[ad_1]

Wells fargo (New York Stock Exchange: WFC) and all banks took a hit on September 8 with the market in part because of another revelation that Warren Buffett Berkshire Hathaway (NYSE: BRK.B) sold more shares of the bank. My investment thesis remains very optimistic about bank stocks. My previous research has already identified that Berkshire selling airline stocks near the lows was a great call option in Delta airlines (OF).

Image source: Wells Fargo website

Buffett unloads Wells Fargo

Warren Buffett has historically held 10% of Wells Fargo as his favorite bank stocks. Whether it’s losses from COVID-19, repeated damages from fraud cases, or some other reason, the Oracle of Omaha has changed its mind on the actions.

According to a filing for Exhibit 13G, Warren Buffett now controls only 3.3% of the shares. He only controls 136.3 million shares as of August 14, while he recently held a 5.9% position as of June 30. The stock is now trading around $ 25 for a month since these last shares were sold on August 14.

In the past, Wells Fargo was Berkshire Hathaway’s largest equity position. The company owned 480 million shares, worth more than $ 25 billion when the share hovered around $ 60 in 2017 and 2018.

Source: Forbes

Warren Buffet selling the bank’s stock for $ 24 is amazing because his average acquisition price was apparently the same price. The move follows a strikingly similar move to ditch the airlines after stocks fell to lows.

After a few months have been spent on the airlines, one can really question whether Buffett made the right decision. Delta airlines (DAL) was trading in the mid-$ 20s when Buffett dumped the airline’s stock, but now the stock is trading at more than $ 32.

In fact, Delta was trading at $ 20.75 in initial trading on Monday in early May after word broke over the weekend that Berkshire Hathaway had completely pulled the airlines. The stock is up nearly 55% from where investors might have gone the opposite trade from Warren Buffett.

Another reason not to follow Buffett out of Wells Fargo is that Berkshire Hathaway no longer seems like a value investor. The company just took a large stake in Snowflake (SNOW) at the inflated IPO price in a move to chase quick money, very different from any Warren and Charlie Munger philosophy in the past.

$ 10 billion reasons to ignore Buffett

While the banking sector is sunk due to economic reasons from the COVID-19 related closures, the situation is not so dire in the sector as to panic banks sell out here. Many of the big banks like JPMorgan Chase (JPM) are still generating billions in revenue, including $ 4.7 billion in the last quarter despite large loan provisions.

The big bank that matches what strong banks are achieving in this environment along with the knowledge that the new CEO has plans to eliminate $ 10 billion in annual operating costs should produce a desired result for shareholders. The stock is not pricing in better financial results going forward, even though Charlie Scharf is known to have the banking experience to make Wells Fargo a more tech-savvy bank.

My previous research has the bank generating in the range of $ 4 to $ 6 in normalized profit in a scenario where $ 10 billion in costs is eliminated from an organization that just printed a quarter with an efficiency ratio of 81, 6%. All good banks have ratios in the 50% range.

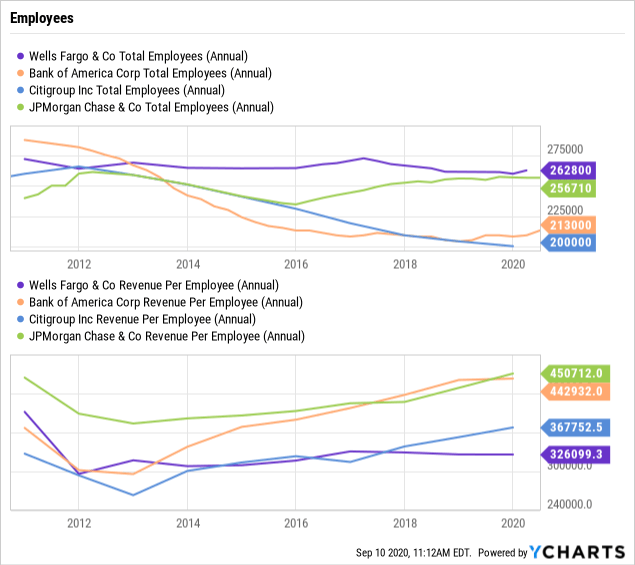

The best way to clearly understand the efficiency problem at Wells Fargo and the potential ease of solving the problem is this insight into the number of employees and revenue per employee over the past decade. All the big banks, including JPMorgan, Bank of America (BAC) and Citigroup (C), have seen revenue per employee grow from the low around 2012/2013. The other banks reduced the number of employees, while Wells Fargo has generally had a flat workforce throughout the decade. A couple of banks recently started hiring employees to match revenue growth.

YCharts data

YCharts dataMedia reports suggest Wells Fargo initiated layoffs in August after the virus originally slowed down efforts to reduce the number of employees. According to the October third quarter earnings report, the big bank should be able to provide some tangible evidence of progress in streamlining the operations necessary to re-attract investor interest. After all, the bank needs to improve revenue per employee by nearly 50% to match JPMorgan and Bank of America.

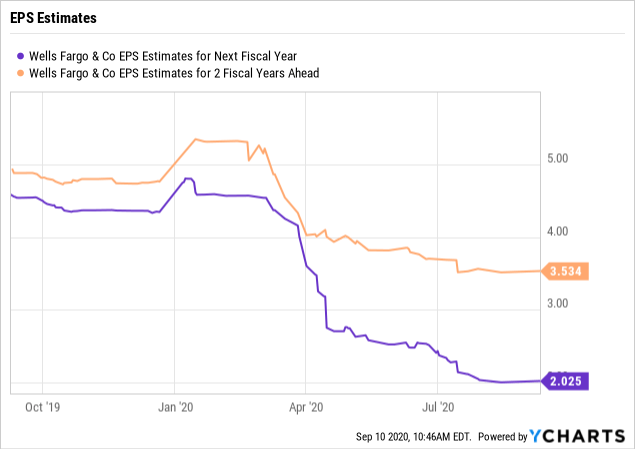

Even in these tough times, analysts still have Wells Fargo generating $ 2 to $ 3 in profit in 2021/2022. Clearly, analysts are not expecting much from the bank now despite expectations of earnings above $ 4 before the virus.

YCharts data

YCharts dataThe new CEO and the likely removal of the Fed’s $ 1.95 trillion asset cap placed on the bank in 2018 should set 2021 to be a better year than 2019. By matching this with $ 10 billion in lower spending In the coming years, analysts and investors should conclude that they are financially better by 2022, not worse.

To carry out

The key investor conclusion is that the example of Delta Air Lines provides an excellent example of why investors should not follow Warren Buffett outside of Wells Fargo. The big bank has a plan to improve efficiency rates and increase profits in the coming years. The stock is a bargain here with normalized earnings above $ 4 and potentially touching $ 6 in reduced expenses.

If you’d like to learn more about how to better position yourself for a rally in stocks defeated due to COVID-19, please consider joining. Outside Fox The Street.

The service offers a portfolio of models, daily updates, trade alerts, and real-time chat. Register now to access the legacy pricing available to future subscribers.

Divulge: I am / we are long WFC, C. I wrote this article myself and express my own opinions. I am not receiving compensation for it (other than Seeking Alpha). I have no business relationship with any company whose actions are mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a request to buy or sell securities. Before buying or selling stocks, you should do your own research and come to your own conclusion or consult a financial advisor. The investment includes risks, including loss of capital.

[ad_2]