[ad_1]

An Airbus SE A321 aircraft operated by Cathay Dragon, a unit of Cathay Pacific Airways Ltd. (top) passes an Airbus A330 aircraft operated by Cathay at Hong Kong International Airport in Hong Kong Special Administrative Region, China, 5 August 2018. / Reuters

An Airbus SE A321 aircraft operated by Cathay Dragon, a unit of Cathay Pacific Airways Ltd. (top) passes an Airbus A330 aircraft operated by Cathay at Hong Kong International Airport in Hong Kong Special Administrative Region, China, 5 August 2018. / Reuters

Cathay Pacific Airways Limited will close its wholly-owned subsidiary Cathay Dragon and eliminate approximately 8,500 positions in the Cathay Pacific Group, the airline said in a listing on Wednesday.

Hong Kong’s flagship carrier said it intends to seek regulatory approval to transfer most of the Cathay Dragon routes to the company and its other wholly owned subsidiary, Hong Kong Express Airways Limited.

The 8,500 positions estimated to be phased out represent around 24 percent of the Group of 35,000’s established workforce. Among them, 5,300 Hong Kong-based employees and 600 overseas employees “will be laid off in the coming weeks,” the document said.

Due to the impact of COVID-19, Cathay lost $ 1.27 billion in the first half of this year, and its capacity was down 65.7 percent compared to the same period in 2019, according to the latest Cathay interim report.

The restructuring will cost approximately HK $ 2.2 billion ($ 284 million), and a deferred tax asset of HK $ 1.3 billion will be affected, the company said.

“The global pandemic continues to have a devastating impact on aviation, and the hard truth is that we must fundamentally restructure the Group in order to survive,” Chief Executive Augustus Tang said in a statement.

“We have to do this to protect as many jobs as possible and fulfill our responsibilities to the Hong Kong aviation hub and to our customers.”

Read more: The impact of COVID-19 on aviation goes ‘beyond’ the worst case

Cathay is based in the Hong Kong Special Administrative Region of China (HKSAR), with frequent flights in and out of mainland China and also a large number of routes to Europe and the United States that pass through that airspace.

The airline’s largest shareholder is Swire Pacific Ltd., with a 45 percent stake, followed by China’s flagship airline Air China Ltd., which owns 30 percent, according to the airline.

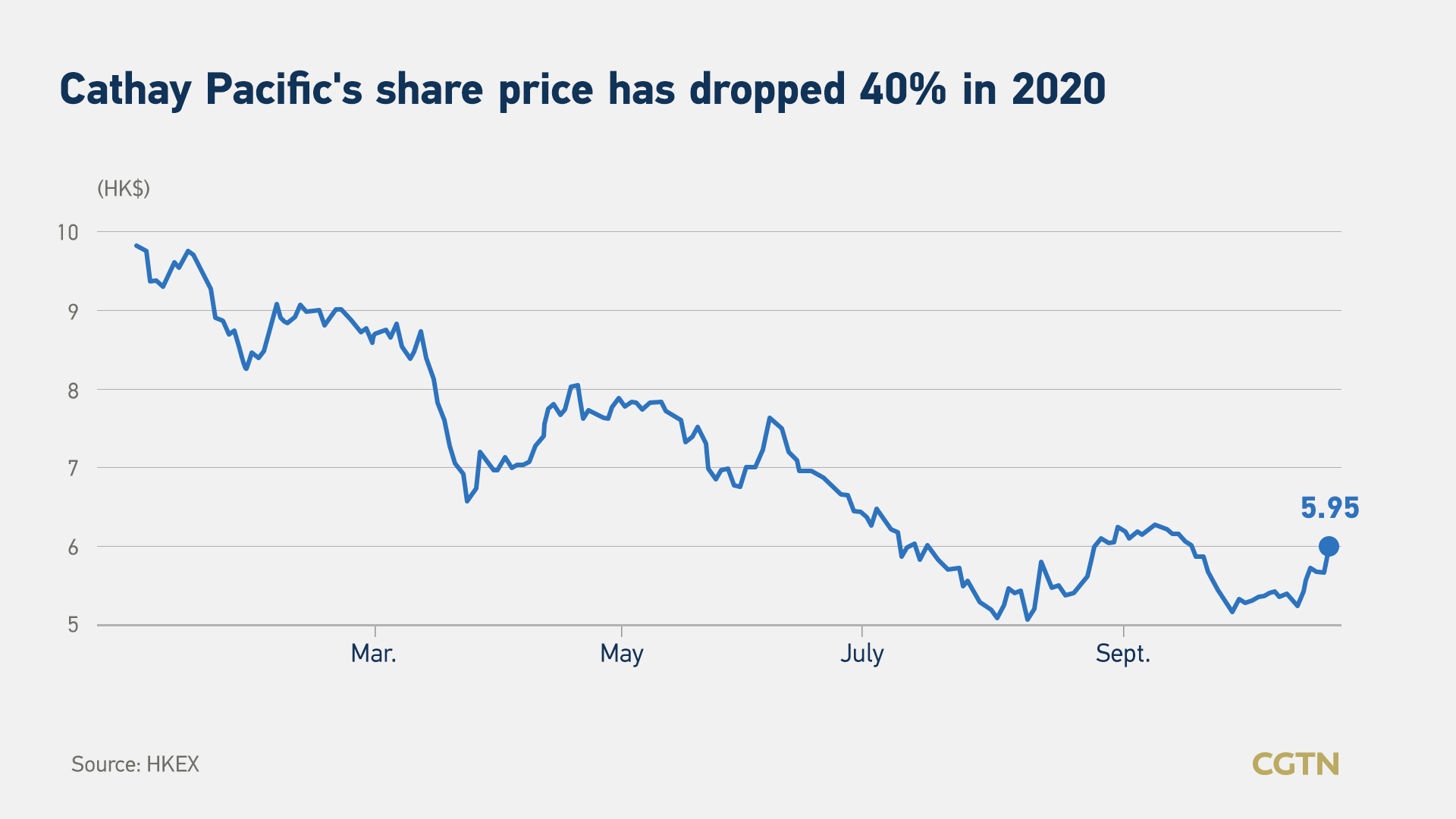

As of noon on Wednesday, Cathay’s share prices rose 4.02 percent to Hong Kong $ 5.95. The airline’s shares have fallen 40 percent since the beginning of the year due to poor performance.

CGTN Yin Yating Chart

CGTN Yin Yating Chart

Airline revenues plummeted 80 percent in the first six months of the year, according to industry body IATA, but they still had fixed costs to cover: crew, maintenance, fuel, airport taxes and now aircraft storage.

Repeated efforts to assure passengers that air travel is safe haven’t made much of a difference, and government restrictions, including quarantines of up to 14 days for returning passengers, have only added pressure. Dozens of major airlines have cut jobs in response.

Cathay has grounded most of its aircraft due to falling demand amid new coronavirus-related travel restrictions, flying cargo only and a skeletal passenger network to major destinations including Beijing, Los Angeles, Singapore, Sydney, Tokyo and Vancouver.

Even before the pandemic, Cathay Pacific was in a tough spot. The months of protests in Hong Kong last year caused a drop in customers, especially from the mainland market.

The airline was also embroiled in controversies regarding the protests, with former CEO Rupert Hogg and some of the staff openly supporting the unrest.

Read more:

China Civil Aviation Administration Issues Safety Advisory to Cathay Pacific

By the time the pandemic hit in early 2020, Hong Kong was already in recession and Cathay Pacific in the red.

Cathay obtained a bailout package of almost 40 billion Hong Kong dollars in August, and the HKSAR government contributed 27.3 billion Hong Kong dollars to prevent its collapse.

Tang said the airline was consuming up to HK $ 2 billion in cash each month during the pandemic.

“This is simply unsustainable. The changes announced today will reduce our cash spending by about HK $ 500 million per month,” he said.

There is little hope on the horizon. In a note to investors Monday detailing its most optimistic scenario, Cathay Pacific said it expected to run at half capacity in 2019 next year.

The airline is set to give more details at a press conference on Wednesday at 1 pm local time.

(With contribution from AFP)

1969 km