[ad_1]

MANILA, Philippines – 2020 was a turbulent year, but public health aside, the economy likely suffered the brunt of the damage from the unprecedented coronavirus crisis.

Since economic growth slowed, trade stalled, the stock market fell, and even our most trusted migrant workers returned home in droves, economic officials correctly characterized this year as unexpected, unforgettable. Next year, the Duterte administration projects a strong rebound, but with big drops across all data points, a recovery in 2021 would inevitably be shallow and distorted by this year’s record devastation.

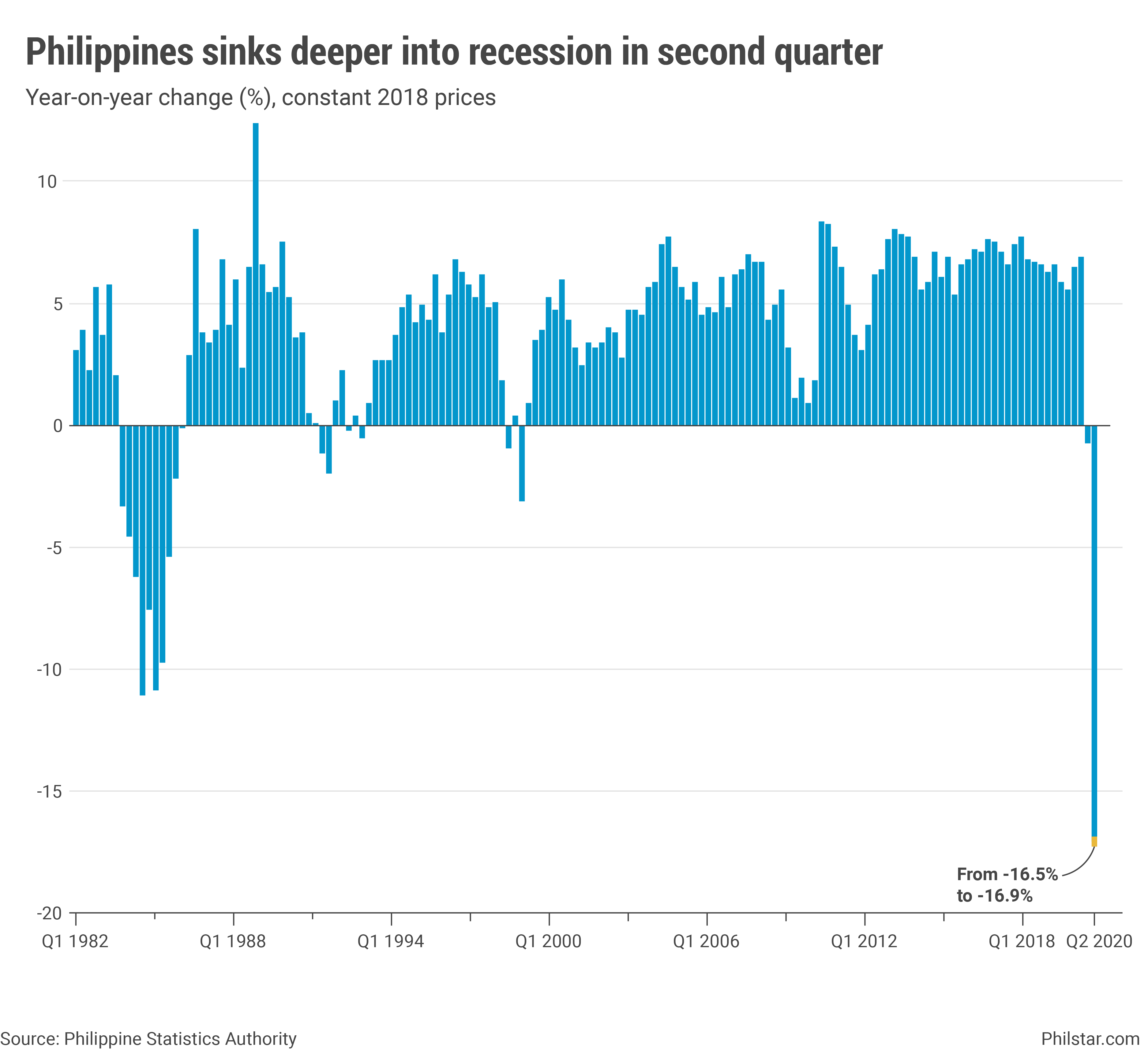

Sinks of gross domestic product

Probably the most closely watched indicator of economic health, gross domestic product (GDP) plunged 16.9% year-on-year in the second quarter, the worst drop on record, even surpassing the twilight years of Marcos’ corrupt administration. It was the clearest evidence of the lasting scars that the coronavirus will leave. Before the pandemic last March, the government entered 2020 with the hope of achieving 7% growth. Now, he hopes to cap the year by seeing up to 9% of the value of GDP reduced from last year.

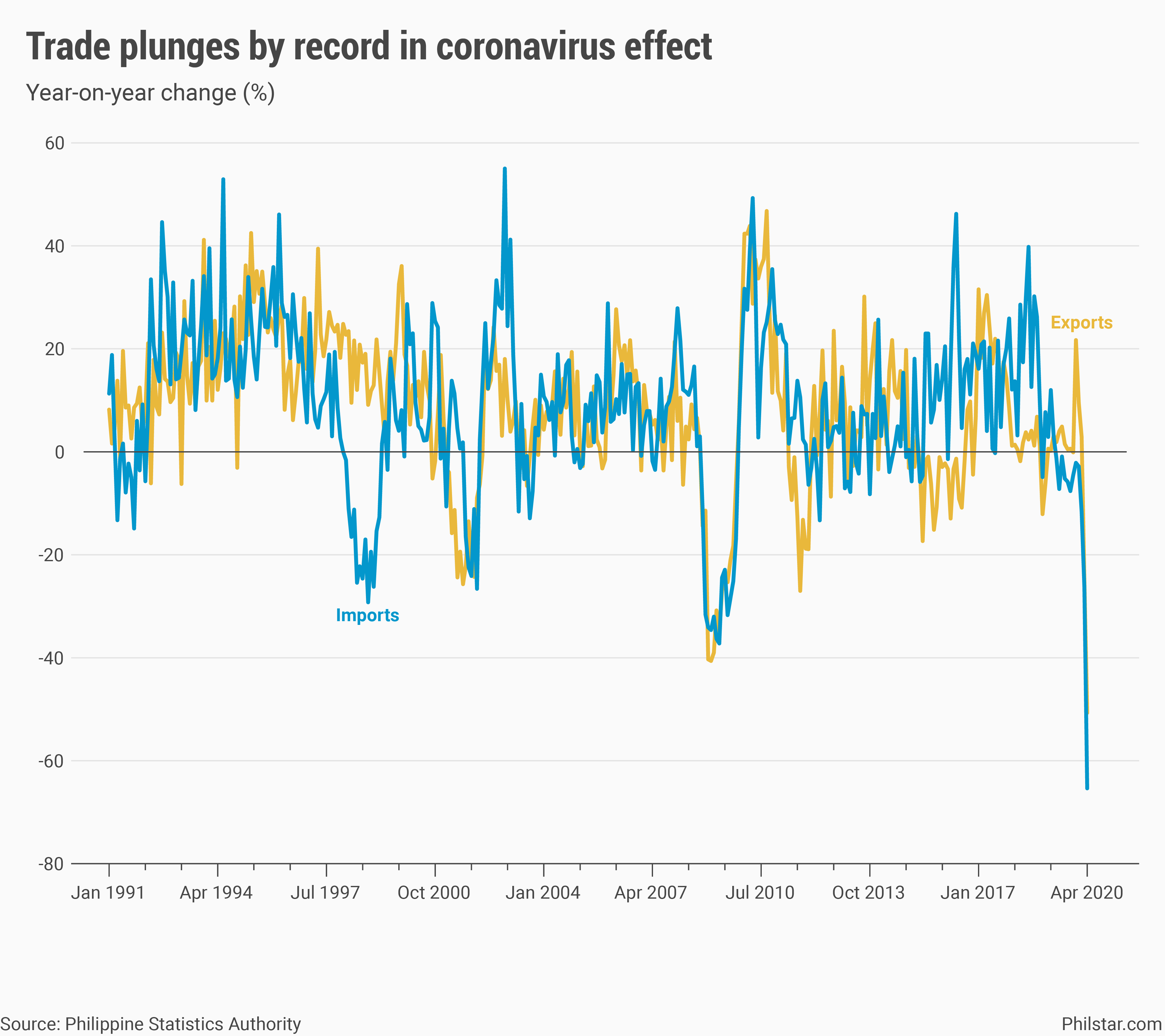

Trade implodes

However, a drop in GDP is just a sum of the dominoes that fall elsewhere. Trade, for example, suffered greatly this year. Exports and imports fell to historic levels in April when closures paralyzed port operations. Since then, some activity has recovered with restrictions easing from June, but the recovery remains fragile as exports returned to negative territory in October. Meanwhile, imports have been imploding since May 2019, a crucial barometer of weak domestic demand.

Weight gets stronger

It’s not all bad news in 2020, at least in the eyes of the central bank. The Philippine peso is one of the strongest currencies in the region this year, gaining 5% against the dollar as of Monday. The local unit is currently trading more than a 4-year high against the dollar, even flirting at the P47 level on a few days. But while the Bangko Sentral ng Pilipinas tries to paint the strength of the peso as good news, it is also evidence that mediocre imports reduce the demand for dollars and therefore its strength. Lower imports mean that traders do not see the need to ship more goods because consumer demand is weak. Bad news for economic managers, indeed.

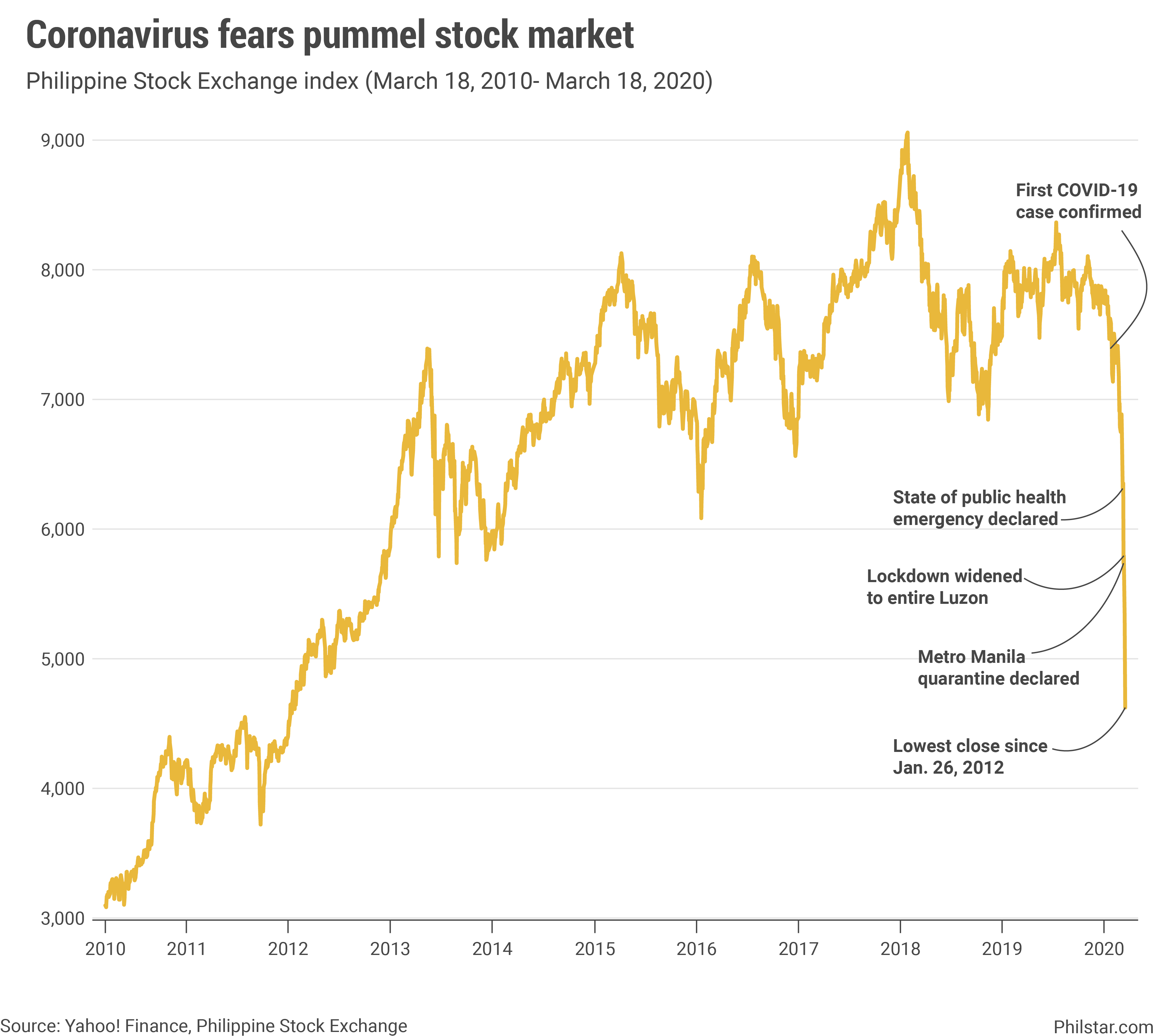

PSEi falls, then recovers

In the stock market, investors were also in a bad mood for most of the year. On March 18, following the Luzon-wide lockdown, the benchmark index of the Philippine Stock Exchange (PSEi) plunged 13.34% to close at 4,623.42, its lowest level since January 26, 2012. Basically, the coronavirus fears ended with P1.14 trillion from the PSEi. at the time.

Since then, the PSEi had regained some ground with the restart of companies and according to the news, vaccines against the coronavirus are accelerating. The leading index closed at 7,202.39 on Tuesday, though it is still trading below last year’s close of 7,815.26 – and losing some of its optimism – with a few trading days remaining in 2020.

Again, not all milestones are bad news. This year, three companies, AREIT Inc., MerryMart Consumer Corp. and Converge ICT Solutions, braved the tumultuous year by going public. AREIT was the first publicly traded real estate investment trust, with an 11-year history in the making. Converge, meanwhile, had a record IPO, raising P29 billion in October.

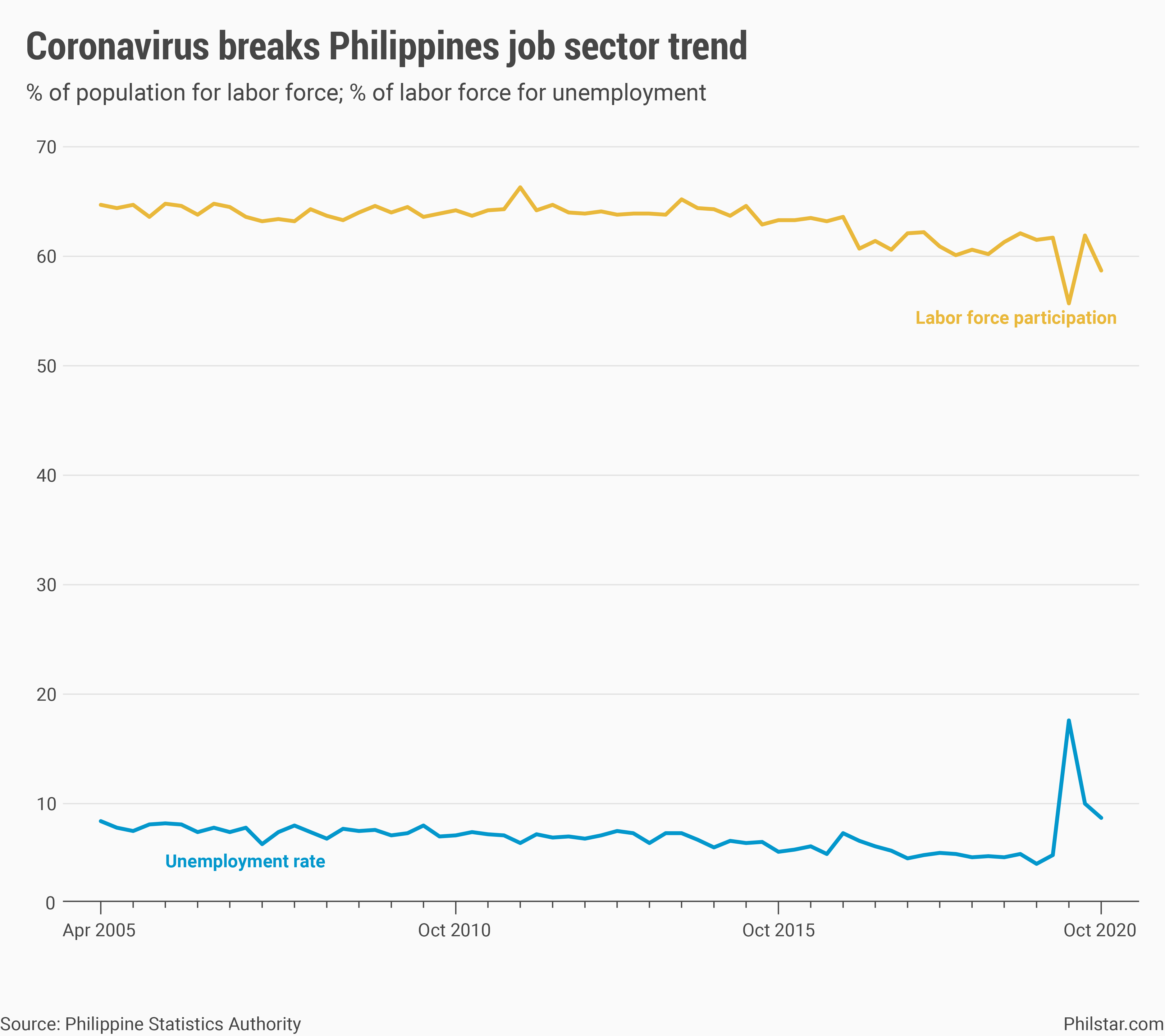

Unemployment slowly decreases

With the economy weakening, people lost their jobs and some gave up on finding one entirely. The unemployment rate hit a record high of 17.6% in April, before falling to 10% in July and more recently to 8.7% in October. For all of 2020, it was estimated that 10.4% of the workforce aged 15 and over were unemployed due to business closures. Unemployment was so severe that people were discouraged from looking for work. The labor force participation rate did not rebound in October despite the restrictions being relaxed.

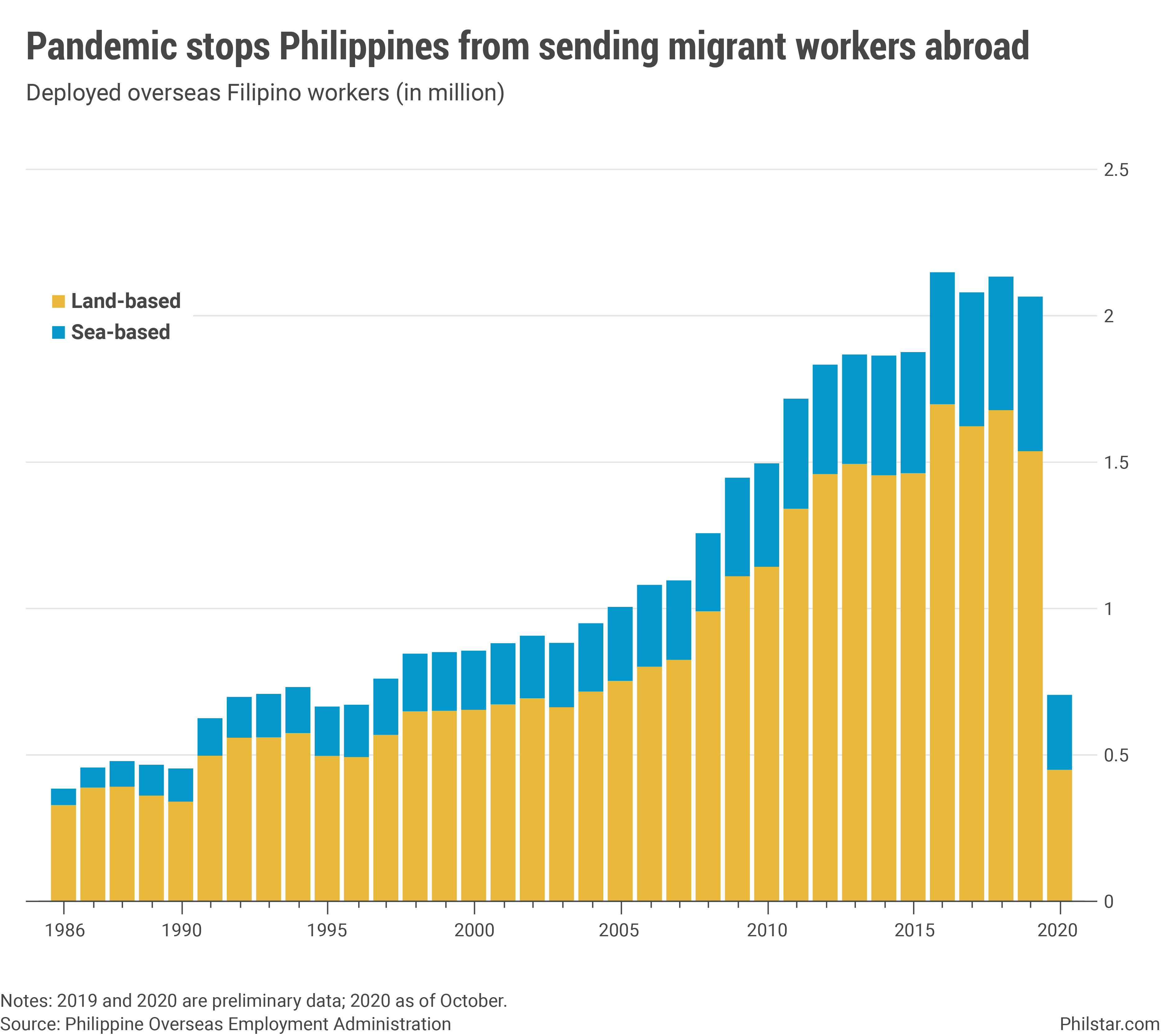

OFW deployment, remittances remain unharmed

Even Filipino migrant workers lost jobs. More than 380,000 overseas Filipino workers have returned home as cities around the world closed their borders. The OFW rollout was also running at a 24-year low in October, indicating that a slowdown in remittances is likely to persist in the future. Cash remittances fell 19.3% year-on-year in May, the deepest drop in more than 19 years. But tickets had since recovered, proving their resilience amid the crisis.

BSP projects a 2% year-on-year decline this year, but as of October, cash remittances were only down 0.9% from a year earlier.

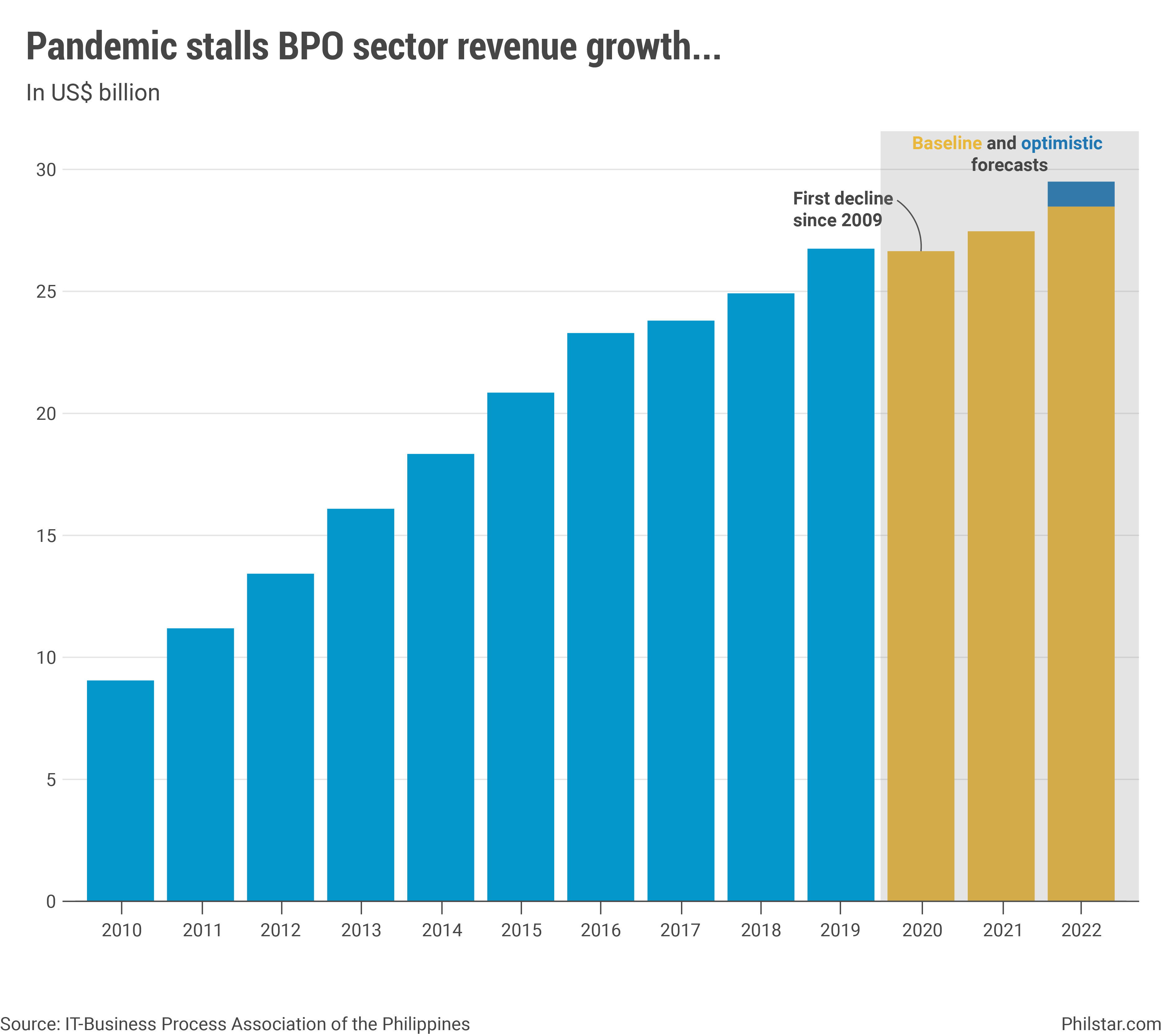

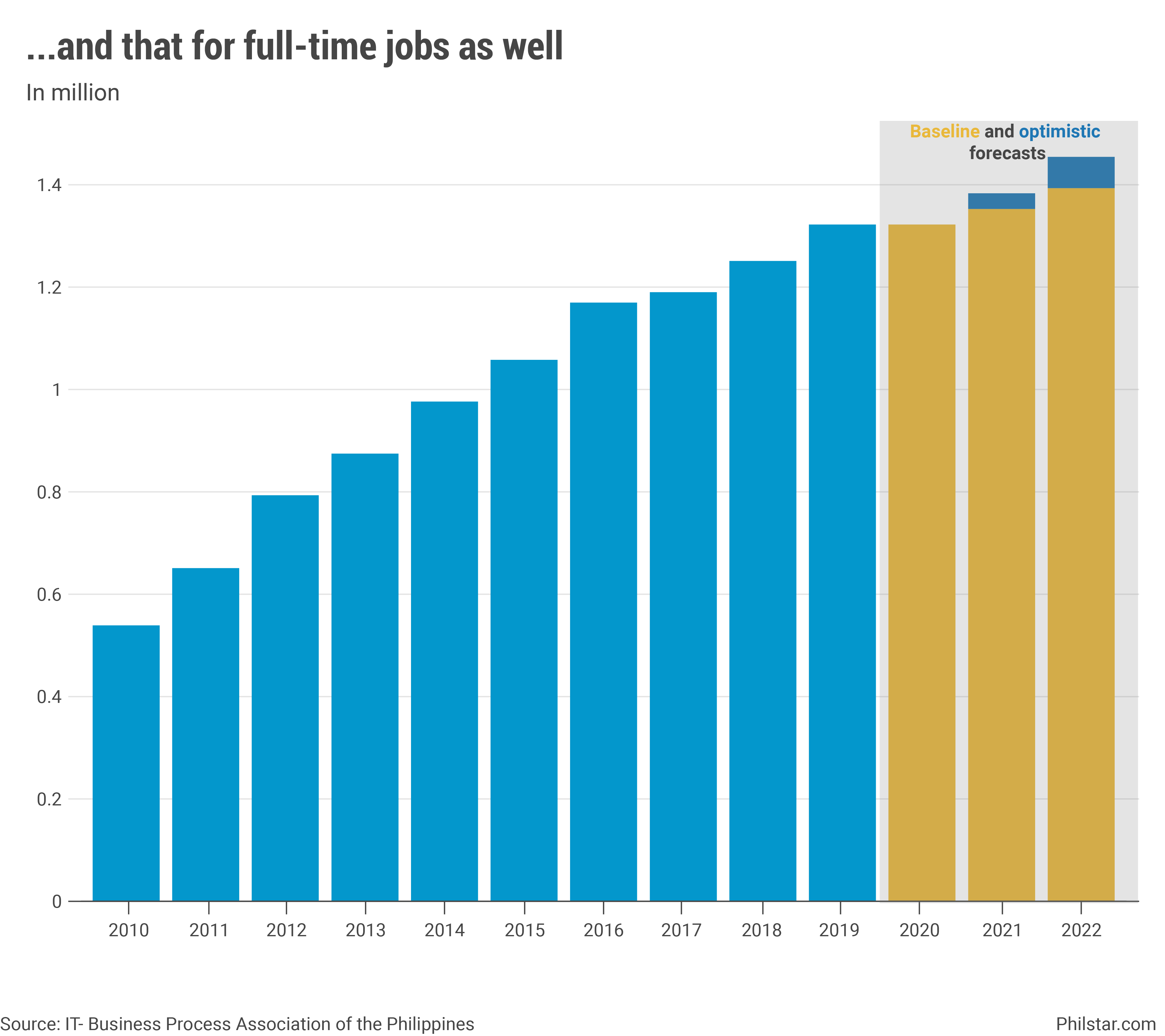

BPOs suffer

However, the Philippines’ other main source of income, export earnings from business process outsourcing operations, was not so lucky. The umbrella industry group expects revenue to decline 0.5%, the first drop in 11 years, while job creation in the sector is about to stagnate. BPOs have had trouble operating even when exempt from closures. Companies had to pay for their workers’ accommodation and transportation services during quarantines.

Including those outside the group, BPO revenue is projected to fall 1% this year, according to the central bank.

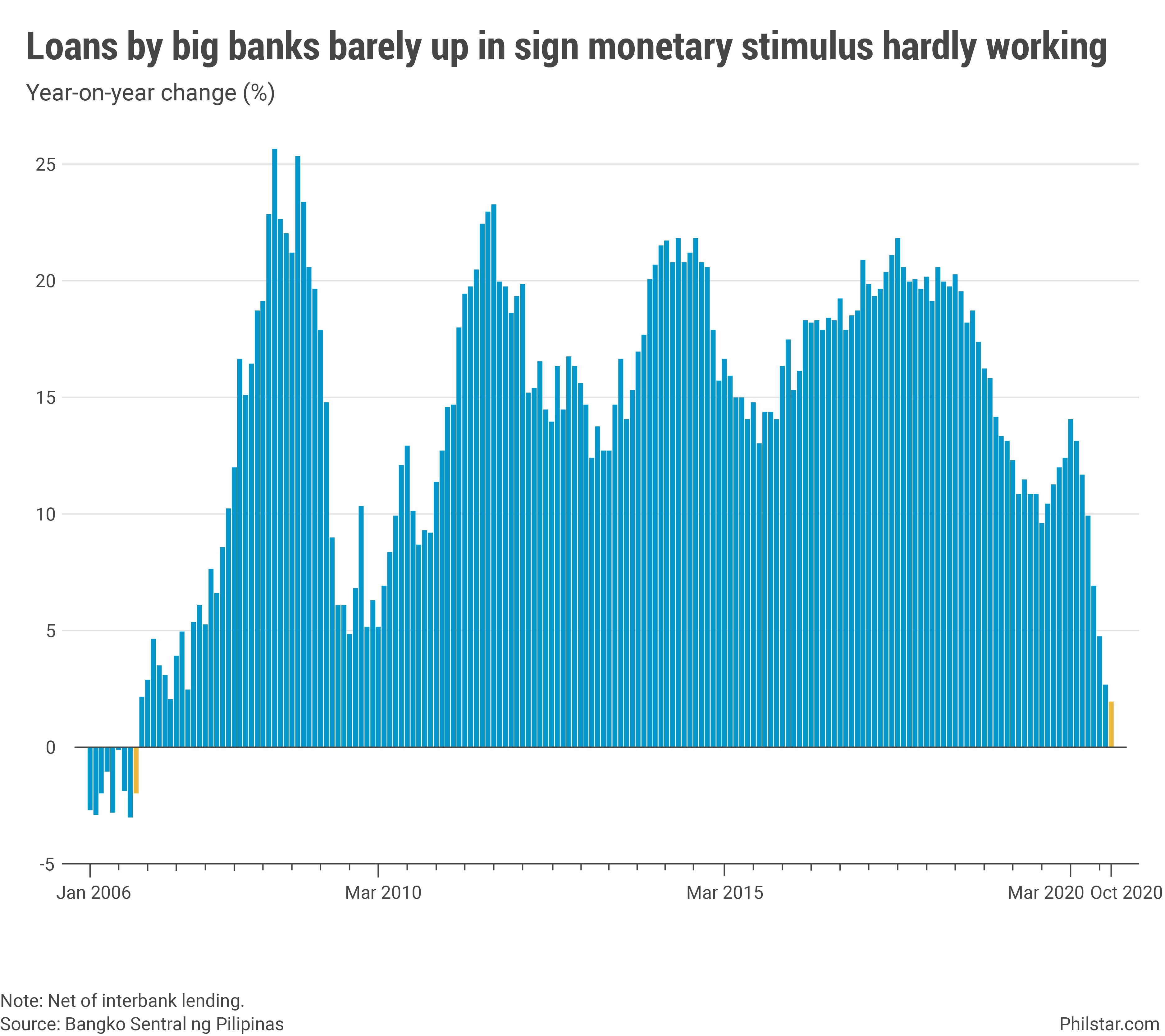

Banks refuse to lend

The unprecedented economic damage led the Duterte administration to rely heavily on banks to provide cash to individuals and businesses. But this strategy has so far failed. The banks, fearful of being harassed by bad loans, refused to lend even with BSP giving them more cash to extend credit. Loans were up a measly 1.9% year-on-year to October, the weakest in 14 years, and monetary authorities expect this to slow further in the last two months of record.

This presents a challenge for a government that is hesitant to spend on its own for fear that doing so, with reduced revenue, would cost it its investment grade rating. An investment grade rating allows borrowers to borrow funds cheaply.

External indebtedness soars

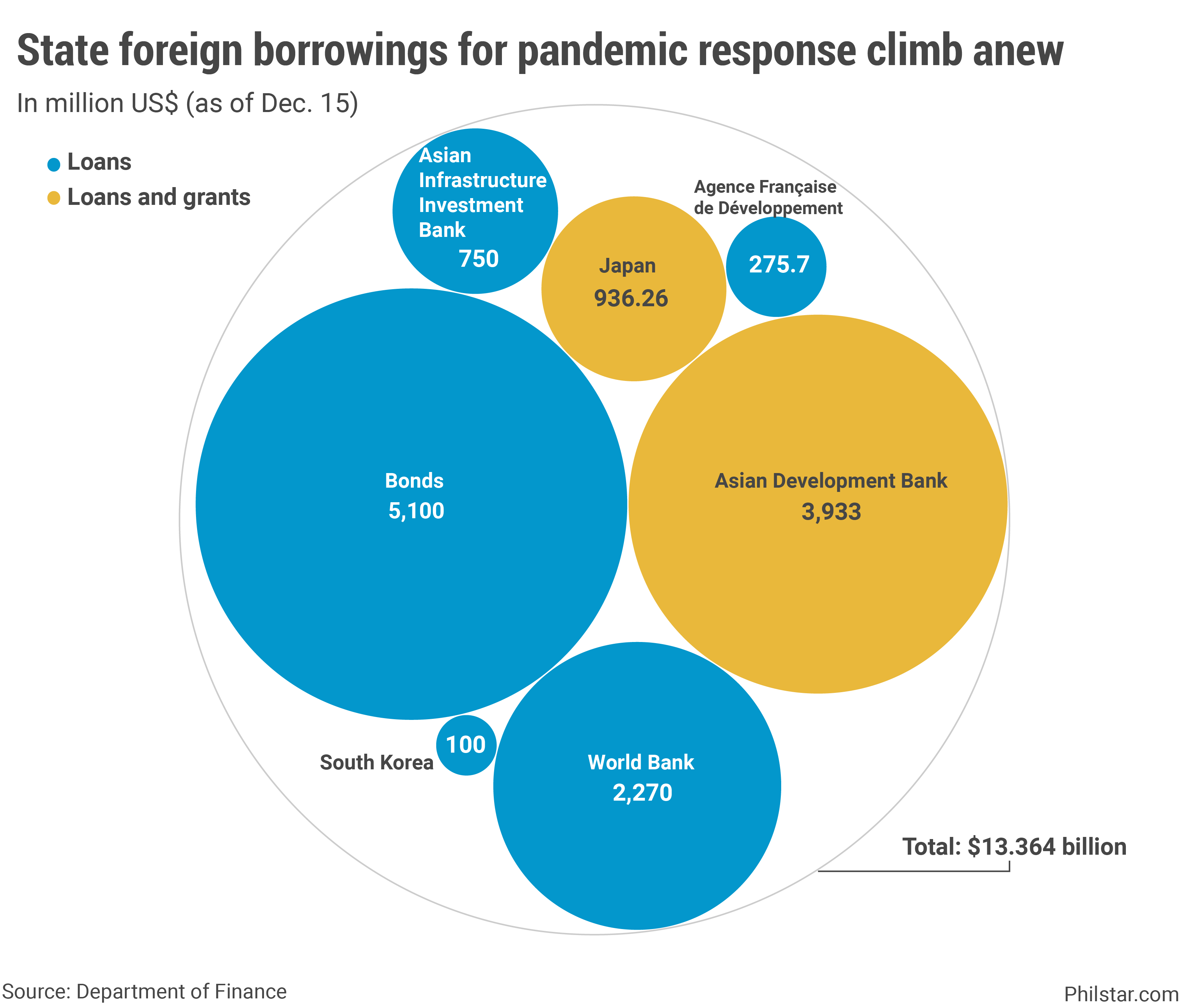

With consumers staying home and many out of business, tax revenues fell. This, and the invoice required to pay the coronavirus response, led the Duterte administration to incur more debt. The loans and grants were obtained from multilateral agencies such as the World Bank and Asian Development, but the largest component of external liabilities for the COVID-19 response came from bond issues.

As of December 15, data from the finance department showed that external borrowing increased to $ 13.3 billion with no signs of abating. The government, for example, had said it would depend on ADB funding to purchase coronavirus vaccines once they are available.

Foreign workers still stand

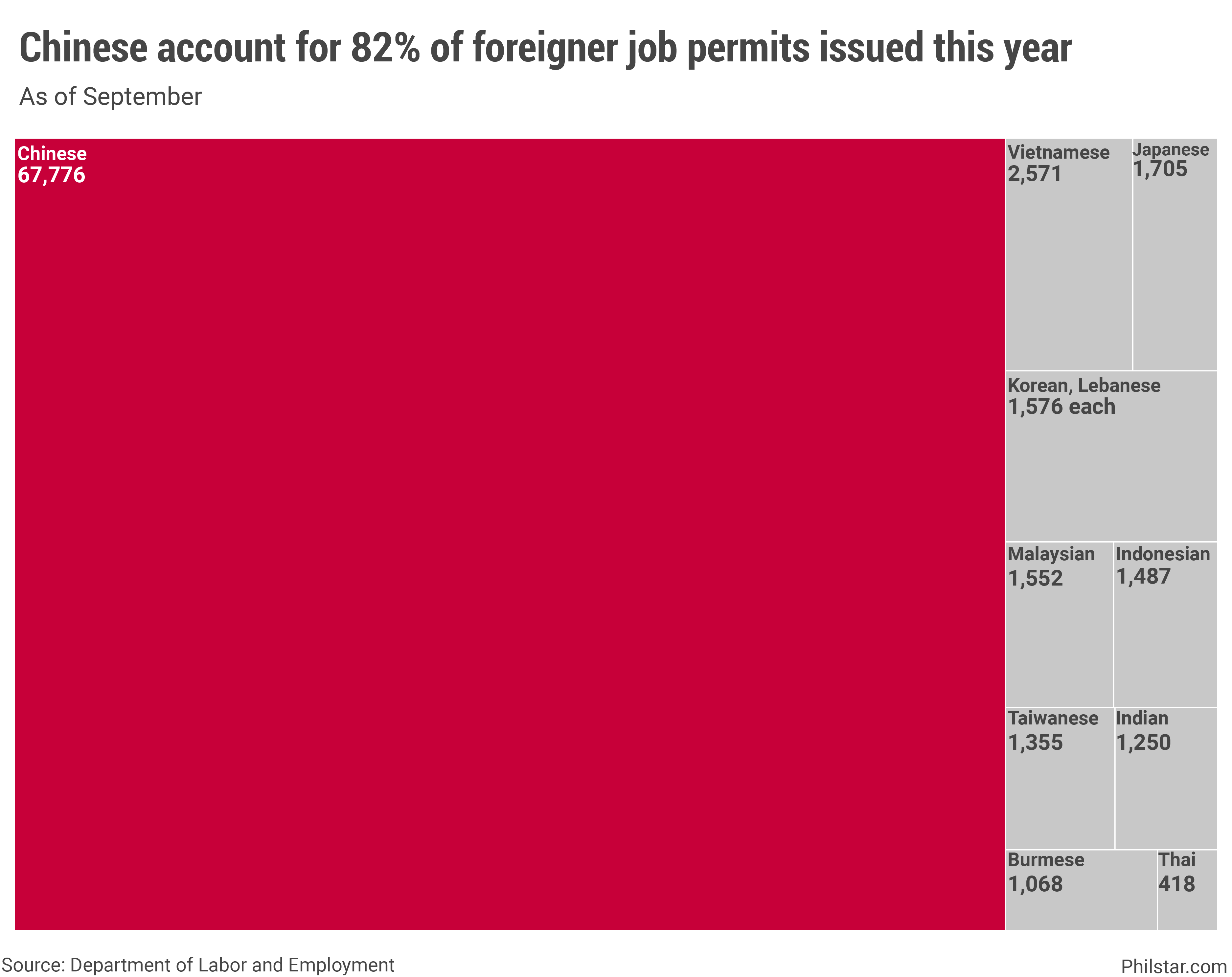

Despite travel restrictions, Chinese workers continued to find work in the Philippines. The number of foreign employment permits issued to all foreign workers, regardless of nationality, as of September increased slightly to 83,204, mainly due to an increase in the first quarter when the closures were just imposed. Of that figure, 81.5% went to Chinese citizens.

Labor officials said that while some overseas gambling companies shut down during the pandemic, not all did, and some workers stayed. A surge of Chinese workers in the Philippines under President Rodrigo Duterte has become a political problem due to allegations that Filipinos are stealing jobs and anecdotal reports of misconduct by Chinese citizens. This has only exacerbated Filipinos’ aversion to China.

Vietnam about to overtake the Philippines

A drastic economic underperformance for the Philippines means its people will become poorer than their Vietnamese counterparts this year, at least according to the International Monetary Fund. GDP per capita, which measures how economic wealth is distributed among people, would reach $ 3,497.51 for Vietnam, higher than the $ 3,372.53 for the Philippines at current prices. Analysts said that getting coronavirus infections under control made a difference for Hanoi.

[ad_2]