[ad_1]

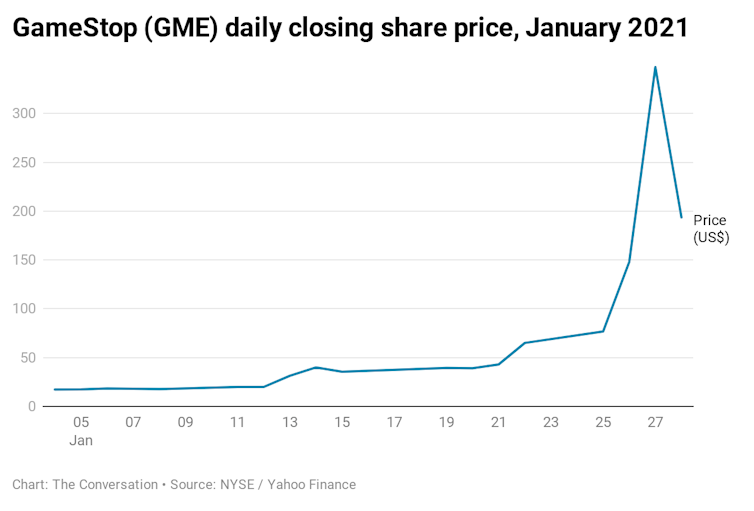

How does a small retail business that sells video games, worth less than $ 400 million in mid-2020, turn into a $ 10 billion business in less than six months? How does your stock price rise from about $ 20 on January 12, 2021, to $ 347 on January 27, and then drop back to $ 193 the next day?

The impressive rise in prices in GameStop shares, largely driven by Reddit users hyped up with the help of Elon musk, has caught the attention of the US government, sparked calls for regulation by the head of the NASDAQ exchange, and even boosted the shares of an Australian mining company with a coincidentally similar stock market code.

How is this happening? The simple answer is that this is a power game, magnified by social media, between small retail investors who want some stock prices to rise and larger hedge funds who have made big bets that those same prices will fall.

Revenge of the little fish

Melvin Capital is a hedge fund (worth US $ 12.5 billion until recently) with a “short position” in GameStop. A short position means that Melvin was betting that GameStop’s share price would fall (a reasonable bet, as the outlook for traditional video game stores is a bit like what happened with Blockbuster and other video rental outlets) . This in itself is nothing unusual.

What made the last two weeks so unique was the large participation of small individual investors driving the action. Through platforms like Reddit (specifically the Wall Street Bets forum, which describes itself as “how 4Chan found a Bloomberg terminal”), these retail investors have worked together to drive prices so high that hedge funds have had you abandon your short positions.

As a result, short sellers have lost a lot of money and retail investors (and anyone else with GameStop stock) have made huge profits. Normally on the stock market, the shark swallows the minnow. Now the minnows eat the shark.

These individual investors began buying stocks (and options to buy stocks in the future) in GameStop and other companies that had significant short positions. In fact, the 50 shortest companies on the Russell 3000 Index are up 33% this year.

This increase has turned into a rally in recent days. GameStop jumped in value 92% on January 26 (US time), jumped another 134% on January 27 and has traded over 178 million shares. The average volume normally traded by GameStop is approximately 10 million shares per day. This is not normal.

How long can redditors stay irrational?

How is it possible that small retail investors can increase the value of a company in this way?

Two important factors have led to the situation. The first is structural. Investors took advantage of the fact that Melvin and another fund called Citron Capital had significant short positions in GameStop.

When the price of a stock increases, short sellers must invest more money to hold or liquidate their position. Melvin tried to keep his short position, because hedge fund managers believe the stocks are overvalued and, as a result, he has suffered massive losses (last week, Melvin announced that it was already down 30% for the year). This is a case of the well-known idea that “the market can remain irrational longer than you can remain solvent.”

Ultimately, Melvin may be right, and GameStop’s price will eventually drop, but retail investors who were aware of Melvin’s gamble pushed him into an untenable position. With the price steadily rising, Melvin was left with a tough choice: go short or realize his losses.

How to buy create more purchases

This leads to the second factor, which is mechanical. The retail investors driving the price surge are much smaller than the hedge funds they are struggling with. By buying shares and call options (which are effectively rights to buy shares in the future at a given price), retail investors are causing market makers to buy GameStop shares as well.

Market makers are companies that make it easy to trade stocks by owning stocks and putting them up for sale. Market makers don’t care whether stock prices go up or down; they just want a cut when people buy or sell.

So when an investor buys a call option from a market maker, the market maker will immediately hedge the position by buying the shares. In this way, they are covered whether the price rises or falls.

If there is a large enough increase in speculators buying call options, as we have seen with GameStop, it will be accompanied by a large number of stock purchases.

This is a cascading effect, leading to price runs. In this case, the price is going up, but we are likely to see the same effect by lowering the price as well. (This is what happened on a larger scale on October 19, 1987, triggering the Black Monday stock market crash.)

After the surge

These two factors, short sellers under pressure and market makers hedging their bets, have led to this situation. You need both for what we’re witnessing: an investor with an exposed position (Melvin) and a flurry of investors targeting that position (Redditors and others).

RELATED: Explainer: Why regulators may scrutinize GameStop’s Reddit-fueled retail stock surge

Soon all this will end. Late on January 27 (US time), Melvin Capital announced that it had abandoned its short position. It’s unclear how much money Melvin lost, but he has invested nearly $ 3 billion of the Citadel and Point72 funds to cover his losses.

The next morning, the price of GameStop actually kept going up, coming in at nearly $ 500 for a brief moment. However, at the time, several popular retail brokers, including Robinhood, Interactive Brokers, and E * Trade, stepped in to limit the trading of several highly active stocks, including GameStop. The price quickly plunged before recovering and ending the day at $ US193.60.

Whats Next? With short sellers removed from the game, the reality of the company’s business prospects may reassert itself.

The past two weeks have been exciting times for market watchers. But we cannot ignore the apparent ease with which these stocks have been manipulated and the possibility of further market manipulation in the future.

James Doran, Associate Professor / Assistant Principal of the school, UNSW. This article is republished from The Conversation under a Creative Commons license. Read the original article.

[ad_2]