[ad_1]

A flame burns from a pile at the oil processing facilities at the Shaybah oil field in Saudi Aramco in the … [+]

Leaders of OPEC +, Saudi Arabia, and Russia reached a historic cut in oil production on Thursday night, effectively stopping a bitter oil war that saw prices implode more than 50% from January highs. . The details of the OPEC + virtual conference have just emerged:

- Members will adjust their total crude oil production downward by 10.0 mb / d, effective May 1, 2020, for an initial two-month period ending June 30, 2020. For the subsequent 6-month period , from July 1, 2020 to December 31, 2020, the agreed total adjustment will be 8.0 mb / d.

- Thereafter, an adjustment of 6.0 mb / d will be made over a 16-month period, from January 1, 2021 to April 30, 2022.

- The baseline for the calculation of adjustments is oil production for October 2018, with the exception of the Kingdom of Saudi Arabia and the Russian Federation, both with the same base level of 11.0 mb / d.

- The agreement will be valid until April 30, 2022, however, the extension of this agreement will be reviewed during December 2021.

The US Oil Shale Patch USA He has been supporting such a deal, which would ideally reduce supply, raise prices, and launch a lifeline to an industry that has been hit by catastrophically low prices. President Trump pushed for an OPEC production cut of 10-15 million bpd personally on April 2North Dakota phone call with Russian Vladimir Putin and Saudi Crown Prince Mohammed bin Salman. OPEC seems to have heard.

Russian President Vladimir Putin (L) shakes hands with the Deputy Crown Prince and the Saudi Defense … [+]

But the announced levels may not again surprise prices within the economically acceptable range for producers. An organized production cut of this magnitude is unprecedented, yet even 10 million bpd may be insufficient to balance current markets.

Both Russia and Saudi Arabia are vitally interested in higher prices to balance their budgets and minimize digging into their foreign exchange reserves. At the current price, Russia can last 5-7 years and Saudi Arabia no more than 3 years, as crude represents 80% of the revenue of the Kingdom government.

For Russia, this agreement represents a political failure. His refusal to join KSA’s proposed production limits in March was intended to punish the US shale patch. USA And flex your muscle as one of the top 3 world producers. By not cutting when necessary, Russia will now cut much more. Moscow incited a price war that led to falling oil prices (along with the value of the ruble).

The destruction of demand after the global Coronavirus, as planes stop flying and workers stop traveling, is beyond what anyone could have imagined. The blockade is estimated to eliminate between 15 million bpd and 35 million bpd of demand by 2Q2020, or about a third of typical daily consumption levels. If the high demand scenarios of 35 million bpd are lost, oil producers will need to find room for a billion barrels of oil in just one month. That is more than the total amount of onshore and floating storage available globally (~ 900 million barrels).

If stores reach full capacity, there is an unlikely but real chance that oil producers will have to pay customers to eat their crude, causing negative oil prices. The fact that we are discussing this possibility just three months after Brent was in the mid $ 70 range is a testament to Covid-19’s catastrophic impact on energy markets.

Wall Street reacts to OPEC news

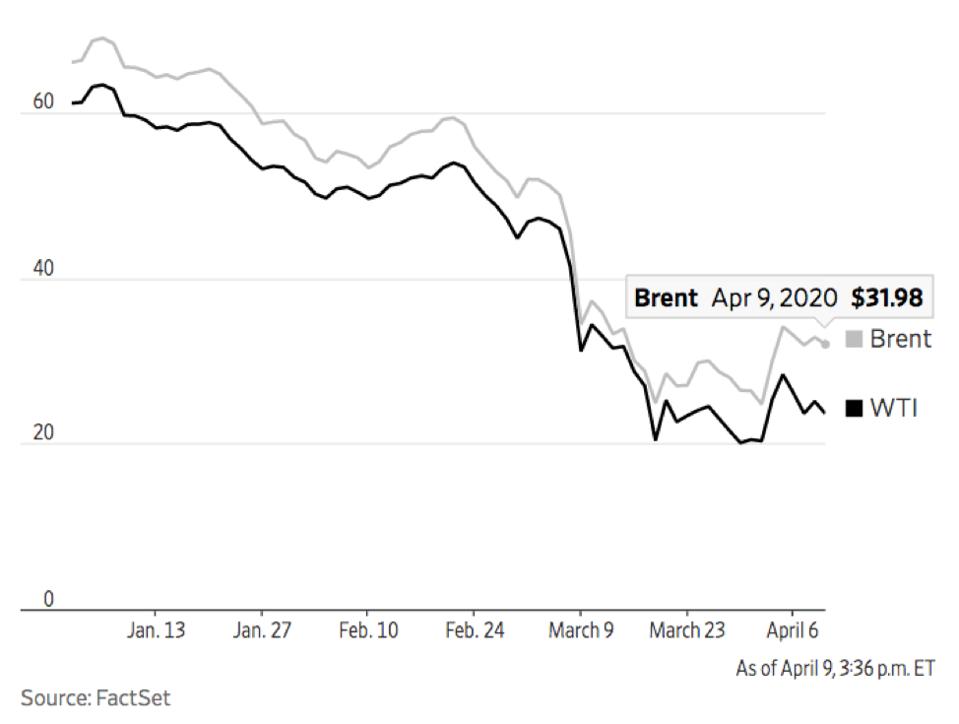

Following Thursday’s initial announcement, operators did not respond well. At the close of the market on April 9, WTI futures fell 7.61% on the day to $ 23.19, with Brent crude losing 2.95%, closing at $ 31.87. This is certainly not the response OPEC + expected.

Brent and WTI crude oil futures to date.

Dr. Carole Nakhle, Founder and CEO of Crystol Energy, had the following to say about the current OPEC negotiations:

“The current possible agreement between Russia and Saudi Arabia, and more broadly between OPEC and OPEC + may not be enough. Demand destruction can be 30 million bpd (mbd). Figures released on Thursday, April 9 suggest 1.6 mbd for Russia and 3 mbd cut for Saudi Arabia; this may not be sufficient.

More broadly, the clash between Moscow and Riyadh reflects internal differences: Saudi Arabia is a place of decision-making. In Russia there are a number of private and state companies and financial institutions. It takes longer to reach decisions. “

Given that President Trump refuses to officially participate in OPEC + output reduction (he rightly points out that free markets will naturally reduce U.S. oil production), the current deal will provide storage relief for producers, but it will not be adequate to balance the market.

The talks will continue today, Friday, April 10, at the G20, where OPEC + energy ministers hope to enlist the support of other key oil-producing nations such as the United States and Canada.

James Grant