[ad_1]

Withholdings at source for next year will be, on average, 2% below those practiced this year, which means that salaries increase as the monthly advance to the State falls. The accounts are from PwC, based on the tables published this Thursday in the Diário da República, and reveal that the monthly savings of families can be one euro or several tens, depending on the value of the gross salary. All earnings from work are covered crosswise and more or less identically. In the case of pensioners, only the retention rate of the lowest pensions is modified.

For both married and unmarried taxpayers, “withholding rates have generally been reduced by approximately 2%”, and “this reduction will generate an increase in net disposable income that will depend fundamentally on the level of income increasingly between 0% and 2% ”, explains Ana Duarte, specialist at PwC.

Some examples: for single taxpayers, without dependents, with a monthly income of up to 800 euros, “the increase in the net monthly salary will be one euro”. If the income is between 1,200 euros and 1,400 euros, then the increase in net income will be four euros per month. For income levels of approximately 3,400 euros per month, and again for single taxpayers, but also for two married holders, without dependents, the increase in net monthly income will reach 20 euros per month, reveal the PwC simulations.

The reduction in withholdings at source, announced by the Government as a way of providing taxpayers with greater monthly liquidity in difficult times of the pandemic, “will have a great impact on the disposable income of families, around 200 million euros “, underlines the Ministry of Finance in a statement.

However, this does not mean any tax reduction. Withholding tax is a monthly advance that taxpayers make to the state coffers. The following year, when the tax authorities pay the tax, the accounts are settled and the overpayment is returned, in the form of a refund. If withholdings decrease, the following year’s refunds will also be shortened. The difference is that people will have the money in their pocket sooner. And the IRS levels remain exactly the same.

Pensions almost unchanged

In the case of pensioners, the withholding tables are still practically identical to those of 2020. The Secretary of State for Tax Affairs, who signs the order with the tables now published, had already said that it would be the case, since there will be the that less There are discrepancies between the amounts withheld monthly and the tax actually owed by taxpayers.

The option ended up being to update only the lowest levels, “to maintain the level of net income of pensioners benefited by the extraordinary increase in lower pensions,” explains the Ministry of Finance.

Thus, and again according to the simulations carried out by PwC, between 700 and 750 euros of gross monthly pension the withholding will be lower than the current one between two and two euros.

The need to end the discrepancy between the amount of withholdings made and the final amount of tax to be paid by dependent workers has been debated for a long time. With these reductions, “the Government continues the actions of recent years to blur” this “differential”, underlines the Ministry of Finance.

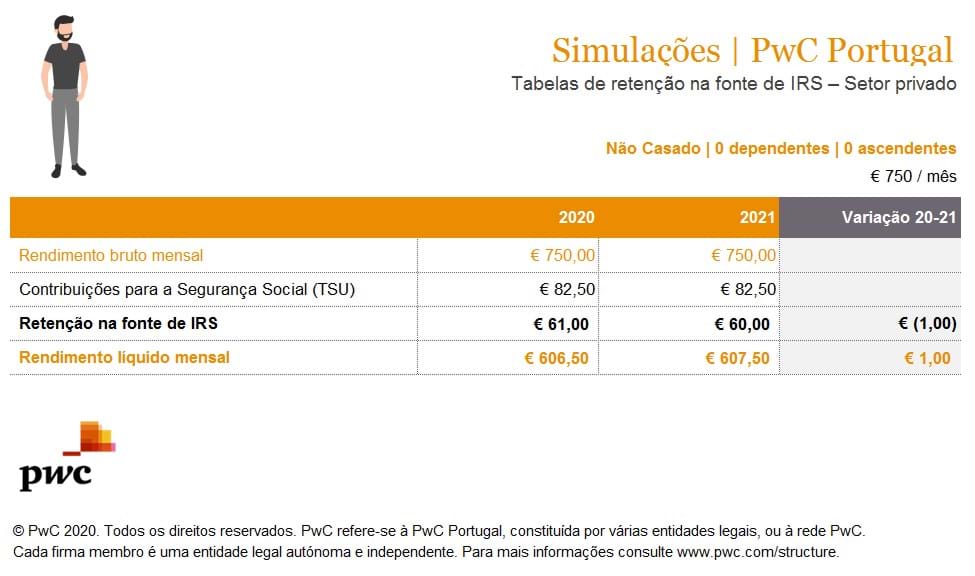

SIMULATIONS BASED ON THE NEW TABLES

Single taxpayer without dependents – 750 euros of gross monthly income

In this case, the monthly “savings” corresponds to one euro, and will be the same for married taxpayers, one or two taxpayers and with dependents.

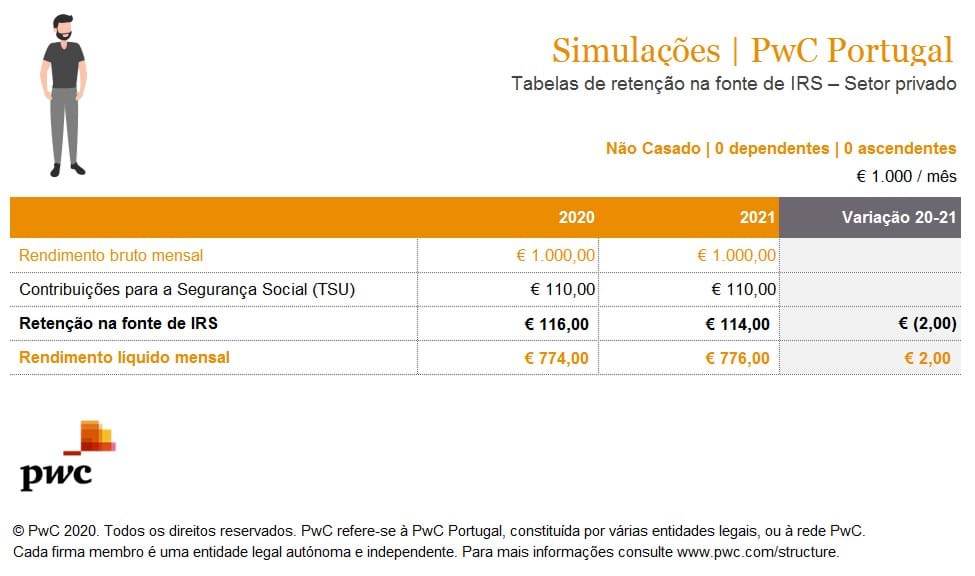

Single taxpayer without dependents – 1000 euros of gross monthly income

In this case, the monthly “savings” corresponds to two euros, and will be identical for married taxpayers, one or two holders and with dependents. The reduction will be less if the number of dependents increases because in these cases the withholding tax is already lower, since it is assumed that in the end they will have less taxes to pay.

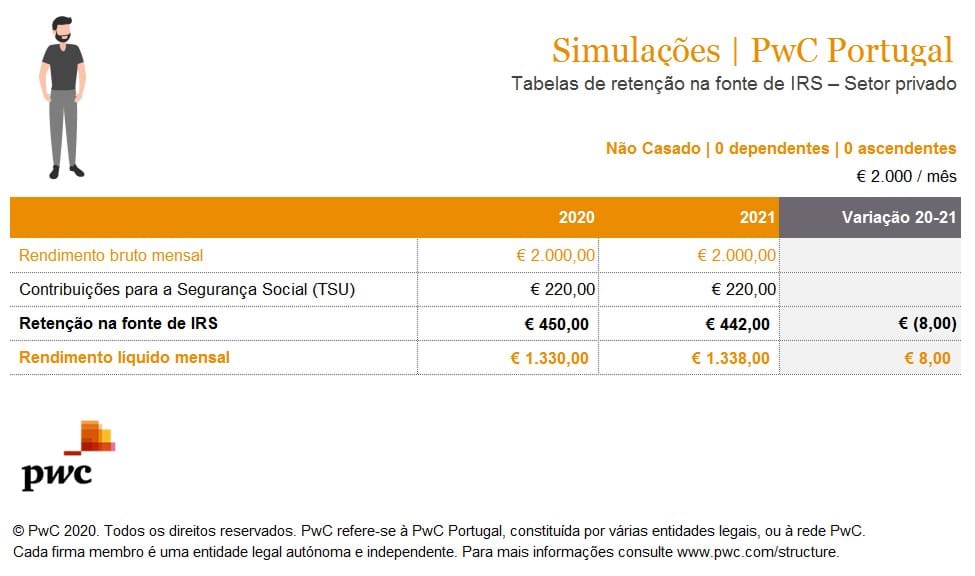

Single taxpayer without dependents – 2000 euros of gross monthly income

In this case, the monthly “savings” corresponds to eight euros. For, and will be identical for married taxpayers, two holders and with dependents. The reduction will be less for married couples, where only one is the owner of the income and, in all cases, if the number of dependents increases because the withholding tax is already lower, since it is assumed that in the end they will have less taxes. Remove.

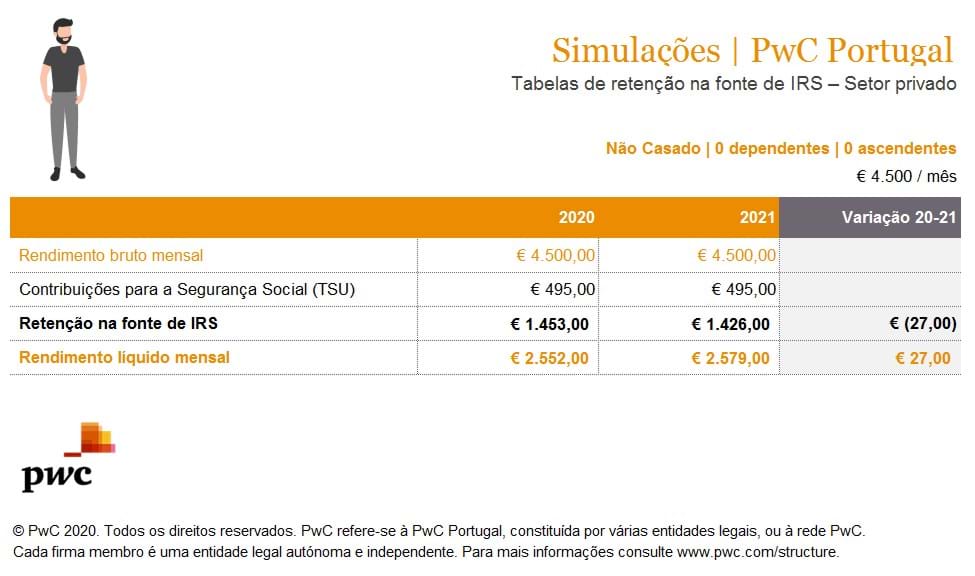

Single taxpayer without dependents – 4,500 euros of gross monthly income

The gross income increases, the reduction in withholding tax increases. In this case, the monthly “savings” will already be more significant, 27 euros. In the cases of a married owner, or of families with dependents, the value is reduced to the extent that the withholding itself would always be lower.

See the tables published today in Diário da República:

[ad_2]