Peacock is the new broadcast service from NBCUniversal and the last major participant in the colloquial broadcast war. But Gidon Katz, the company’s direct chairman of the consumer, believes that Peacock can win by leaning on something that most of its biggest competitors do not: offer premium entertainment, primarily for free.

When Peacock launches tomorrow in the United States, people can choose from three different levels: a completely free version with advertising that gives them access to more than 13,000 hours of content, daily news and sports programming, and samples of original Peacock series. , but not full access. Then there is Peacock Premium, a version of $ 4.99 a month that gives people over 20,000 hours of content, including all Peacock originals and exclusive live programming, but it will still feature some announcements. Lastly, there is a $ 9.99 a month version that offers the same without any ads. (The $ 4.99 level will be free for Comcast and Cox subscribers.)

It’s a break from traditional streaming services, which generally fall into two main categories: SVOD (Video On Demand Subscription) and AVOD (Video On Demand Advertising). According to Katz, Peacock is taking a unique approach by crossing the line between the two, but the company’s focus is to give Peacock as free as possible to as many people as possible.

It’s free with a giant asterisk attached, as the entry-level tier comes with much less content, including access to some of the live perks that NBCUniversal is promoting as a key differentiator for its service (like soccer games from the Premier League live). To get full access to those live services, to really enjoy Peacock for what it’s designed to do, it will cost me $ 10 a month (since I’m more willing to go ad-free).

(Disclosure: Comcast, owner of NBCUniversal, is also an investor in Vox Media, The edgeThe parent company.)

Furthermore, even paid levels have their limitations. There’s no access to NBC’s regular linear channel, only selected live streams from Peacock, a major difference from other services like CBS All Access, which offers its traditional channel for $ 5.99 a month. And while NBCUniversal sees Peacock as a basic type of cable replacement, it will still offer content from NBCUniversal, which means it can’t compete with more comprehensive (but expensive) TV replacement services like Sling TV, YouTube TV, or FuboTV. That leaves Peacock as a more exclusive basic cable NBC version with many limitations, rather than a true basic cable replacement.

NBCUniversal is arguing that Peacock is the best version of that idea, expanding on what live games, shows and news scheduling options are available to Peacock, and Comcast customers, beyond a direct copy of the NBC channel, which offers things like Premier League games and access to a new 24 hours Today is the show Live news broadcast portal.

But even with the more limited live view, Katz hopes that having access to news and some sports will create a more intriguing streaming experience for people accustomed to Netflix, Disney Plus, and other SVODs. NBCUniversal’s hope is that people really want to incorporate aspects of live TV viewing into their streaming services, and that will separate Peacock from its competitors.

“By putting them in one application, we believe we can serve a broader range of customer needs,” said Katz. “What we have designed is something that takes advantage of the most fundamental underlying reasons why people watch television. That is very different because nobody else in the streaming world is doing that. “

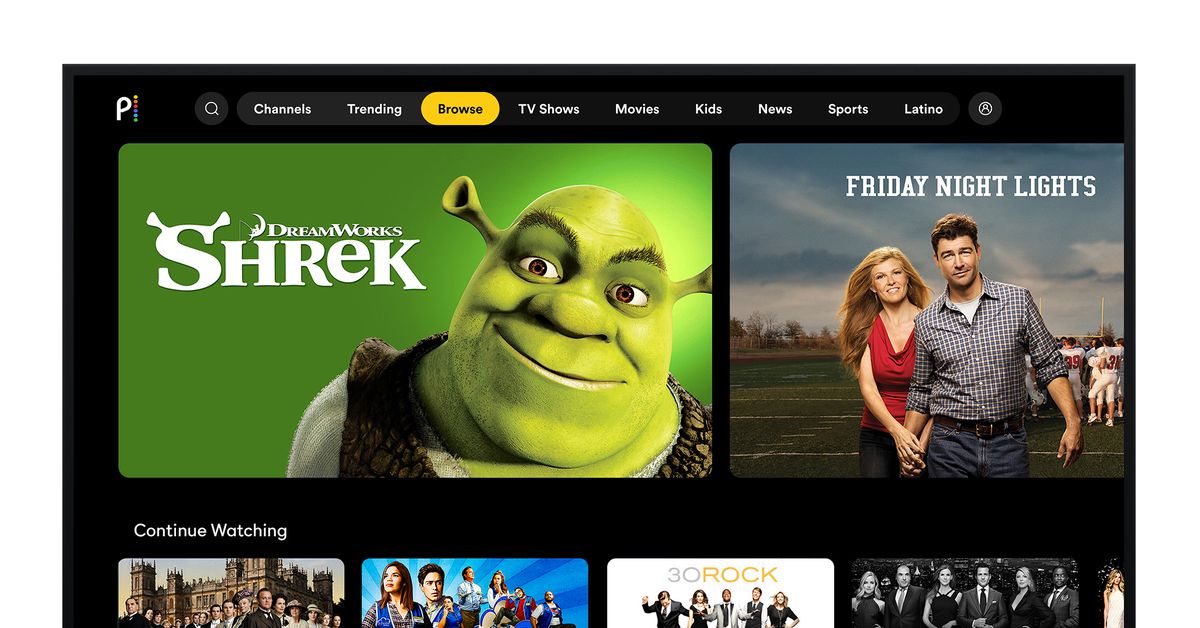

Even Peacock’s design (made to look like a live TV service) focuses on highlighting live TV programming, including exclusive Premier League soccer games, a channel dedicated to Saturday night live, up-to-the-minute news programming. Peacock is read as a defensive strategy to try to bolster cable’s benefits to customers who prefer new transmission options. According to Katz, “being able to offer a totally free ad-supported version (and a” free “premium tier for people who stick to their Comcast or Cox plans) is” absolutely critical. “

If typical streaming services hit the market with the idea of disrupting the way people watch television, Peacock almost acts as a reminder of why consumers like cable television in the first place. After having Peacock on the market in a limited release (it was available starting in April for Comcast Flex and X1 customers), Katz said what they really noticed is that people liked to have something playing when they opened Peacock, similar to standard cable television.

“It gives people comfort,” said Katz. “It makes people feel like TV is alive.”

Katz told him The edge prior to Peacock’s launch, they saw “a massive market gap” for premium content on an ad-supported platform. That includes everything from popular shows and movies like 30 rocks and the Fast and Furious franchise, live programming, as well as sports and news.

Finally, NBCUniversal’s goal is to give away the $ 4.99 Premium Peacock tier for free to everyone through distribution agreements with all major pay TV providers like Comcast and Cox, and other platforms like Roku and Amazon, currently not advertised on Peacock. Peacock President Matt Strauss said Variety the end of the game is to have “the majority of the market to be able to free Peacock”.

“The idea of launching a free service at this time, in this type of environment with economic difficulties, for us is absolutely fundamental,” said Katz. “It removes all those barriers for those consumers who are concerned, while looking at it on paper, all those other subscription fees.”

Depending on who you ask, Peacock will arrive at the best or worst time. Several of NBCUniversal’s planned originals will not be released with Peacock as originally intended due to production issues caused by the pandemic. (Its competitors, like HBO Max, are in the same boat.)

But what Peacock lacks in the new original content, a game currently dominated by Netflix, the streamer has released more than 50 movies in the first six months of the year, it makes up for the cost – it’s free. Your beloved extensive IP library and live news will come at a time when almost everyone is trapped inside and glued to the news cycle, which could help increase their profile.

On paper, Peacock is both a smart move for Comcast and a good deal for average consumers. Peacock is offering a reinvented basic cable package, Katz suggested; Even on the more expensive end, $ 10 a month is even less than Netflix, HBO Max, Amazon Prime Video, or Hulu without ads. In addition, it offers an IP catalog with which most transmission services cannot compete. (Note: Due to an existing relationship, some of the titles that appear on Peacock are also streamed on Hulu.) Peacock also allows Comcast to collect more customer data and sell higher-priced hyper-targeted ads. NBCUniversal developed a completely new ad technology for Peacock, and company executives have not shied away from the importance of Peacock working as a supported and ad-focused product.

That’s where having two popular levels likely ad-supported separates Peacock from previous iterations of the same idea. Peacock is not the first streamer to try to offer half a catalog as part of a free tier and a much broader and more comprehensive selection as part of a more expensive offering. Hulu attempted to do so over a decade ago, but ended up ditching its free base tier because the company found it wasn’t getting much value by giving away a ton of content on an ad-supported tier. Ultimately, Hulu became a fully subscription-based video-on-demand service, which went from its previous free tier to a $ 5.99 subscription, but Comcast wants to use its two core tiers as advertising platforms.

Now, on the eve of the launch, there are a million thoughts running through Katz’s head about what happens after Peacock’s initial launch. What keeps you awake at night is not getting people to sign up, but figuring out how to keep them. Hearing retention. Shake. These are terms that come up in the industry frequently and something that almost all streamers struggle with over time. For Katz, the answer is not to try to beat a competitor like Netflix, but to figure out how to make TV feel more like TV again, even if it’s a world that is drastically changing.

“Eventually, the opportunity to continue giving people compulsive dramas will expire,” Katz said. “And we will have to make sure that we as an industry discover how we satisfy a broader range of TV use cases.”