[ad_1]

Virus-induced external indebtedness rises to $ 8.96 billion

Ian Nicolas Cigaral (Philstar.com) – September 16, 2020 – 6:07 pm

MANILA, Philippines – Foreign creditors kept lending to the Philippines’ coronavirus response even as the economy has almost fully reopened within 6 months of fighting the pandemic, data from the finance department showed.

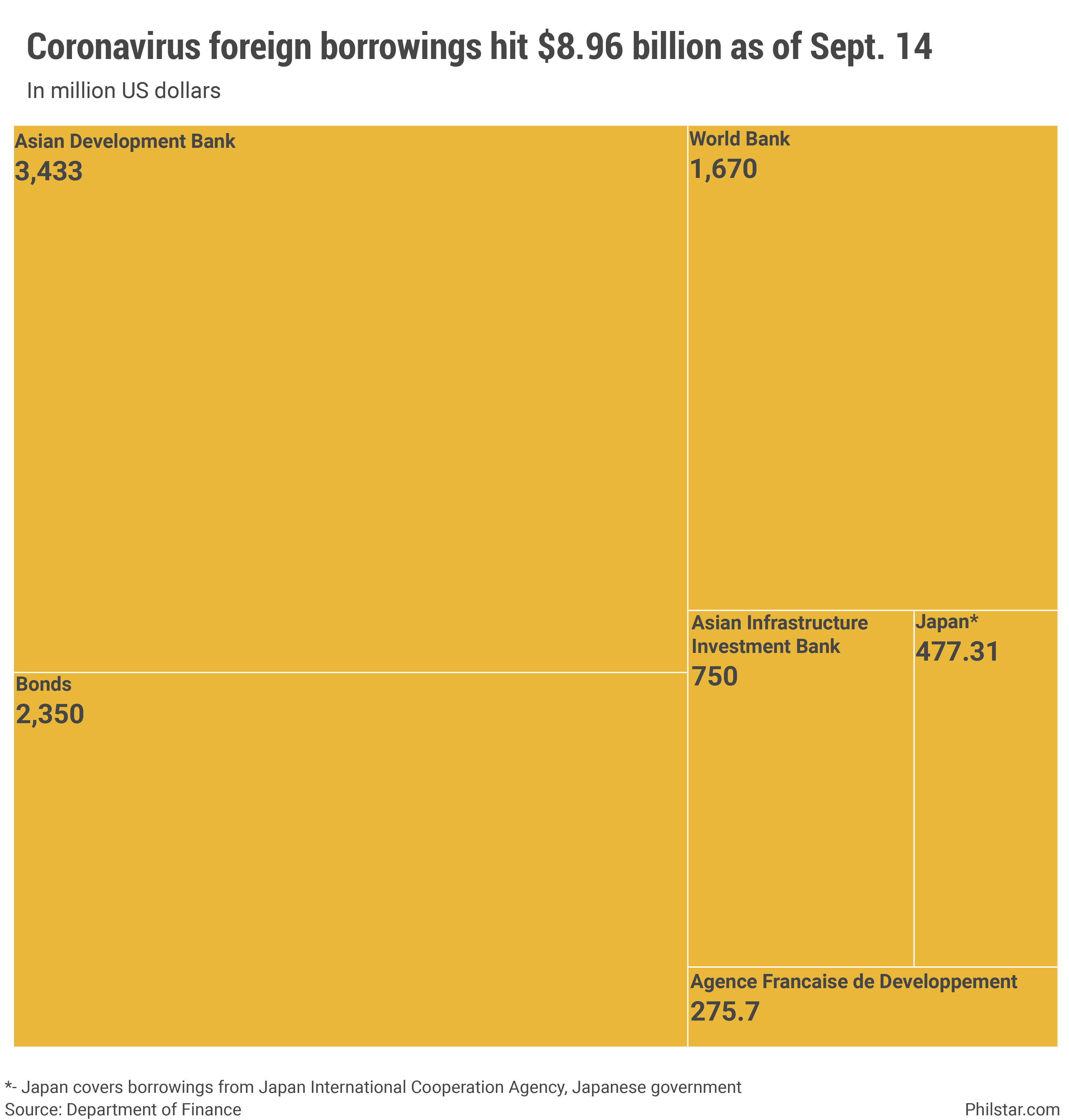

With tax revenues still weakened this year despite business resumption, the Duterte administration secured $ 8.96 billion in foreign loans, grants and securities from March to September 14.

The latest tally was up 10.2% from the $ 8.13 billion raised as of Aug. 5 when the data was reported. The government has relied heavily on taking on larger debts to close the gap between income and spending that is expected to widen to record levels by the end of the year.

The list represents loans already arranged by the Philippines and the lenders, which may or may not have been credited to the state coffers at the time of publication. The figures also only cover external debt and do not include liabilities in pesos, which represent the majority of debt.

From last month, data showed that the common fund increased as a result of two loan agreements with the Asian Development Bank (ADB) for a cumulative value of $ 700 million. The loans were payable over 15 years, including a 3-year grace period, and were charged with corresponding interest.

In total, the Manila-based lender has disbursed $ 343 billion so far, making ADB the largest lender in the country for the pandemic rescue program. Of the total amount, only $ 8 million was in the form of donations and no repayment is required.

After the ADB loans, the proceeds of the government’s twin foreign bond sales were obtained. In April, the government raised $ 2.35 billion by offering foreign investors 10- and 25-year debt securities that they can hold to maturity while being paid 2.457% and 2.95% interest, respectively.

The Washington-based World Bank also accounted for a large chunk of funding for coronavirus programs at $ 1.67 billion in the current count, the data showed.

The China-led Asian Infrastructure Investment Bank, another multilateral agency, also lent $ 750 million. The Japanese government, on its own and through the Japan International Cooperation Agency, also provided a total of $ 477.31 million to the response to the pandemic, part of which was for the purchase of medical equipment by the Health Department.

The Agence Française de Développement, the French aid agency, also granted loans of $ 275.7 million.

To replace the lost income of consumers and businesses affected by the virus, the government said it is expected to take out more loans and finance the needs of the economy. Loans have started to flow into the state’s balance sheet in the form of debt, hitting a record P9.16 trillion in July.

According to official assumptions, the upward trend in debt is likely to persist and outstanding obligations will reach P10.16 trillion by the end of the year and P11.98 trillion next year.

[ad_2]