholding rate applicable to the different income brackets, in values between 0.1 and 0.9 percentage points compared to applied in 2020.

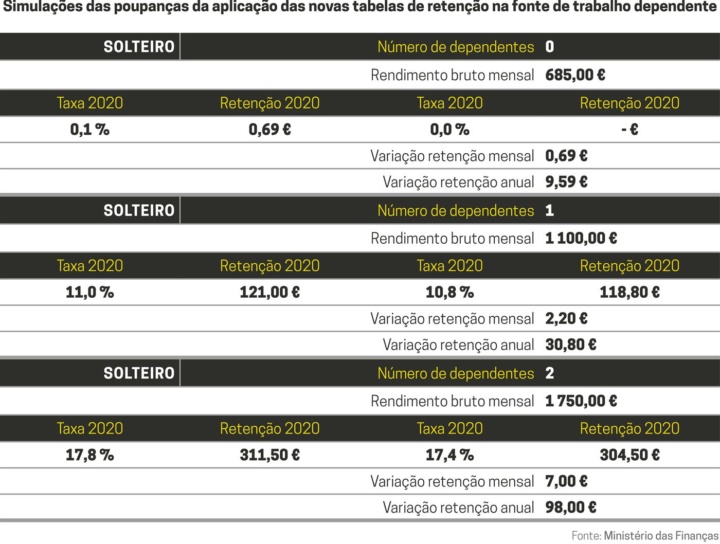

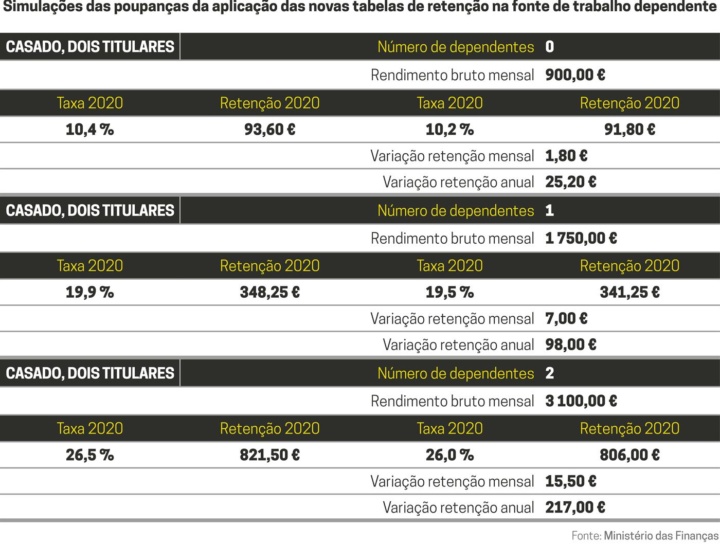

Simulations developed by the Ministry of Finance

For example, a single person, without dependents, who receives a monthly salary of 685 euros will be exempt from this monthly withholding, achieving a monthly withholding of the order of 0.69 euros. At the end of the year, the variation in withholding will be around € 9.59.

In the case of a couple, in which both elements work, with two children and a gross monthly income of 3,100 euros, the monthly profit, compared to this year is 15.50, which represents an increase of 217 euros per month. end of the year.

Get tables here

[ad_2]