[ad_1]

The 90s were a turbulent time for Nissan. While we were enjoying the Sentra, Cefiro, Terrano and the van named Vanette, the Japanese automaker was facing a period of riots on the larger stage.

They struggled for profit for eight years. In America, it seemed like they were giving away $ 1,000 for every car they sold. Sales in Japan continue to decline even as the general market deterioration there seemed to slow down. They may have built some very good performing cars during this time that are still revered today, but sadly these cars couldn’t pay the bills.

Renaissance

Nissan received a lifeboat in 1999. They agreed to form an alliance with Renault that paid out $ 5.4 billion, giving the French a 36.8% stake in Nissan. The deal included the appointment of Carlos Ghosn as director of operations. Nicknamed “Le cost killer,” Ghosn is known for downsizing as part of his restructuring to make his companies profitable again.

The Nissan Revival Plan (NRP) was announced in October 1999 and has three main objectives: return to net profitability in fiscal 2000, a minimum net operating income to sales margin of 4.5% for fiscal 2002, and reduction of consolidated net auto debt. to less than 700 billion yen by fiscal 2002. If not met, the Nissan Executive Committee will resign. Part of achieving this means Nissan will cut 21,000 jobs worldwide and close five factories.

“While cost reduction will be the most dramatic and visible part of the plan, we cannot save our way to success,” Ghosn said at the time. “The revival plan prepares for the future of Nissan.”

In Nissan’s 2001 Annual Report, they reported that targets were met a year ahead of schedule. They finally came out of the red, made a comeback and Carlos Ghosn was now the CEO of Nissan. Normally, things could have continued like this, but it didn’t.

The volume game

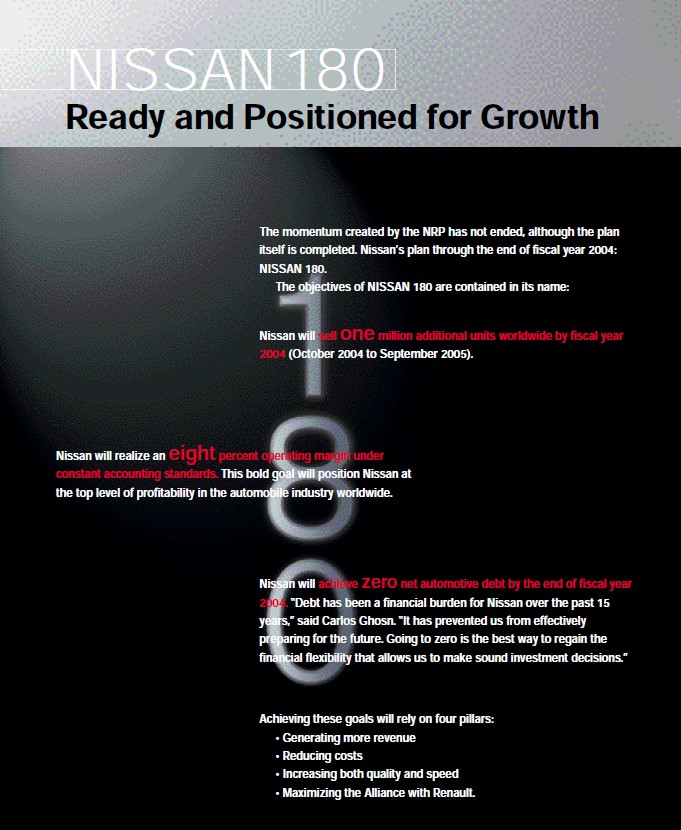

After the impressive NRP, Ghosn and company set their sights on the immediate future and established the three-year plan called ‘Nissan 180’ in 2002, where they will sell an additional 1 million cars worldwide by 2005, they will achieve an operating margin of 8 % and achieve zero auto debt by the end of fiscal 2004. One million cars were lost, but that didn’t deter them from aiming for more.

The ‘Value Up’ plan in 2005 aimed to achieve 4.2 million units in global sales by March 2009. Something they did not meet either. It was followed by the ‘Power 88’ in 2011 targeting a global operating profit margin of 8% and a global market share of 8%. They also focused on the US market in 2012 with the goal of obtaining a global market share of 10%.

Even if Nissan wasn’t meeting their targets, they were still climbing the ladder in terms of numbers. Cars were still leaving showrooms and into garages, and Nissan reports weren’t totally in the red. This was because Nissan’s cost-cutting measures allowed them to have lower prices, so naturally they were more attractive to consumers.

Cutting too many corners?

In his article for Harvard Business Review, Ghosn said that prior to his leadership, Nissan’s cost of purchase was 15-20% higher than Renault’s. They had to look for cheaper parts which, in turn, gave them higher margins. It makes sense from a business perspective, but not for consumers.

Small things like the timing belt guides were replaced by plastic and the panels were less premium. They were also affected by their CVT problem which resulted in a class action lawsuit in the United States and had them extend their warranties to affected vehicles.

Brand perception

The biggest victim of cost reduction was the perception of the Nissan brand. Americans saw them as low-end vehicles because of their prices. The car experience also suffered greatly with a Consumer Reports published in 2014 saying that 14 of the 22 Nissan and Infiniti cars (its premium brand) ‘came in last or penultimate in their respective categories.’ This is crucial because, unlike other surveys, Consumer Reports asks people who have owned their car for years.

Stagnation

Another reason Nissan struggled recently was because its models tend to get out of date on the market. The Leaf, its first all-electric model, launched in 2010 and was never significantly updated until 2017, despite being ahead of Tesla at the time. Its entry-level Versa and Sentra sedans had their previous generations released in 2011 and 2012 respectively, but were only updated last year. Others like the Maxima and Navara are already 5 and 6 years old, while the GT-R is already over 14 years old on its current platform.

Ghosn effect

Nissan was left in a fragile situation when Carlos Ghosn was expelled from the company after being arrested in Japan in 2018. Its profitability and market share strategy also proved fragile. In 2017, Nissan peaked with an 8.4% market share in the US, sold 5.7 million cars worldwide, earned nearly 12 trillion yen in net sales and 747 billion yen in revenue. net. However, once car sales slowed around the world, they realized they were in a thin layer.

After fiscal 2019, Nissan’s market share in the US dropped to 7.2%, they sold 4.9 million cars worldwide, 9.9 trillion yen in net sales, and lost 671 billion yen in revenue. net. They also shared that they project to lose roughly the same amount by 2020 as the pandemic hits the world economy.

The job cuts were huge too, to say the least. In July 2019, they announced the plan to cut 12,500 jobs and reduce production by 10% by 2022. Then, in April 2020, they cut another 10,000 workers in the US due to the pandemic. A month later, 20,000 people were laid off mainly in Europe and developing countries.

Next plan

Learning from past mistakes, Nissan’s new four-year plan moves away from its pursuit of low volume Ghosn. With new CEO Makoto Uchida at the helm, Nissan is looking to further simplify operations and achieve financial stability and profitability.

“Our transformation plan aims to ensure consistent growth rather than excessive sales expansion. We will now focus on our core competencies and improve the quality of our business, while maintaining financial discipline and focusing on unit net income to achieve profitability. This coincides with the restoration of a culture defined by “Nissan-ness” for a new era. “

Under the four-year NEXT plan, Nissan reduces production capacity to 20%, reduces the number of models by 20%, reallocates sources to globally competitive models and markets and reduces the product life cycle to less than 4 years.

Resurgence

To keep people from talking about your past, make them talk about something else. In the auto industry, that means producing new cars and Nissan knows it.

In early July, Nissan finally introduced the Ariya, an all-electric crossover. It was followed by the Nissan Magnite in India, then the prototype Z which is a modern take on the iconic Fairlady Z. Its return to form in the US market will be led by the new Nissan Rogue, while Japan will have a new Note. .

For the Philippines, there is a new Terra and Navara, although both are yet to be released locally, and it looks like we’ll have the Nissan Kicks to replace the Juke very soon.

There are still dark clouds hovering over Nissan from the past, but with this series of movements, it seems like the sun is finally breaking through.