[ad_1]

The surplus of the country’s dollar transactions compared to the rest of the world in the first 10 months of 2020 exceeded the already revised projection for the year despite the economic disruptions caused by the pandemic.

Bangko Sentral ng Pilipinas (BSP) Governor Benjamin Diokno told reporters on Thursday that the country’s balance of payments (BoP) for the period from January to October showed a surplus of $ 10.3 billion.

The balance of payments is generally considered an important economic indicator in an economy as it shows the level of profit or expenditure of the Philippines with its transactions with the world. A surplus means that the country made more profit in dollars than its expenditures during the period.

The 10-month balance of payments exceeded the $ 8.1 billion target at the end of 2020. That was readjusted and announced last month. It also exceeded the total balance of payments surplus for all of 2019.

Last year’s balance of payments surplus for the first 10 months of the year was $ 5.7 billion.

The BSP attributed the current balance of payments surplus to increased external loans made by the national government to support the economy during the pandemic.

Apart from loans, the BSP said that lower merchandise trade deficits and inflows of foreign direct investment (FDI), remittances and trade in services also contributed to the surplus.

The latest data shows that, on average, in the first eight months of the year, the total level of FDI remains 5.6 percent lower, at $ 4.4 billion, compared to $ 4.7 billion in the year. past.

Meanwhile, the latest data on cash remittances shows that Filipino migrant workers sent remittances worth $ 21.89 billion in the first nine months of the year. This is 1.4 percent lower than the total money they sent from January to September of last year.

In October alone, the country’s balance of payments surplus reached $ 3.4 billion, compared to a surplus of $ 2.1 billion the previous month.

Good or bad?

Last week, the BSP governor said that the country’s external accounts, which are largely covered by a country’s balance of payments data, are a strong positive indicator that the Philippines is on the way to recovery.

“While we monitor the impact of the pandemic on external accounts, it can be seen that the effects were mainly felt during the second quarter of 2020, particularly during the months of April and May, as the government imposed stricter blocking measures on part of their efforts to combat the spread of the virus, ”Diokno said previously.

“As we enter the third quarter of the year, preliminary data from July to September suggest that the worst is over,” he added, citing the strong balance of payments surplus in the first nine months of the year.

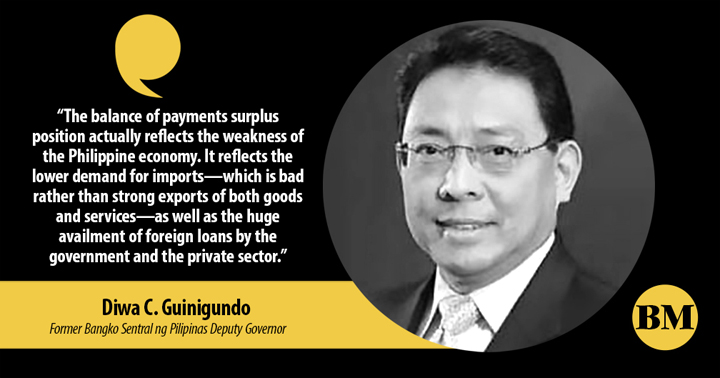

However, former BSP deputy governor Diwa Guinigundo, in a recent forum, warned of premature remarks such as “the worst is over” as it poses dangers to the economy.

“The surplus position of the balance of payments actually reflects the weakness of the Philippine economy. It reflects the lower demand for imports, which is bad instead of strong exports of goods and services, as well as the great availability of external loans from the government and the private sector, ”he said.

Unionbank chief economist Rubén Carlo Asunción said the important indicator is whether the gains from the balance of payments reach the real economy.

“In terms of accounting for the base of the pyramid, what I am looking for is the translation of these numbers into significant and relevant economic activity. Does the level, even if it is in deficit and growing, generate jobs and increase the individual income of the population? ”He said in response to BusinessMirror’s query.

“For me, it doesn’t really matter if it’s a surplus or a deficit, as long as it works through the real economy and makes people feel better about themselves in general,” he added.