[ad_1]

The Philippine central bank cut its key interest rate in a surprise move after the economy contracted more than expected in the third quarter.

Bangko Sentral ng Pilipinas cut its benchmark rate on Thursday 25 basis points to 2.0%, as only five of 18 analysts expected in a Bloomberg survey. Thirteen had predicted that the rate would remain on hold. The latest move brought the total rate reduction this year to 200 basis points.

The central bank’s decision came as a surprise to many economists who expected the monetary authority to remain on hold while they evaluated the effectiveness of previous easing measures. The bank also implemented credit relief and other liquidity measures in response to the pandemic amid limited fiscal stimulus.

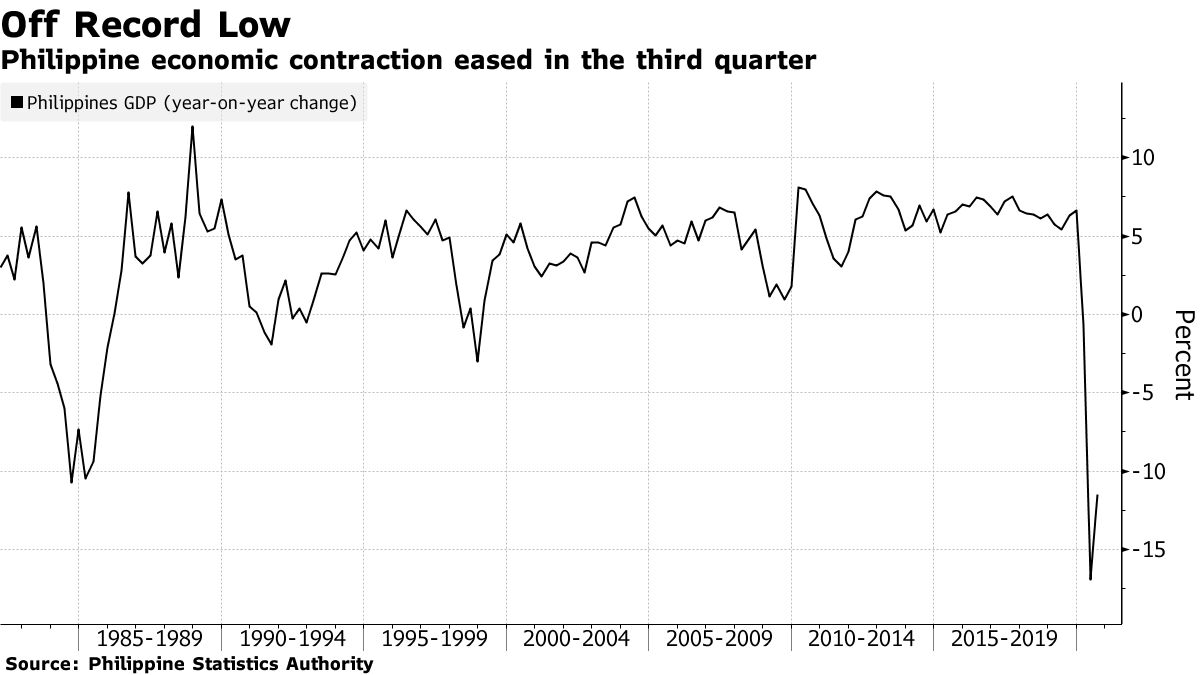

Central bank governor Benjamin Diokno has made clear his view that Monetary policy cannot do all the work to reactivate the economy and that fiscal stimulus will also be key. Gross domestic product contracted 11.5% in the three months through September compared to the previous year, better than the 16.9% contraction in the second quarter but worse than economists’ estimates.

Jobs are being restored as the economy reopens, but consumers remain cautious as Covid-19 cases continue to rise in the second-worst outbreak in Southeast Asia.

– With the assistance of Cecilia Yap, Clarissa Batino, Andreo Calonzo, Michael J Munoz and Tomoko Sato