[ad_1]

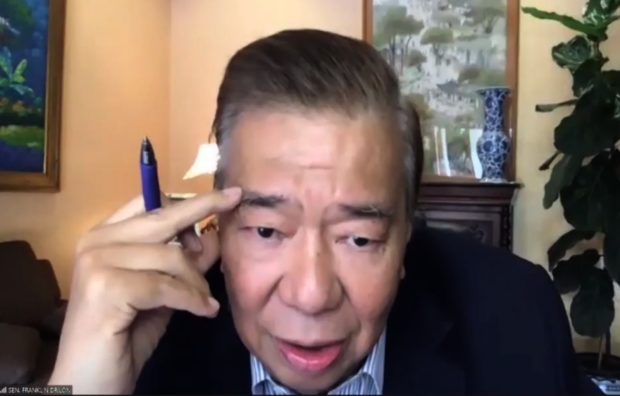

THREAT FROM THE GRAY LIST: Senate Minority Leader Franklin Drilon Points to Regular Threats Issued by the Financial Action Task Force to the Philippines on the Issue of Compliance with Anti-Money Laundering Regulations During the Committee’s Virtual Hearing of Banks, Financial Institutions and Currencies, Wednesday October 28, 2020. Screenshot / PRIB of the Senate

MANILA, Philippines – Two senators on Wednesday called on the government to provide Financial Action Task Force (FATF) guidance regarding necessary amendments to the Anti-Money Laundering Act.

During the Senate Committee Hearing on Banks, Financial Institutions and Foreign Exchange, Senator Grace Poe requested clarification on the Philippines’ rate of compliance with the actions recommended by the FATF regarding anti-money laundering and terrorist financing measures. from the country.

Poe asked this as new amendments to the Philippines’ Anti-Money Laundering Act are being sought amid threats that the country will be included on the FATF “gray list”, which could have repercussions on the national economy.

On the FATF website, a country or jurisdiction included in its “gray list” means “that it has committed to promptly resolve identified strategic deficiencies within agreed time frames and is subject to further follow-up.”

None of the resource speakers present, particularly the AMLC, were unable to respond.

Senate Minority Leader Franklin Drilon backed Poe’s question, saying the government would generally receive notices from the FATF on the matter.

Drilon was the president of the Senate when the original version of the country’s Anti-Money Laundering Act was passed 20 years ago.

“We regularly received notices from the FATF saying that unless you do these things, you will be on the gray list and the threat of being on the gray list carries the threats of hindering our OFW’s remittances, in other words the vulnerability of our The system for maintaining a good remittance system is constantly being questioned, ”Drilon explained.

It was here that Drilon began to question whether the government has any documents to rely on regarding the country’s position before the FATF.

“As I repeat, they have threatened us constantly, I think it is the right thing to do. [term] For lack of any, they have threatened us with sanctions. And we have consistently followed these tips, ”Drilon said.

“My question is, ano pa ba ang dapat nating gawin, bakit regularly merong binibigay sa atin na mga pangangailangan na gawin so that we can be removed from the gray list. In other words, do we see the light at the end of the tunnel when we are completely free from these regular threats? What will it take? Will this be the last time it will happen? “he added.

Poe echoed Drilon’s line of questions, saying that the country’s Anti-Money Laundering Act was just amended in 2017 or just three years ago.

Are they holdovers from previous evaluations? Are there any new shortcomings? Because before we make another amendment, we should have these guidelines in place so we don’t have to keep updating the law, ”Poe said.

“We just had one in 2017, now we have one again. So AMLC surprised me that they did not respond immediately before regarding our question, as Sen Drilon pointed out, we usually get notices, “he added.

Effect on the economy, OFW

At the same hearing, the executive director of the AMLC Secretariat, Mel Georgie Racela, explained that the inclusion of a country on the FATF gray list due to poor anti-money laundering measures could lead to a higher cost of remittances. for Filipino Overseas Workers (OFW).

Racela said the Philippines has to show “tangible progress” to avoid being included on the gray list.

This includes the implementation of new laws and regulations in relation to the fight against money laundering and the financing of terrorism.

“If we fail to demonstrate tangible positive progress, the Philippines will be placed on the gray list. This will have a negative impact on our country and on the lives of Filipinos working abroad, in particular Filipino workers abroad and their families, ”Racela said.

“For OFWs, a higher cost of remittances means less money for food, housing, education and other basic needs of their families,” he added.

Racela also said that the higher costs of remittances can also lead to a decrease in incoming remittances and the country’s gross domestic product.

Being placed on the gray list, Racela said, also has other implications such as the following:

- Countries will impose increased due diligence on Filipino citizens and businesses, which means additional costs and transaction delays;

- For Philippine companies, this means higher interest rates and higher production costs;

Investor and lender confidence may be reduced; - The term to achieve the “A” credit rating may be extended;

- The Philippines will be included in the European Commission’s “EU List of High Risk Third Jurisdictions”.

“In such a case, all EU members have a mandate to impose greater due diligence on Philippine citizens and businesses, as well as prohibit people who implement financial instruments or budget guarantees from starting new or renewed operations with people from the countries. listed, ”Racela said.

President Rodrigo Duterte previously certified as urgent bills that seek to strengthen the country’s anti-money laundering law.

EDV

Read next

Subscribe to INQUIRER PLUS to get access to The Philippine Daily Inquirer and more than 70 other titles, share up to 5 gadgets, listen to the news, download from 4am and share articles on social media. Call 896 6000.

[ad_2]