[ad_1]

Bank loans on the brink of unusual decline as growth hits 14-year low

MANILA, Philippines – John Lesler Antonio, a 24-year-old business owner from Pampanga, will present a loan next year to build a house on his newly acquired land. Your agent told you that you should have no trouble getting bank credit because of your advertising business.

“They told me that advertising is not among the sectors that their bank would not make loans to,” Antonio said in Filipino on an online exchange.

Such is the reality on the ground that it hampers the central bank’s efforts to encourage banks to lend to consumers and help revive a struggling economy. To be fair, the lenders hadn’t failed in their duty, calling customers and offering them loans. However, the problem starts once the application is submitted and processed.

“Many of them are denied for various reasons, such as the type of job or their bank records. It’s really difficult to get a loan these days, ”said an agent for a foreign bank based here who requested anonymity because he was not authorized to speak to the media.

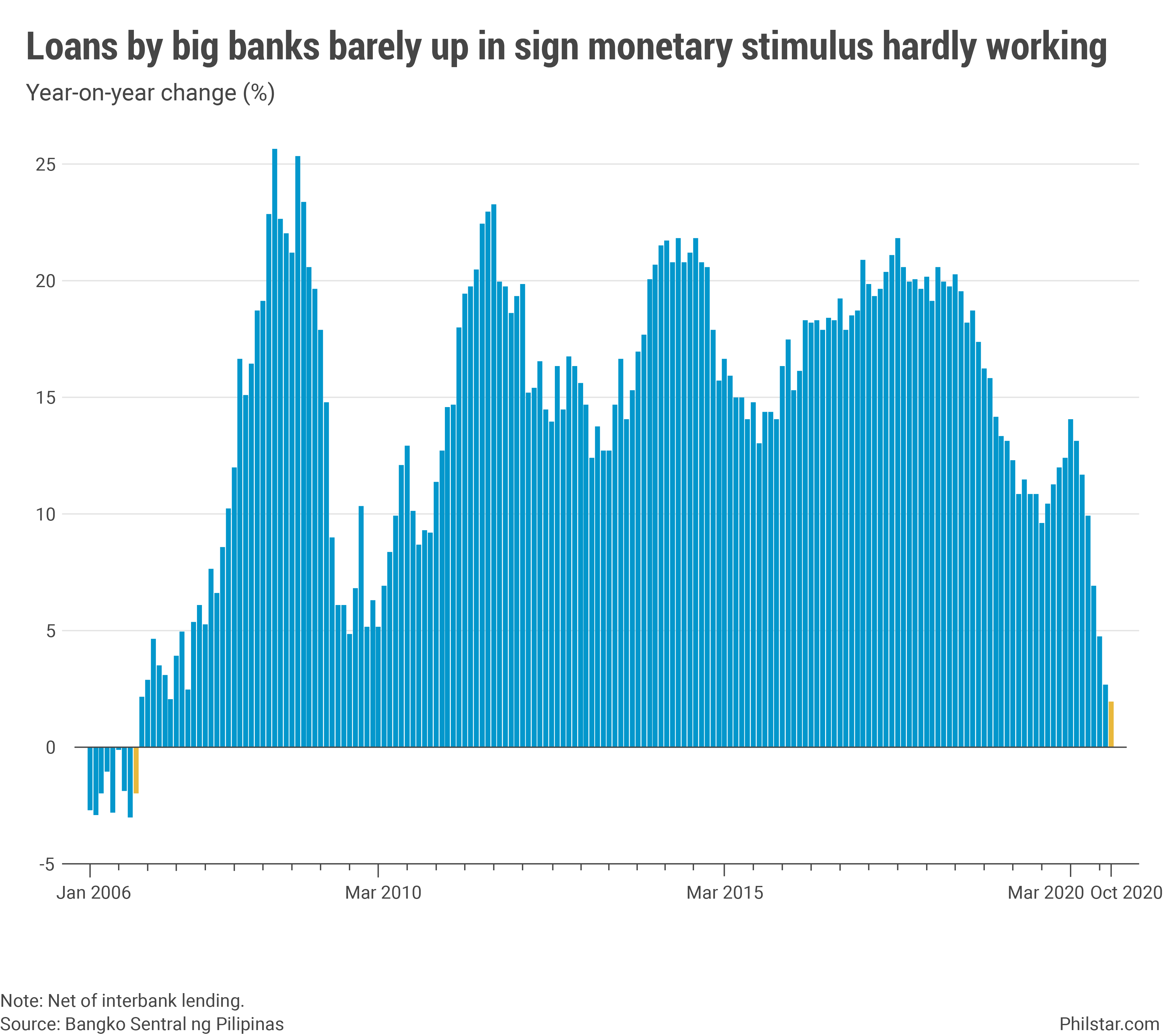

This hesitancy by banks, coupled with what Antonio said was “fear of borrowing” among consumers, is derailing the recovery from the pandemic. Loans from large banks, net of loans between them, rose a paltry 1.9% year-on-year to P8.96 trillion in October, the lowest level in 14 years. The behavior was worse month after month when credit fell 0.4%.

It’s a weakening trend that started in April when lockdowns hampered business activities and the government encouraged consumers to stay home to control the coronavirus. That was a justified recipe at the time, but when the government was set to reopen the economy again in June due to record job losses, businesses didn’t instantly follow through and now, the recovery is taking longer than anticipated.

“We have always doubted the effectiveness since 2Q2020 at a time when SMEs (small and medium enterprises) and consumers are not sure what their cash flows will be like in the coming quarters”, Emilio Neri Jr., leading economist at the Bank of the Philippine Islands said in an email.

For the Bangko Sentral ng Pilipinas (BSP), all this was expected, but something that also did not prevent the monetary authorities from pushing money into the economy in the amount of 1.9 trillion pls. Most of the funds, however, had not reached consumers and were only returning to the BSP through time deposits and securities auctions constantly inundated with offers.

“The overall slowdown in bank loan growth reflects the combined effects of subdued business sentiment and stricter lending standards from banks primarily attributed to continued disruptions in business operations,” BSP said in a statement on Thursday. night.

It also didn’t help that banks found themselves burdened with bad loans after extended grace periods during lockdowns began to decrease. As of September, the past due portfolio represented 3.4% of the loan portfolio, the highest since May 2013.

BSP Governor Benjamin Diokno, who has vowed to do whatever it takes to boost the economy preparing for its worst decline in the post-war era, expects loan growth to pick up just next year.

This suggests that loans could contract soon, following their current slowdown trend. “Bank loans must be in tune with the pace of economic activity. I hope that 2021 will be a year of recovery and that the economy will be back to where it was in 2019 by mid-2022, ”Diokno said in a Viber message.

Data from the BSP showed that among loan types, credit to productive activity grew 2% year-on-year in October, compared to 2.3% the previous month. Loans to households, which typically grew in double digits, slowed further to 8% annual growth from 9.8% in the same period.

After cutting interest rates by 200 basis points this year, Sanjay Mathur, an economist at ANZ, said the central bank had already maximized its options and the government should now do the heavy lifting. “In this scenario, the central bank cannot and should not be forceful. The recovery process will run its own course. However, two steps from the fiscal side can be helpful, ”he said in an email.

But Diokno’s former colleagues in Duterte’s cabinet continue to reject proposals for a greater fiscal boost, even from the BSP chief himself. The central bank, for its part, appears not to be done yet.

“The BSP will remain vigilant in monitoring the dynamics of national liquidity and credit and assures the public that it is willing to implement the necessary measures to ensure that liquidity and credit remain adequate amid the current health crisis from COVID-19, “said BSP.

[ad_2]