[ad_1]

The central bank of the Philippines will leave its key interest rate unchanged for the second meeting in a row, allowing the previous stimulus steps to make their way through an economy in recession.

Bangko Sentral ng Pilipinas will keep the benchmark rate at 2.25% on Thursday, according to all but one of the 20 economists surveyed by Bloomberg. At its last rate meeting in August, the central bank embarked on a “prudent pause ”after a 175 basis point reduction this year and other liquidity measures.

Policymakers “will allow more time for the above measures to carry over to the economy and for the BSP to assess their effects,” said Euben Paracuelles, an economist at Nomura Holdings Inc. in Singapore.

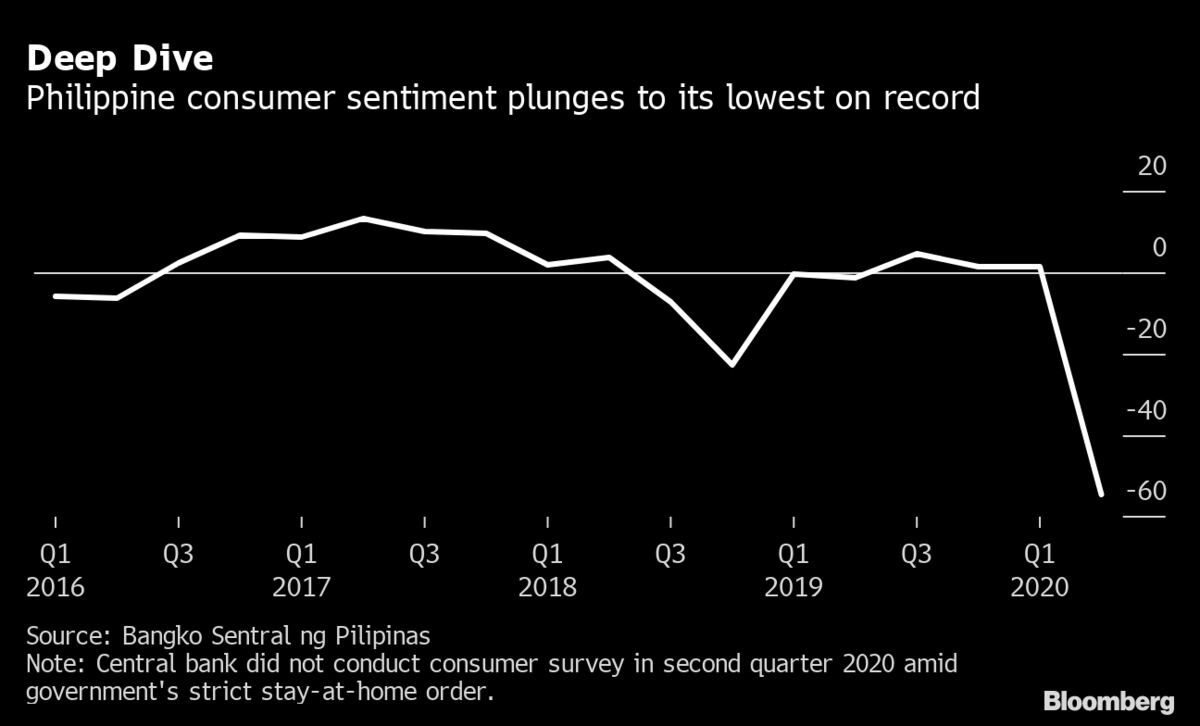

Dive deep

Philippine consumer confidence falls to its lowest level on record

Source: Central Bank of the Philippines.

That earlier easing has yet to seep into the real economy, with consumer confidence falling to the weakest level recorded in the third quarter. With private consumption offsetting Over 70% of the Philippine economy, weak sentiment “speaks volumes about the prospects” for the recovery, and could prompt policymakers to provide “moderate forward guidance,” Paracuelles said.

Here’s what to consider in Thursday’s decision:

Policy space

While consumer price increases remain below the midpoint of the 2% -4% BSP target, the inflation-adjusted interest rate is already below zero. Analysts are watching for signs of the bank’s ability and willingness to provide more monetary support.

“BSP still has the monetary cushion to make rate cuts, and the market is looking for more clues on that front,” said Howie Lee, an economist at Oversea-Chinese Banking Corp. in Singapore.

With the central bank doing much of the heavy lifting to revive the Philippine economy amid limited fiscal stimulus, some analysts argue that the BSP has reached the end of its rate cut cycle.

“The rates are low enough,” said Trinh Nguyen, an economist at Natixis SA in Hong Kong. The recession was due to virus containment measures rather than money supply problems, and policy makers “will keep rates in place to leave room for fiscal policy to act,” he said.

Deficit financing

Governor Benjamin Diokno recently said that the bank is ready to lend more to the government to help counter the economic blow of the pandemic, and on Wednesday said the government has asked for 540 billion pesos ($ 11 billion) in new budget support. Analysts will be on the lookout for clues as to the BSP’s willingness to do that and also any indication of the size of the central bank’s bond buying activity in the secondary market.

Growth view

Policy makers have said the second quarter marked the lowest point for the economy, but any comment on how long the recession will last could shed light on future monetary or fiscal policies.

Exit It will contract in the third quarter compared to a year earlier, Economic Planning Undersecretary Rosemarie Edillon said this week, citing weak sentiment, high unemployment and subdued manufacturing.

– With the assistance of Tomoko Sato